[ad_1]

WASHINGTON â $ ” When the Federal Profession Compensation settled a policy previously this month prohibiting non-compete provisions, the blowback was swift: Within 24 hr, the united state Chamber of Business led a handful of service teams to submit a claim looking for to obstruct the restriction. They said that the FTC did not have the authority to enforce it to begin with.

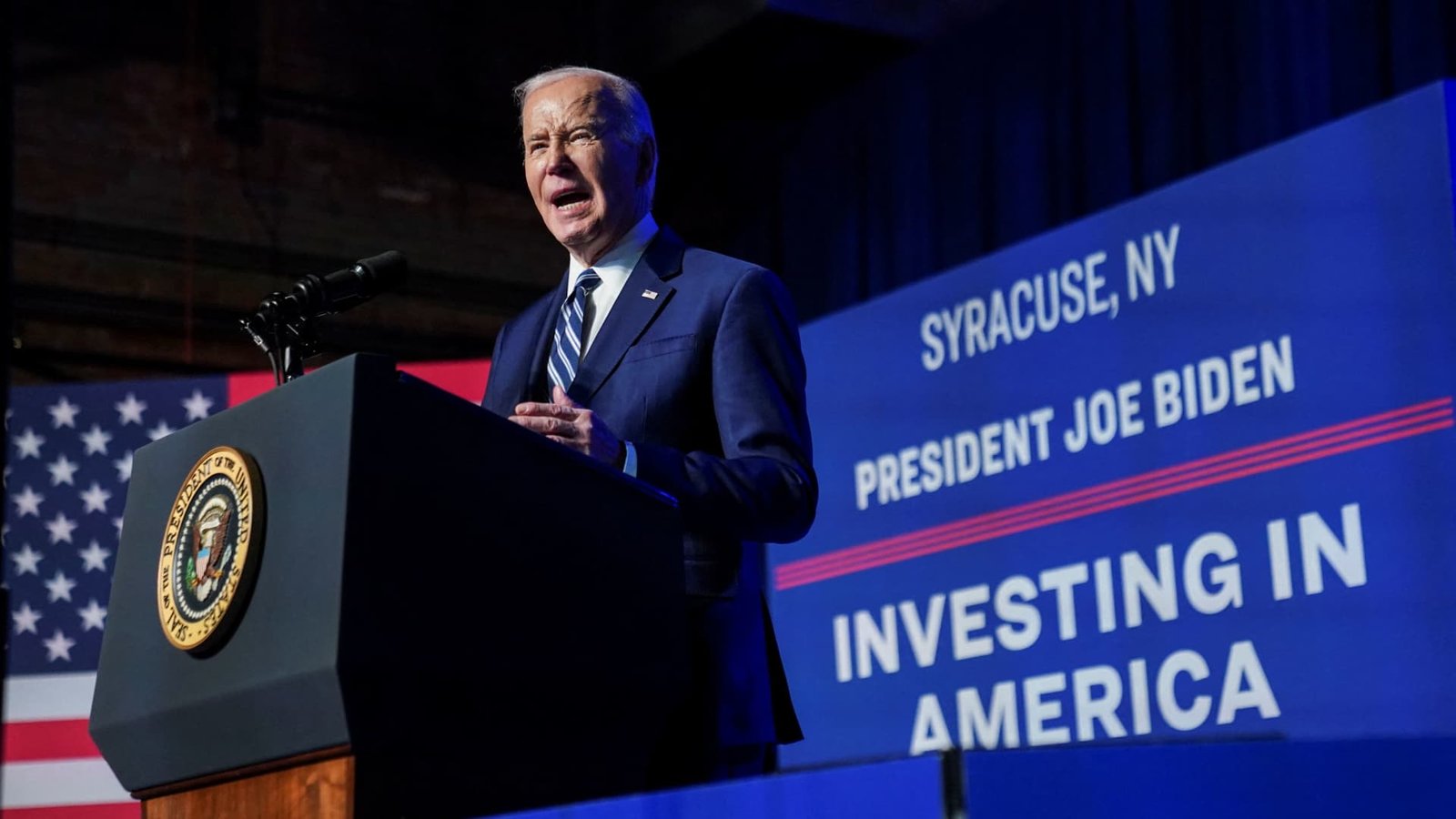

The playbook is ending up being an acquainted one: The Biden management wraps up a brand-new policy managing service, and the Chamber and market lobbying teams instantly file a claim against to quit it by suggesting that the company has actually exceeded its authority.

Up until now this year, the management has actually settled 7 policies, attending to whatever from independent professionals to charge card late costs and environment disclosure demands, just to see them met near-immediate suits by the Chamber and various other teams.

In all, the Chamber anticipates to submit at the very least 22 suits versus the Biden management prior to completion of Head of state Joe Biden’s present term, a significant rise from the 3 matches it submitted versus the Trump management and the 15 it submitted throughout Obama’s initial term.

And they are not the only one. The American Bankers Organization, one more significant lobbying team in Washington, has actually joined to 4 suits versus financial regulatory authorities because Sept. 2022, after not joining to any kind of lawful obstacles to government plan for approximately a years prior to that.

Authorities at both the Chamber and ABA stress that lawsuits is constantly a last resource. However they see it as a needed action when companies release guidelines that go outside the extent of their authority.

” It’s not practically a solitary law, right? It has to do with the 1,000 guidelines that are mosting likely to go last this year. It has to do with the 200-plus guidelines that have a financial effect of greater than $200 million a year,” Neil Bradley, executive vice head of state at the Chamber, informed CNBC in an interview.Â

” We went from a time when we would certainly say concerning a specific law,” Bradley stated, “to a duration where the worry has to do with the instructions overall.”

Total economic sector guidelines have actually been raising under Biden, according to one statistics from George Mason College â $ ” specifically contrasted to the Trump management, throughout which they remained essentially flat.Â

But Patrick McLaughlin, supervisor of plan analytics at George Mason’s free-market, liberal Mercatus Facility brain trust, that developed the statistics, states the nature of Biden’s guidelines is a lot more noteworthy than the quantity of them.

The Biden management, in McLaughlin’s sight, has actually been “large in their analysis of licensing laws.”

” The Chamber and others see a chance to press back on guidelines that, in their sight, are surpassing what Congress accredited,” McLaughlin stated.

The particular targets of the suits have actually been differed: The Chamber has actually currently filed a claim against a lots companies under the Biden management, as contrasted to simply 4 companies under Obama. In spite of the variety of problems at play, the team’s debates mostly fixate the insurance claim that companies are looking for to establish policies in locations that can just be resolved by Congress.Â

Even prior to the FTC provided its restriction on non-compete provisions, as an example, the Chamber promised to take FTC Chair Lina Khan to court over it, no matter the specifics.

Federal Profession Compensation Lina Khan talks throughout the New york city Times yearly DealBook top on November 29, 2023 in New York City City.Â

Michael M. Santiago|Getty Images

” She may develop a plan that we would really concur with on material,” Bradley stated of Khan prior to the last policy was launched. “However the criterion of that authority is inappropriate.””

Regulation movie critics additionally say that the Biden management has actually not been suitably complying with the rulemaking procedure, partly by falling short to include point of views from stakeholders as component of the last law.

” When they demand wrapping up policies that drop outside their regulative province, and when they neglect positive responses from financial institutions and various other stakeholders, lawsuits is the only staying device in our tool kit,” ABA Head Of State and chief executive officer Rob Nichols stated previously this year. “It’s not a device we intend to make use of, however it’s one we will certainly remain to tactically possess as required.”

The Biden management states the emphasis with every one of its guidelines gets on shielding customers and conserving them cash. Their quotes reveal that the FTC’s non-compete restriction will certainly improve earnings by at the very least $400 billion over the following years.

The management additionally approximates that the Customer Financial Defense Bureau’s relocate to reduce charge card late costs will certainly conserve 45 million Americans $220 annually, and the Epa’s air-quality policy will certainly generate approximately $46 billion in internet health and wellness advantages in 2032.

” We are completely certain these companies are acting within their authorities,” stated White Residence Aide Press Assistant Michael Kikukawa, in a declaration to CNBC. “These policies aid American employees and family members by raising earnings, decreasing expenses, conserving lives, and constructing a fairer economic climate.”

But there can be a price to following law, tooâ $” specifically when each brand-new management can revise the policies of the road.Â

” If you make a financial investment in one point, are you mosting likely to figure out that there’s some rare law that you were not aware of, that would all of a sudden lower the worth of that financial investment?” asked McLaughlin, of the Mercatus Facility. “Or make you quit having the ability to create it completely?”

[ad_2]

Source link .