[ad_1]

One of the messages that Warren Buffett and Berkshire Hathaway’s leading insurance policy exec, Ajit Jain, sent out to capitalists throughout the business’s annual shareholder meeting in Omaha last month was that cyber insurance policy, while presently successful, still has a lot of unknowns and threats for Berkshire, a significant gamer in the insurance policy market, to be totally comfy underwriting.

Cyber insurance policy has actually come to be “an extremely trendy item,” Jain claimed at the yearly conference. And it’s been a cash manufacturer for insurance firms, at the very least to day. He explained present earnings as “relatively high” â $ ” at the very least 20% of the overall costs winding up in the pockets of insurance firms. However at Berkshire, the message being sent out to representatives is just one of care. A main factor is the problem in analyzing just how losses from a solitary incident do not spiral right into a gathering of prospective cyber losses. Jain provided the theoretical instance of when a significant cloud service provider’s system “stops.”

” That gathering possibility can be big, and not having the ability to have a worst-case void on it is what frightens us,” he claimed.

” There’s no area where that sort of a problem participates in greater than cyber,” Buffett claimed. “You might obtain a gathering of threats that you never ever imagined, and perhaps even worse than some quake taking place someplace.”

Berkshire remains in the cyber insurance policy business

Industry experts typically state while several of Berkshire’s care is necessitated, the basic state of the cybersecurity insurance policy industry is maintaining as it ends up being successful. And Gerald Glombicki, an elderly supervisor in Fitch Score’s united state insurance policy team, mentions that Berkshire Hathaway is releasing cybersecurity plans regardless of Buffett’s caution. According to Fitch’s evaluation, Berkshire Hathaway is the sixth-largest provider of such policies. Chubb, which Berkshire just recently exposed a huge financial investment in, and AIG are the biggest.

” Today [cybersecurity insurance] is still a sensible company version for several insurance firms,” Glombicki claimed. It is still a small market, standing for just one percent of all plans provided, according to Glombicki. Due to the fact that the cybersecurity company is so little, it provides insurance provider latitude to execute numerous plans to see what is functioning, and what isn’t, without an incredible quantity of direct exposure.

Berkshire, in addition to Chubb and AIG, decreased to comment.

” There is a component of changability that is really distressing, and I recognize where [Buffett] is originating from, yet I assume it is actually difficult to prevent cyber threat completely,” Glombicki claimed. He included though that there has actually still been no considerable lawsuits that designates guilt or checks the borders of the plans, and till the courts listen to some guilt instances, some insurance firms might continue extra very carefully.

‘ Might damage the business’ Buffett says

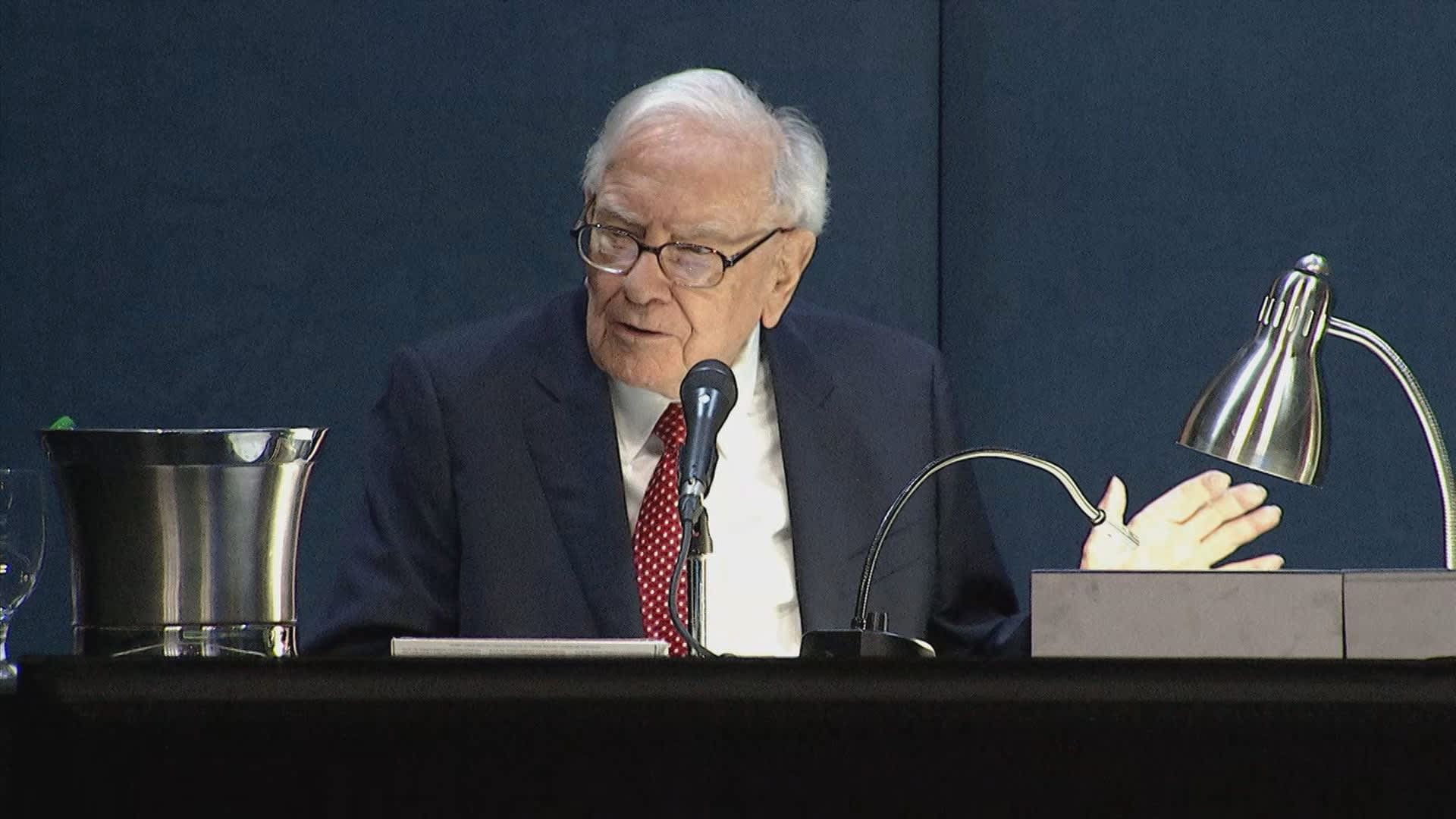

Top Berkshire execs Warren Buffett (L), Greg Abel (C) and Ajit Jain (R) throughout the Berkshire Hathaway Yearly Investors Fulfilling in Omaha, Nebraska on Might 4, 2024.

CNBC

The issue with composing several plans, despite having a $1 million limitation per plan, is if a “solitary occasion” ends up to impact 1,000 plans. “You have actually created something that in no chance we’re obtaining the correct rate for, and can damage the business,” Buffett claimed.

While some significant leaders, like previous Homeland Protection principal Michael Chertoff â $ ” that currently runs an international safety threat monitoring company â $ ” have actually asked for a federal government cybersecurity backstop of some type, the majority of specialists do not think that is required now. Glombicki claims that while the feds are checking out what function they can play, treatment most likely will not occur till an event triggers it.

Any kind of federal government participation “will possibly occur after a huge, pricey cyber-incident,” he claimed. “After September 11, the federal government created a terrorist threat program. In cyber, we have actually not yet seen an assault of that scale. We are still in the phase of thinking of feasible strategies.”

Cyber insurance policy information reveals development and market confidence

While the variety of cybersecurity plans being created is little currently, experts do not anticipate it to remain by doing this.

” Prices are decreasing, which reveals security in the marketplace,” claimed Mark Friedlander, a representative for the Insurance policy Info Institute. According to its information, cyber costs are approximated to fold the following years. In 2022, costs completed $11.9 billion. By 2025, Friedlander claims, they are anticipated to increase to $22.5 billion and enhance to $33.3 billion by 2027.

” This is plainly among the fastest-growing sectors of insurance. Extra firms are composing cybersecurity plans than ever,” Friedlander claimed, connecting self-confidence amongst insurance firms to extra advanced underwriting and maintaining prices. He mentioned a 6% decrease in cybersecurity insurance policy prices in the initial quarter of 2024, adhering to a 3% decrease in 2024, as a clear signal that insurance firms really feel extra certain concerning delving into business.

” Many business insurance policy like automobile, home, and life insurance policy have actually all been boosting, so the decrease is considerable. It signifies security and a decrease in insurance claims extent,” Friedlander claimed.

And even more insurance firms are getting in the marketplace since they have the devices and information to value the risk. ” If you can do it at noise prices, you will certainly create that insurance coverage,”  Friedlander claimed.

‘ You’re shedding cash’

Buffett and his leading insurance policy lieutenant do not concur. It’s the insurance policy “loss expense” â $” what the expense of items marketed can possibly be â $” that has Berkshire undecided with a larger step right into cyber insurance policy. Jain claimed losses have actually been “relatively well had” to day â $” not going beyond 40 cents on the plan buck over the previous 4 to 5 years â $” yet he included, “there’s insufficient information to be able to hang your hat on and state what your real loss expense is.”

Jain claimed that in many cases representatives are Berkshire are prevented from composing cyber insurance policy, unless they require to create it to please certain customer demands. And also if they do, Jain leaves them with this message: “Regardless of just how much you bill, you need to inform on your own that each time you create a cyber insurance coverage, you’re shedding cash. We can suggest concerning just how much cash you’re shedding, yet the state of mind must be you’re not earning money on it. … And afterwards we need to go from there.”

Google Cloud claims the threats are being overstated

There is an understanding that cyber threat is quickly altering and, consequently, as well unforeseeable to finance in a methodical method, claims Monica Shokrai, head of company threat and insurance policy at Google Cloud. However she included that the understanding does not match fact, which the threat can mainly be handled.

” We do not hold the very same deem Warren Buffet on the subject,” she said. In Google’s sight, most of cyber losses can be protected against or minimized via fundamental cyber health. Â

” By comprehending safety, you can reach an area where your controls remain in a far better area, where the threat is extra workable,” Shokrai claimed. Disastrous strikes from nation-states, on the other hand, remain in a different group and have actually been uncommon. Insurance companies are currently inoculating themselves from prospective threat by making exemptions for sure disastrous events. Several cybersecurity plans have insurance coverage exceptions for nation-state strikes.

” What they are attempting to do is continue to be durable and solvent in case of an extensive occasion; what they have actually done to handle that is placed in exemptions,” Shokrai claimed, and those consist of essential facilities, cyber battle, and various other extensive turbulent occasions.

Uncertainties and subjectivities continue to be. Suppose somebody is the sufferer of a cyberattack from a foreign-based gang that isn’t formally connected to a nation-state yet may have obtained some supplementary logistical support? Can an insurer conjure up a nation-state exemption? Shokrai claims classifying just how to associate an occasion is the subject of much dispute in between insurance provider. “That is a huge dispute in between insurance provider; it is a vital difference that requires clearness,” Shokrai claimed.

Some specialists state it is the obscurity bordering the sector’s margins that has capitalists like Buffett and insurance policy gamers like Berkshire terrified. However thus far, business has actually verified to be audio total. “It is still a sensible company version for several insurance firms,” claimed Josephine Wolff, an associate teacher of cybersecurity plan at The Fletcher Institution at Tufts College, that has actually been researching the developing market for the previous a number of years. However she included that an idea that business is feasible does not imply points are not regularly altering, indicating the current ransomware rise over the previous number of years that saw big payments by insurance provider â $” though especially still insufficient to make business unlucrative for the majority of providers.

Cyber insurance policy assists make the whole community much safer, according to Steve Lion, founder of L3 Networks, a California-based handled providers that focuses on cybersecurity. Plans call for firms to follow particular cyber criteria to obtain insurance coverage, and the even more organizations that enroll in insurance coverage, the much safer the whole system ends up being. And if an organization recognizes they’ll be rejected an insurance claim if they do not have some fundamental cybersecurity safeguards in position, that works as a reward to place them in position.

Berkshire does think business will certainly expand, it simply isn’t certain at what expense. “My assumption goes to some factor it may end up being a significant company, yet it may be connected with big losses,” Jain claimed.

” I will certainly inform you that most individuals intend to remain in anything that’s trendy when they create insurance policy. And cyber’s a very easy problem,” Buffett claimed. “You can create a great deal of it. The representatives like it. They’re obtaining the payment on every plan they create. … I would certainly state that humanity is such that the majority of insurance provider will certainly obtain really thrilled and their representatives will certainly obtain really thrilled, and it’s really trendy and it’s sort of intriguing, and as Charlie [Munger] would certainly state, it might be rat poisonous substance.”

While Lion recognizes Buffett’s care, he sees a generational divide over the threat overview, and is confident concerning the cybersecurity insurance policy field.

” Possibly Warren Buffet would certainly have called cybersecurity insurance policy a chance when he was more youthful,” he claimed.

[ad_2]

Source link .