[ad_1]

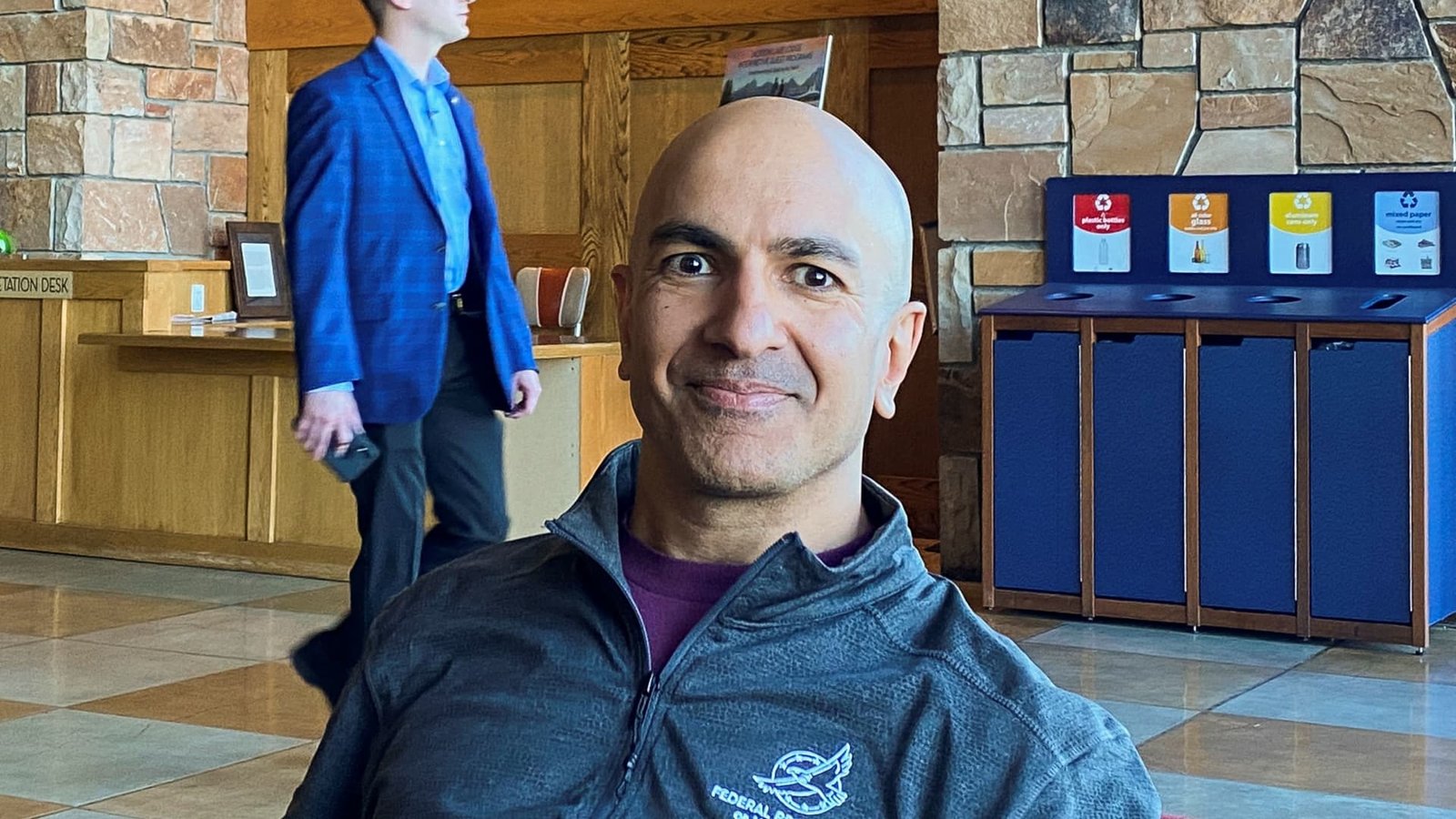

Federal Book Financial Institution of Minneapolis Head of state Neel Kashkari beings in the entrance hall of the Jackson Lake Lodge in Jackson Opening, where the Kansas City Fed holds its yearly financial seminar, in Wyoming, August 24, 2023.

Ann Saphir|Reuters

Minneapolis Federal Book Head Of State Neel Kashkari on Sunday stated it’s a “affordable forecast” that the united state reserve bank will certainly reduce rates of interest as soon as this year, waiting up until December to do it.

” We require to see even more proof to encourage us that rising cost of living is well on our back to 2%,” Kashkari stated in a meeting with CBS’ “Face the Country” program.

The Fed recently held its benchmark plan price in the 5.25% -5.50% array, where it has actually been given that last July, to maintain ongoing stress on the economic climate so regarding cool down rising cost of living. It additionally released forecasts that revealed the average projection from all 19 united state main lenders was for a solitary rate of interest reduced this year.

” We remain in a great placement now to take our time, obtain even more rising cost of living information, obtain even more information on the economic climate, on the labor market, prior to we need to make any kind of choices,” Kashkari stated. “We remain in a solid placement, yet if you simply stated there’s mosting likely to be one cut, which is what the average showed, that would likely be towards completion of the year.”

Kashkari, that has actually been extra mindful regarding the opportunity of relieving financial plan than a number of his coworkers, did not claim the amount of price cuts he directly anticipates.

He stated he has actually been shocked by exactly how well the united state task market has actually executed also as the Fed elevated loaning prices strongly in 2022 and 2023, yet that he anticipates extra cooling in advance.

” I wish it’s moderate air conditioning, and afterwards we can come back to even more of a well balanced economic climate,” he stated.

Rising cost of living by the Fed’s targeted procedure, the year-over-year modification in the individual usage expenses consumer price index, signed up 2.7% in April. The Fed has a 2% target.

The joblessness price in May ticked approximately 4%, the highest possible given that right before the Fed introduced its price treking project in March 2022 yet still listed below what the majority of its policymakers view as lasting.

Inquired about the obstacle high loaning prices present for individuals shopping a home, Kashkari stated the very best point the Fed can do for the real estate market is to bring rising cost of living pull back to target.

” If we merely reduced rates of interest to attempt to sustain own a home now, that would most likely raise the cost of residences, and it really would not result in any kind of much better price,” he stated.

” The most effective point we can do is do our task – obtain rising cost of living pull back to our target – and afterwards, with any luck, the supply side of the economic climate can action in to construct the homes that Americans require.”

[ad_2]

Source link .