[ad_1]

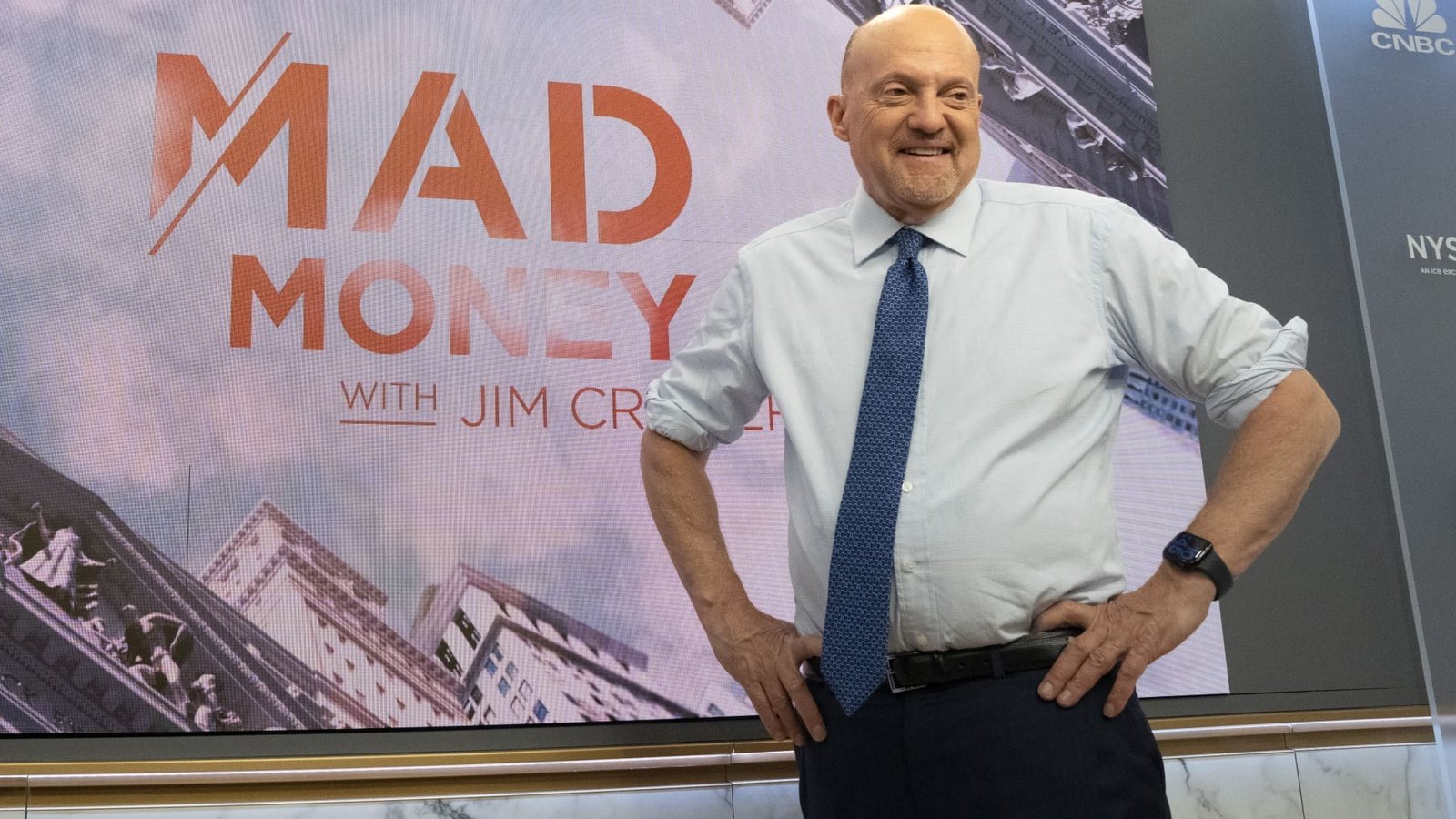

On the eve of the May work record, CNBC’s Jim Cramer advised capitalists concerning the complicated harmonizing act the Federal Book is trying to manage â $” reducing rising cost of living without seriously harming the economic situation.

Capitalists are favoring weak numbers so the Fed will certainly be much more likely to apply rates of interest cuts. Yet Cramer claimed Wall surface Road ought to remember what goes to risk for customers, particularly those with reduced revenues, when it concerns this information and the Fed choices.

” I desire greater supply rates, as well, yet if we obtain several price cuts and rising cost of living comes barking back, it’s the have-nots that’ll obtain harmed,” he claimed. “That’s why the risks are so high for the Fed. It can not pay for to reduce prices till there are even more individuals unemployed, yet, at the exact same time, it does not wish to create mass discharges â $” challenging placement.”

He additionally kept in mind that it is foolish to generalise concerning the customer in the abstract, claiming that while many really feel the sting of rising cost of living, “the have-nots are feeling it a hell of a great deal greater than the riches.” According to Cramer, it is tough for merchants to properly refer to as customers as weak or solid since they recognize with their very own consumers, not the more comprehensive populace.

Cramer proceeded, claiming, “the gulf is large” in between customers, yet recommended that lots of well-off capitalists do not recognize sufficient concerning this duality.

” Wall surface Road might be favoring a weak task market to ensure that the Fed can begin reducing prices, yet bear in mind what you’re wagering versus when you vomit your hands in temper tomorrow at a below 4% joblessness price,” he claimed. “[Fed Chair] Jay Powell isn’t stressed over those people with large profiles â $” he’s stressed concerning the 10s of numerous individuals with practically absolutely nothing in the financial institution.”

[ad_2]

Source link