[ad_1]

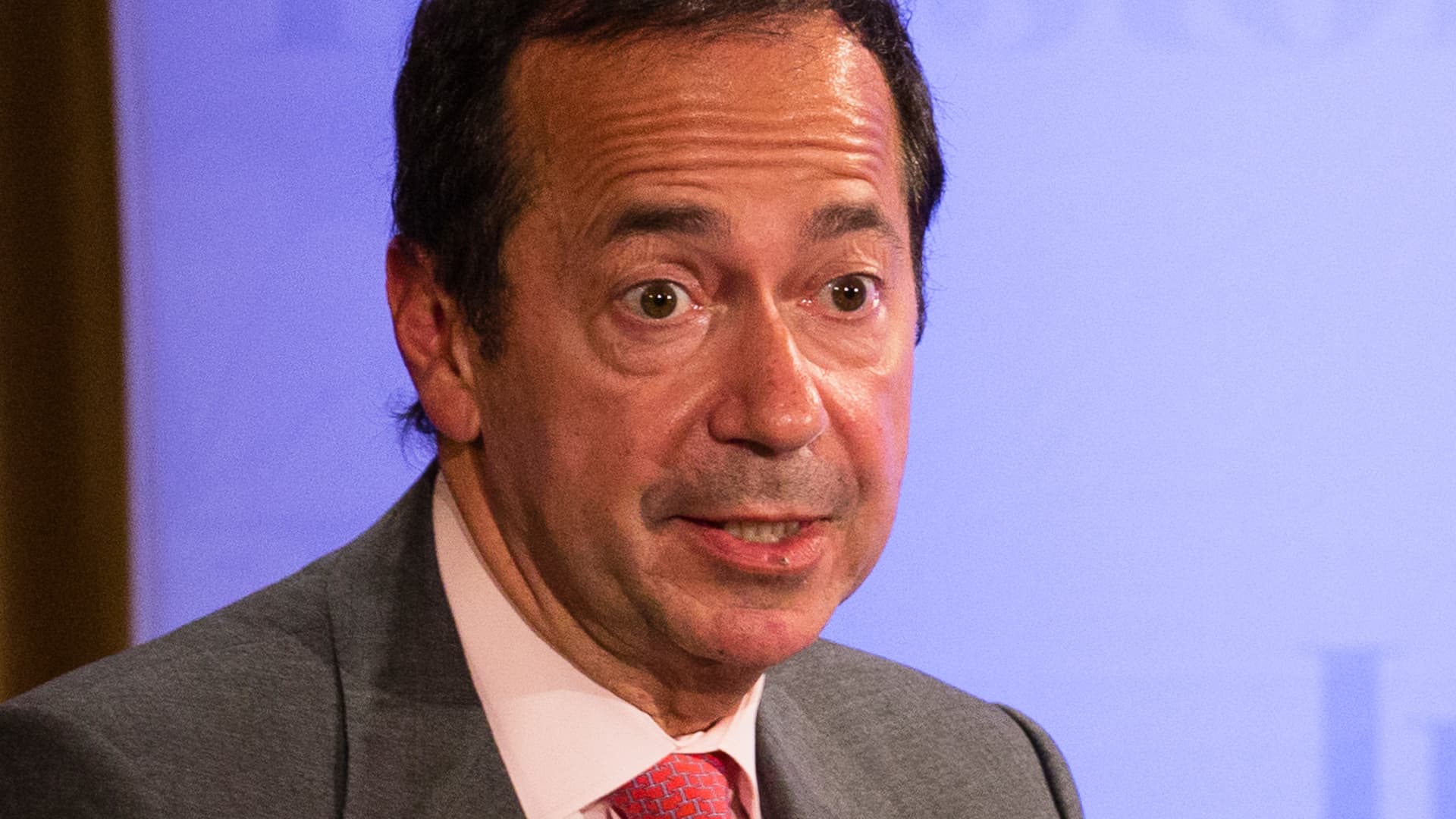

Billionaire financier and bush fund professional John Paulson claimed Friday that he want to see the Federal Get start enormous with its value cuts. The Fed is anticipated to lower its benchmark charges of curiosity on Wednesday, nevertheless buyers are divided on precisely how enormous the motion will definitely be. The primary lenders look like figuring out in between a lower of 25 foundation elements or 50 foundation elements. A foundation issue quantities to 0.01 portion elements. Paulson claimed Friday on CNBC’s” Money Shifting corporations” that he believes a 50-basis-point lower would definitely be higher. “I imagine the Fed is slightly behind the contour. â $ ¦ I imagine they’ve really seen sufficient data that they’ll start bringing costs down, and I would definitely advocate further strongly can be a lot better,” he claimed. One property course that often climbs when the Federal Get reduces value is gold, and Paulson is a very long time bull on the yellow metal. He claimed that issue gold is buying and selling close to doc highs is because of ardour from worldwide federal governments. “I imagine the numerous cause gold is growing is a worldwide [trend of] â $ ¦ having a lot much less self-confidence in paper cash, particularly amongst reserve banks,” Paulson claimed. He included {that a} 10% allowance to gold may be “smart” for capitalists, although outlined he was not making an organization referral. Paulson claimed his profile has direct publicity to each provides and by-products linked to gold. His relations office, Paulson & & Co., has dangers in a lot of gold mining provides, consisting of Agnico Eagle Mines, based on VerityData. Paulson, a venture contributor to Donald Trump, alerted that the securities market would definitely” collision” if a number of of the tax obligation propositions from Vice Head of state Kamala Harris’ venture had been carried out. He likewise claimed he’s anxious concerning the federal authorities’s monetary debt nevertheless just isn’t wagering versus united state Treasurys presently. Paulson is an professional quantity within the bush fund globe and is perhaps hottest for wagering versus the actual property market upfront of the 2007 collision. Paulson revealed in 2020 that he was reworking his bush fund proper right into a family office.

[ad_2]

Source link .