[ad_1]

In the face of decreasing oil manufacturing and financial obstacles, Nigeria’s oil market stands at an essential time. The immediate requirement for performance and price decrease has actually never ever been even more noticeable. This short article discovers the transformative possibility of boosting boring efficiency and minimizing well distribution expenses, highlighting the considerable chances and techniques that can drive the market ahead and protect its lasting sustainability.

To price quote Joel Barker in “Business of Paradigms,” “It’s so very easy to claim no to an originality. Besides, originalities create modification; they interrupt the status. They take individuals out of their convenience areas and produce unpredictability … And also, it is much less function to do points the method we have actually constantly done it. Much less job, possibly. Expensive, certainly.”

New concepts are withstood from oily gear floorings in the Niger Delta Swamps to comfy office and meeting room in regulatory authorities’ workplaces in Abuja, each with extremely excessive expenses of passivity.

Yet it’s company customarily in Nigeria’s oil market regardless of present financial truths in the nation, which offer the motivation for an extreme makeover of its price base. Drawing the troubling economic climate from the edge requires an extreme enhancement in performance within its pillar market. Diminishing day-to-day manufacturing and considerably decreased forex incomes and international gets develop the seriousness to drive down the device price per barrel of oil created.

Just mentioned, today’s ‘great’ is tomorrow’s ‘unsatisfactory,’ and what collections us apart today will certainly be the standard tomorrow. The future comes from those that show seriousness and insight.

A Substantial, Yet Untapped Opportunity

Successful upstream procedures are underpinned by the capacity to stabilize the triad of price, timetable, and manufacturing and make best use of NPV, i.e., generate one of the most barrels in the quickest way feasible at the most affordable mean price throughout a profile of properties.

Step-by-step enhancement in well distribution (boring & & conclusion) performance in the United States defined the shale oil boom, which successfully started in 2007. Performance gains reduced well expenses by a 3rd and decreased price per barrel by 75% in the years in between 2007 and 2017. Essentially, America ended up being an oil and gas giant within this duration, increased United States shale manufacturing, and tripled overall day-to-day oil outcome.

In Nigeria, the oil and gas market is the biggest income factor to the Nigerian economic climate, yet manufacturing has actually decreased by 40% from 2010 to day. Decreasing oil manufacturing provides significant income obstacles and speeds up persistent macroeconomic situations in the brief to tool term.

Minimizing device manufacturing expenses by driving down well distribution expenses provides an untapped possibility to raise federal government incomes and decrease its financial shortage.

Being one of the most complicated, expensive, and extremely specialized upstream growth task, which quickly represents as much as 60% of oilfield growth CAPEX, piercing provides an one-of-a-kind possibility to decrease the price of oil manufacturing.

Therefore, in the very early eighties, piercing designers and various other workers running in the UK North Sea acknowledged the requirement to gain from each various other and contrast efficiencies throughout each various other’s boring procedures. This resulted in the development of the Exploration Efficiency Evaluation (DPR) in 1989, a boring benchmarking club. Most of global drivers that are value-driven remain to sign up for the DPR to today for the fundamental advantage to their worldwide procedures and venture monetary efficiency.

Generally, as much as 60% of boring time mosts likely to non-productive time (NPT) and ineffectiveness, understood in boring parlance as unseen lost time (ILT). The price of ILTs, being an unseen variable, to the Nigerian oil market remains in the order of billions of bucks overspent yearly.

Improving boring efficiency, for that reason, is an enabler to minimizing the price of oil manufacturing. Reduced boring expenses promote even more boring tasks, which subsequently raises manufacturing and minimizes device manufacturing expenses.

You Can not Boost What You Do not Measure

Drilling efficiency in Nigeria is filled with remarkable ineffectiveness. A a sign criteria of a typical Nigerian and a comparable North American well discloses considerable underperformance in the Nigerian well as determined by days to pierce a 10,000-foot well. A 10,000-foot well regularly supplied in 10 days in the US/Canada can take as long as 85 days in Nigeria. This difference is theorized to be the source of the regularly high well distribution price in Nigeria. Overmuch long well periods postpone time to market (deferred manufacturing), decrease job NPV, and expensive wells decrease the variety of lucrative chances, which subsequently minimizes gear tasks and connected need for solutions.

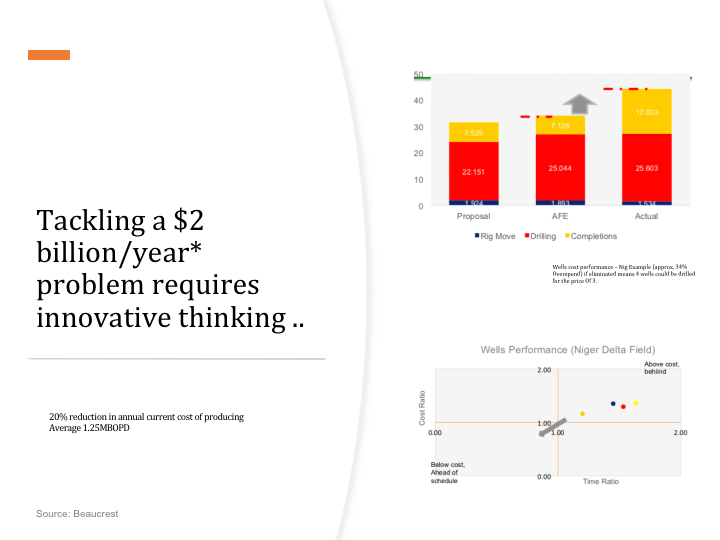

By top-down price quotes, the market invests circa $11.4 billion to generate 1.25 million barrels day-to-day and around $6 billion in boring wells. A 30% efficiency space in between the licensed expense (spending plan) and real expenses, as amassed from an evaluation of Nigerian wells, stands for a $1.8 billion a year possibility.

The unrelenting search of quality in well distribution starts with developing essential signs, which should be tracked with roughness, and gives an indicator of boring efficiency and performance fads.

An exceptional boring performance statistics generally tracked is the invest ($) per storage tank foot of opening. US-based oil solutions study company Spears & & Associates, Inc. took a look at this statistics in United States land procedures from 2006 to day, revealing the price of a foot of revealed storage tank dropping by 75% in over a years when considering what was paid to the agreement driller. Likewise, the directional driller price per revealed storage tank foot dropped from $45 to $35, a decline of 25%.

Along with the decreased price per barrel, various other effects of piercing performance gains damage down as adheres to:

- The cost of acquiring a gear in 2006 is currently the cost of 4 gears in 2023, i.e., 4 gears can be running today wherefore it set you back 16 years ago.

- 4 gears piercing methods 300 oilfield employees used (rather than 75 on one gear). This is straight labor. We understand the amount of mouths obtain fed when 300 employees are used rather than 75.

- 4 gears functioning indicates a greater gear matter generally. A greater gear matter indicates much more solutions acquired, e.g., wireline, mud logging, casing, and sealing teams, and so on. This indicates 4X the variety of casing running teams, mud logging teams, wireline teams, and so on, required (in addition to the variety of mouths each of them feed). This merely indicates greater task and costs in the industry.

- 4 gears functioning indicates even more storage tank direct exposure, greater manufacturing, greater possibility of brand-new explorations, which raises gets, and equates to greater incomes for the nation in the type of (a) enhanced federal government share of oil manufacturing and (b) enhanced tax obligations and aristocracies building up to the state.

- Driving down boring expenses can make the distinction in between a low area owner’s capacity to market a property.

Where There Is a Will, There Is a Way

Investments in the Nigerian oil and gas industry decreased by 70% in between 2017 and 2021, carefully associating with the tightening in manufacturing outcome. Nigeria can just draw in $3 billion in financial investments (around 5% of the overall financial investment right into the industry in Africa) in the 5 years in between 2017 and 2022 regardless of having 38% of the continent’s overall hydrocarbon gets. As the federal government promotes even more transfer of source possession to residents through arranged property farm-outs and International Oil Business (IOC) divestments, Nigeria’s oil market’s uncompetitiveness is definitely at its peak.

For the market several of us enjoy for being the resource of our resources, the thousands of hundreds of mouths it feeds straight, and the thousands of numerous Nigerians it’s lasting sustainability effects, drawing the market (and by expansion the economic climate) back from the edge is not optional, yet an issue of feral seriousness, a job which relaxes directly with the market governing firms.

Warm as the execution has actually been, the Oil Sector Act pushes the Nigerian Upstream Oil Regulatory Compensation (NUPRC) to drive price and funding performance in oil market upstream procedures. An overall transmutation of NUPRC’s operating viewpoint from that of its precursor company, the DPR (not the business-as-usual method), will certainly be called for to open a $2 billion a year possibility in these essential times as the oil market proceeds hemorrhaging unrelenting.

Neighborhood drivers and IOCs remain to fight a getting worse funding dry spell and market tightening. Stakeholders that will certainly be assembling in the country’s funding on the 26th and 27th of June at the NUPRC-organized market consultatory workshop will certainly be looking for support from their hosts, interested to discover what fresh concepts will certainly be revealed that will certainly prompt the disastrous activities to stem the existential situation facing the industry.

Present truths offer the motivation to set up a calculated boring price decrease campaign in Nigeria. Initiative should be made to sustainably decrease well distribution expenses throughout all joint endeavors, single danger, and manufacturing sharing agreement (PSC) procedures for the lifeline it supplies to a sector actually tethering on life assistance.

Operators be entitled to understandings and solution to these essential inquiries, which actually can be removed from gigabytes of boring information in PDFs, and in hundreds of paper copy folders being in messy closets in NUPRC’s storage facilities.

- That are the most effective in Course/ Leading Quartile Nigerian Operators throughout essential efficiency metrics (boring performance (rate) and price ($)) in each surface?

- What are the efficiency spaces in between their very own wells and the very best in course wells?

- What are the original variables for the inconsistencies in efficiency (space) in between their wells and the very best in course wells?

- What can they do to shut the spaces and bring up their efficiency in the direction of the very best in course?

While they scrape their heads looking for solutions, we suggest the regulatory authority quickly institute efficiency enhancement programs that utilize the most recent computer innovations in addition to a wealth of human funding to drive the methodical optimization of boring programs and the invasion of industrial sustainability throughout the breadth of Nigerian boring procedures. This will certainly function as a financial stimulation by reducing all essential metrics, consisting of device operating, in addition to searching for and growth expenses. It will certainly boost the financial breakeven cost of oil.

There is no standing still. We are either expanding or passing away, and because we are not expanding, as developed by all indices, we test the custodians of this atrophying market to lead, adhere to, or merely finish.

Concerning the Author

Dimeji Bassir is an achieved oil and gas exec with over twenty-five years of global experience dealing with international drivers and oilfield solution firms. Throughout his occupation, he has actually held different functional, getting in touch with, and industrial duties at Chevron, Baker Hughes, Halliburton, and General Electric. Presently, Bassir leads Ofserv, an independent working as a consultant concentrating on subsurface design, job administration, piercing efficiency enhancement, and integrity solutions. Prior To Ofserv, Bassir was the Nation Supervisor for Nigeria at GE Oilfield Modern Technology and an Exploration Dependability Professional at GE Power Providers. He likewise functioned as an Exploration Efficiency Professional for customers such as BP, Covering International, and ConocoPhillips, and held area design placements in both onshore and overseas boring procedures with Baker Hughes, Halliburton, and Chevron.

[ad_2]

Source link .