[ad_1]

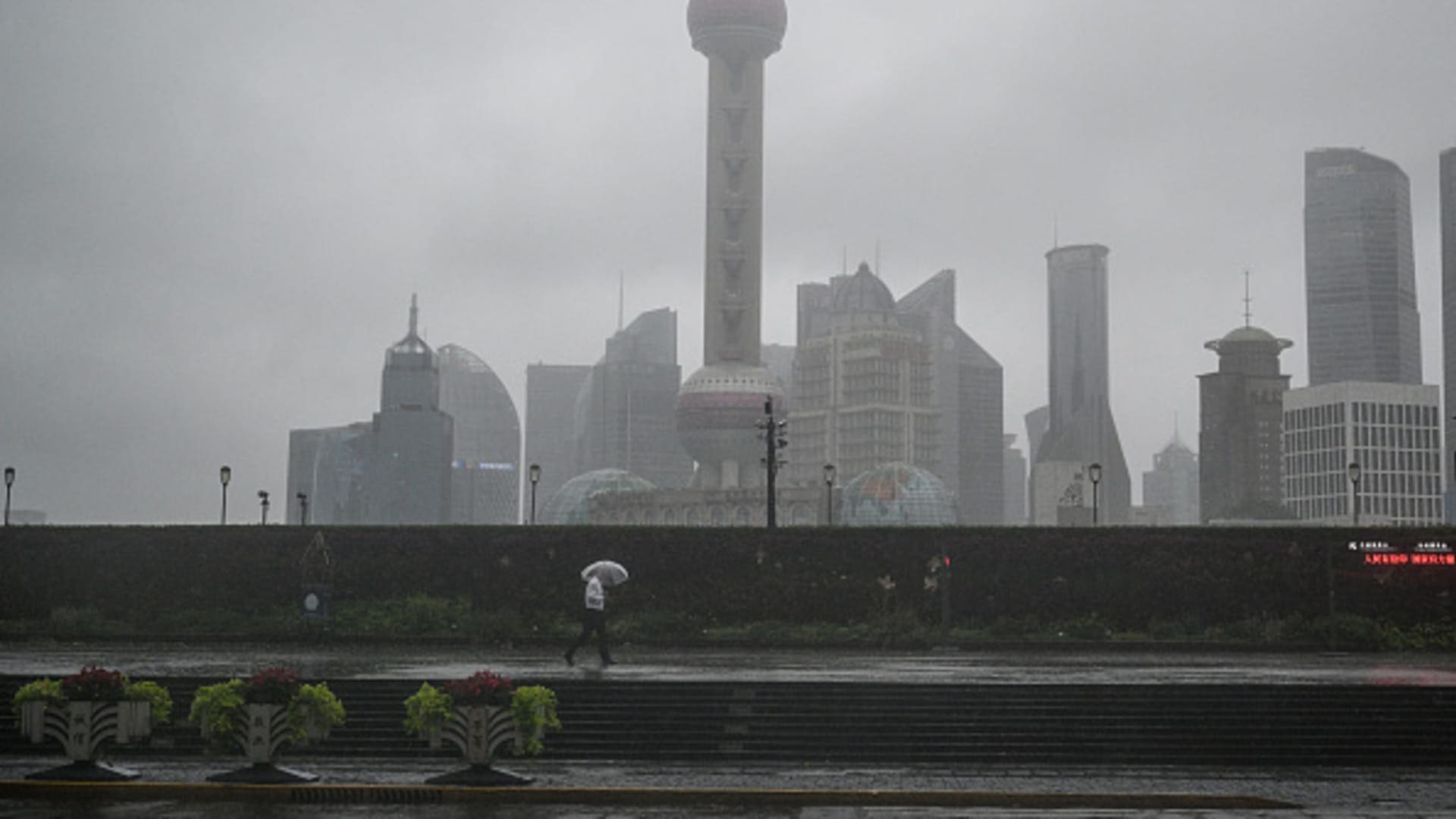

A man strolls alongside The Bund all through the circulate of Tropical storm Bebinca in Shanghai on September 16, 2024. The best twister to strike Shanghai in over 70 years made landfall on September 16, state media reported, with journeys terminated and freeways shut as Tropical storm Bebinca lashed the town with strong winds and downpours.

Hector Retamal|Afp|Getty Photos

Asia-Pacific markets had been primarily higher Monday, as financiers analyzed through monetary data from China and waited for the Federal E book’s monetary plan motion.

Hong Kong’s Hold Seng index was up 0.13% since its final hour of buying and selling, turning round coaching course in an uneven session.

China launched quite a lot of stressing monetary data over the weekend break, with August manufacturing facility outcome, retail gross sales and monetary funding numbers lacking out on assumptions. City unemployed worth elevated to a six-month excessive whereas year-on-year residence prices dropped at their quickest velocity in 9 years.

The Fed is fulfilling on Tuesday and Wednesday, with predominant lenders anticipated to cut back costs for the very first time as a result of 2020.

Australia’s  S&P/ ASX 200 elevated 0.27% to close at 8,122.60. The Taiwan Weighted Index included 0.42% to complete at 21,850.08.

Markets in landmass China and South Korea had been shut for Mid-Autumn celebration. Japan markets had been shut for Regard for the Aged Day.

Tropical storm Bebinca has truly led to termination of quite a few journeys in China and Shanghai is anticipated to be struck by the best twister as a result of 1949.

Jap financiers likewise await a swath of important data and reserve financial institution decisions from the world.

Japan’s rising price of residing is anticipated to tick higher in August, in accordance with a Reuters survey, backing the state of affairs for the Monetary establishment of Japan to stay hawkish because the board establishes its plan on Friday.

The reserve financial institution is ready for to keep up the worth unmodified whereas signaling that further rate hikes had been within the homicide.

The Japanese yen bolstered Monday early morning to commerce at 140.49 versus the greenback. If the yen holds these levels, the cash will definitely shut at its best in higher than a yr.

China is positioned to determine its one- and five-year finance prime costs on Friday. The 1 yr worth, which influences most brand-new and superior fundings, is presently at 3.35%, whereas the five-year worth, that impacts the charges of residence loans, is presently at 3.85%.

[ad_2]

Source link .