[ad_1]

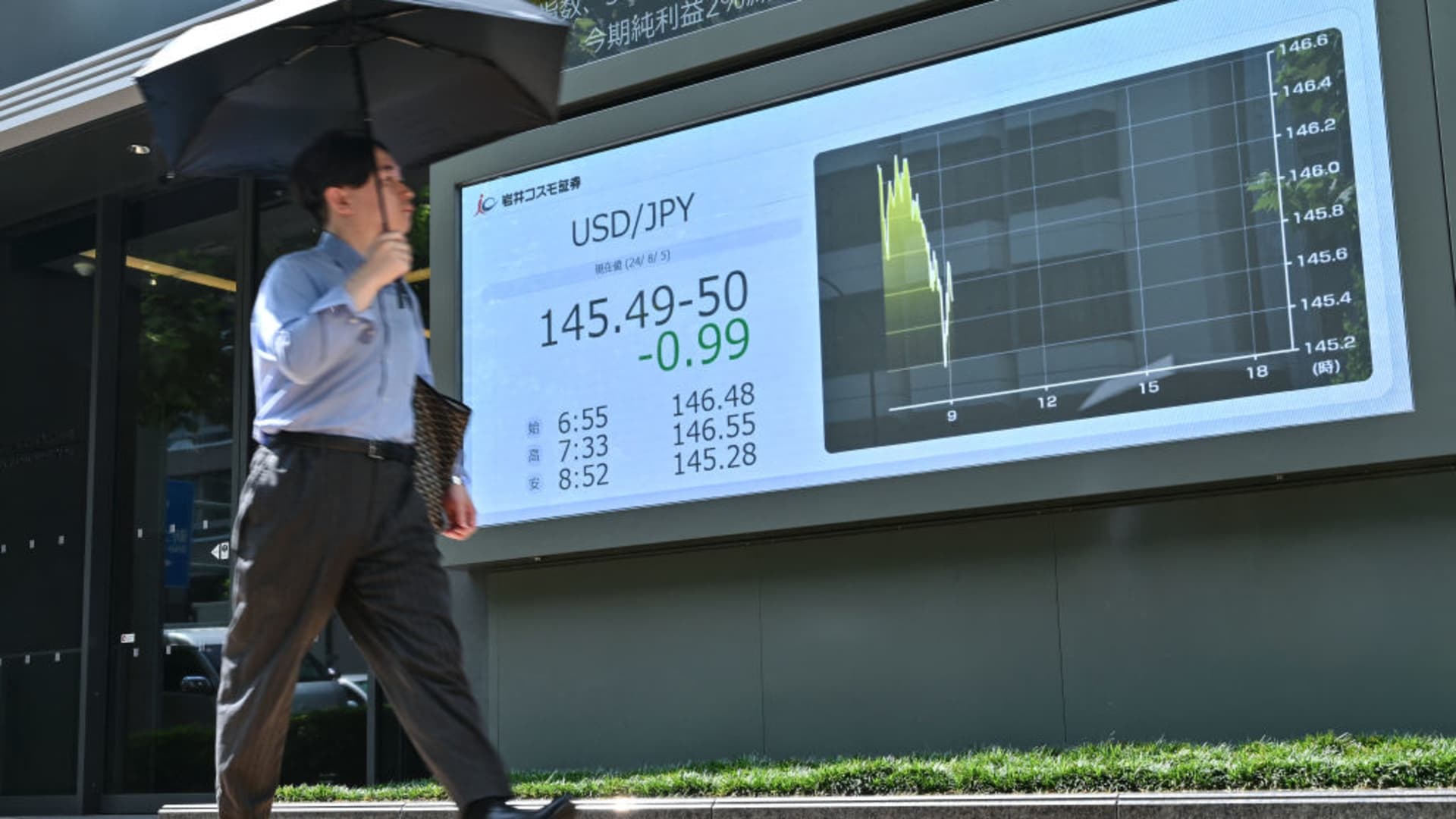

The Nikkei 225 recouped Tuesday, up 10.2%, adhering to a decrease of 12% on Monday. That decline, the most awful decline for the Japanese stock exchange given that 1987, had to do with far more than a downturn in the united state economic situation and whether international supplies ought to have their multiples reduced. That could be worth a 2% -4% decline. Those losses were greatly regarding the yen bring profession. In its most basic type, the yen bring profession has capitalists obtaining economical yen to purchase greater generating possessions, commonly money. When there is a huge differential in rate of interest, like 4% in the united state versus almost absolutely no in Japan, the profession can appear like cost-free cash. Yet it can spoil extremely promptly if rate of interest start to alter. A larger concern is exactly how nontransparent the entire company is. Just how large is the yen bring profession? As an example, since there is not a main resource to track money professions, we have no concept exactly how large the yen bring profession is. Yet it allows. The Wall surface Road Journal kept in mind that Japanese financial institutions’ international borrowing got to $1 trillion in March, a 21% surge from 2021. We have no concept where all the cash goes. The usual description is that some purchase money, some purchase equities. Yet we do not understand. We likewise do not understand that is making use of the bring profession. The normal response is institutional capitalists or hedge funds. That’s absolutely real, however we do not have a failure. Ultimately, we have no concept just how much utilize is being utilized. These are great deals of unknowns, however I would certainly bet that the Federal Get, and the Financial institution of Japan, were a little bit stunned at a 12% decrease in the Nikkei. Just how the yen bring profession jobs The heart of the issue is that Japanese main lenders have actually been speaking about greater rate of interest. The yen is increasing, which is making the yen bring profession much less rewarding. Right here’s an easy instance. “XYZ Bush Fund” obtains 10 million yen, which up till just recently was setting you back simply a little over absolutely no passion. It takes the profits and gets the united state buck at 155 yen to the buck, regarding where it was selling July. The fund currently has $64,516, where you can gain a rates of interest north of 4%. It seems like cash for absolutely nothing. Points can fail since the fund still has actually obtained 10 million yen and needs to pay it back. If the worth of the Japanese yen begins to enhance, the fund needs to settle that financial debt with even more bucks. Keep in mind that $64,516? If the yen goes from 155 to 145, which is where it traded Monday, it will certainly take $68,965 to settle that 10 million yen (10 million yen separated by 145 = $68,965). Suddenly, XYZ Bush Fund needs to divulge $4,449 of their very own cash to cover the financial debt ($ 68,965 – $64,516 = $4,449). And this is nobodies. Some funds might have numerous countless bucks in this profession. Take advantage of makes this much more complex Much of this is being done on margin, where the bush fund is obtaining cash from a broker. If the worth of the financial investment decreases and the equity drops listed below the minimum developed by the margin arrangement, the broker might release a margin telephone call needing the bush fund to transfer even more funds, or offer the safeties. Down payment a lot more funds implies locate even more yen, or begin offering. Provided the 12% decrease in the Nikkei on Monday, a great deal of individuals were offering. The lower line The rate of economic possessions are not simply identified by assessment metrics like revenues and multiples. Circulations â $” just how much cash is moving right into a possession course â $” is likewise a crucial factor. The yen bring profession has actually produced huge cross-market circulations. It is likely a substantial motorist of circulations right into the united state buck and international equities, consisting of the united state stock exchange. It is absolutely not unreasonable to think that a substantial take a break of this profession, ought to it proceed, would certainly be an added headwind to united state equities. It’s little marvel the always-astute Nicholas Colas at DataTrek kept in mind that, “Till the yen supports, it is difficult to see exactly how international equity market volatility decreases.” One favorable indication: the ETF to view is the Invesco Japanese Yen ETF (FXY), which tracks the rate of the Japanese yen, had quantity 6 times regular the other day. After soaring up 5 days straight, it’s down 0.6% on Tuesday on a lot reduced quantity.

[ad_2]

Source link .