[ad_1]

Markets maintained their cool on Monday amidst a fast-moving and unstable geopolitical landscape in the center East â $ ” yet the longer-term danger costs has actually most likely climbed, while oil costs stay on side, experts stated.

Iran launched greater than 300 drones and missiles versus armed forces targets in Israel on Saturday, noting the very first straight assault on the Jewish state from Iranian region. The offensive triggered restricted damages and no casualties.

Iran stated it was acting in self-defense in feedback to a strike on its polite compound in Damascus, Syria, previously this month. Israel has actually decreased to talk about its participation.

Additionally on Saturday, in advance of the strike, Iran took a container ship in the Strait of Hormuz that Tehran stated was connected to Israel. The sea flow is referred to as the “globe’s essential oil chokepoint,” with circulations amounting to around 21% of international oil fluids usage in 2022, according to the united state Power Details Management.

By Monday, international gamers including the U.S. and European leaders were looking for to cool down stress, prompting Israel to reveal restriction in its feedback.

Fx markets are valuing in “close to term de-escalation” following the weekend break occasions, Adarsh Sinha, co-head of Asia FX and prices strategy at Financial institution of America, informed CNBC’s “Squawk Box Europe” on Monday. The ‘safe house’ U. S. dollar was 0.15% reduced versus a basket of significant money early Monday, likewise deteriorating versus the Iranian rial and the Israeli shekel.

Sinha however included that “the reality that we relocated from a proxy conflict to a straight conflict, although that de-escalates in the close to term, the longer term danger costs most likely increases.”

” I assume the FX market eventually will take its hint from oil costs since eventually, that’s the network where it overflows to the FX market,” he stated.

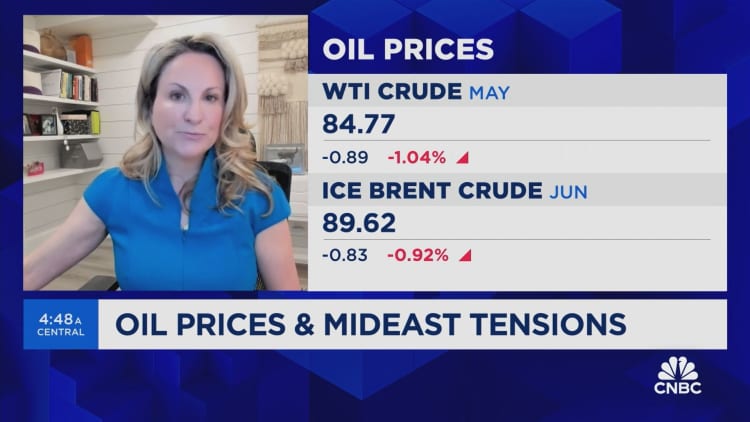

Oil costs were reduced in very early Asia hours on Monday, cooling down from Friday gains which improved the assumption of an Iranian strike. Nymex WTI unrefined futures agreements with May expiration were 0.81% reduced at $84.97 per barrel by very early mid-day in London, while the ICE Brent contract with June distribution was down 0.73% at $89.79 per barrel.

Markets had actually valued in the “well-telegraphed” occasion, which clarifies the rate decrease, Amrita Sen, founder of Power Aspects, informed CNBC’s “Road Indications Europe.”

That does not indicate costs will certainly remain to drop, she included â $” although their program will certainly depend upon Israel’s response and following actions.

Dangers increased

Economists and experts concurred that total lasting dangers and unpredictability are currently increased.

” The extraordinary Iranian assault on Israeli targets casts a darkness over the financial and economic expectation past the area itself. The danger that the problem in the center East might rise even more has actually enhanced,” Holger Schmieding, primary financial expert at Berenberg Financial institution, stated in a Monday note.

Problem in between Israel and Iran is not likely to have an extreme effect on the international economic situation, Schmieding proceeded, indicating the relatively limited effect to the economic outlook caused by Houthi attacks on cargo ships in the Red Sea.

Disruption to oil shipments through the Strait of Hormuz “would be a very different matter,” he said, calling this the “key risk to watch.” However, this hit to oil exports would hurt Iran badly, Schmieding continued, meaning that Tehran is unlikely to want to escalate to such a level.

A possible Iranian blockade of the Strait of Hormuz will hold Brent prices above $84 dollars per barrel for the remainder of the year and cause a potential rally to over $100 per barrel in the event of “open war,” according to Bartosz Sawicki, market analyst at Conotoxia.

Iran’s assault has already threatened regional oil supply in a market that has been “broadly balanced” in the first part of the year, and increased the risk of flipping to undersupply, Sawicki said. Iran’s crude production totals nearly 3.5 million barrels per day, accounting for around 3.3% of global production, he noted.

“A tougher stance on Iran and stricter enforcement of previous sanctions should be expected,” Sawicki, said. Significant retaliation by Israel could meanwhile trigger an oil price rally, strong demand for the U.S. dollar and renewed buying of gold, he added.

European equity markets were slightly higher Monday, with U.S. futures also brightening from a Friday retreat.

Impact on stocks could come by way of a change to interest rate expectations, analysts at Deutsche Bank said in a note.

Yet what form that will take is uncertain, they add. Higher oil prices could keep inflation sticky in major economies, pushing back the timing of interest rate cuts â while a “geopolitical shock” could bring such trims forward by threatening growth.

[ad_2]

Source link