[ad_1]

Airwallex, which was most these days valued at $5.5 billion and is backed by Tencent, has really been tipped as one in all a lot of noticeable fintech IPO prospects.

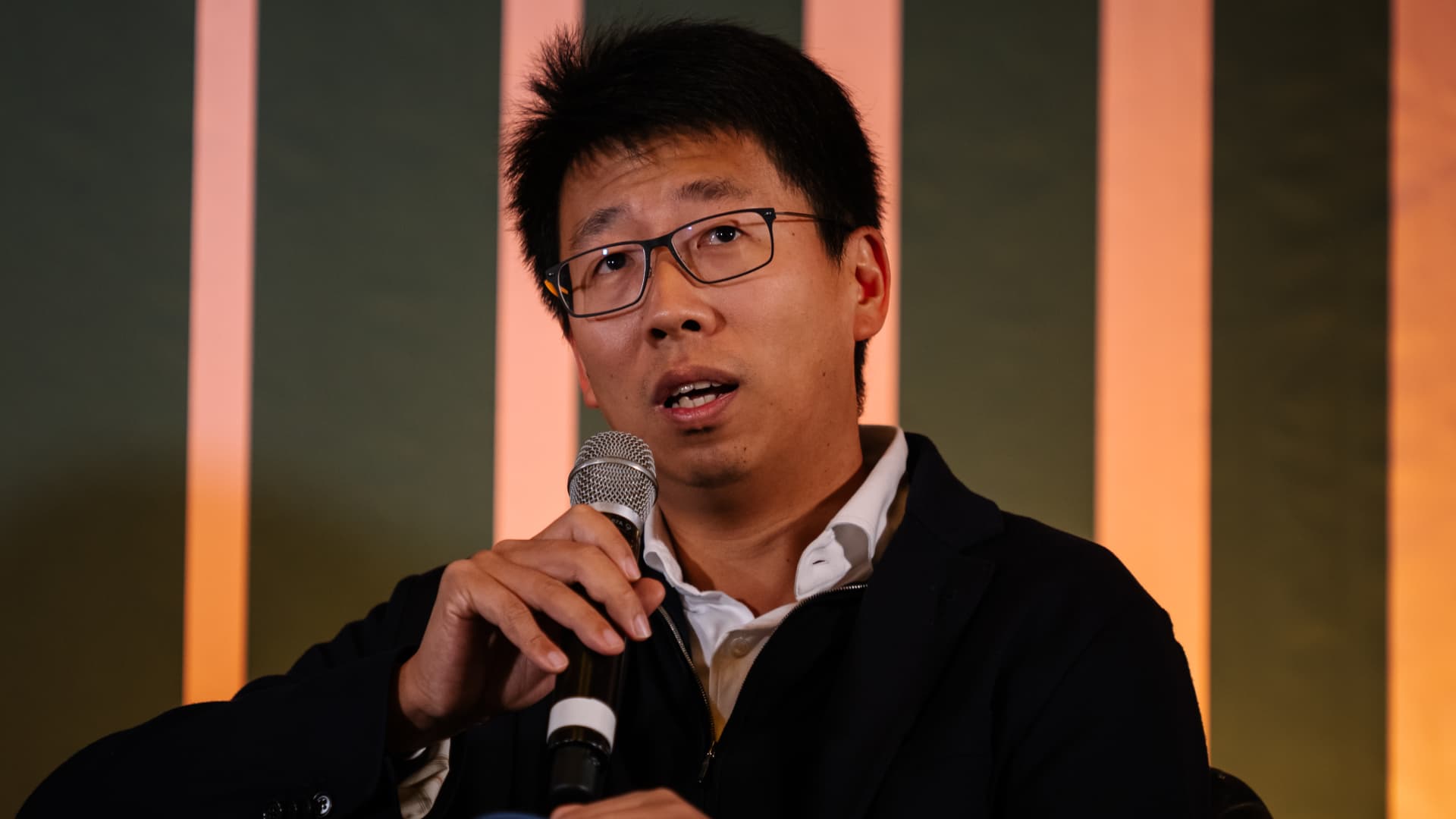

Jose Sarmento|Bloomberg|Getty Pictures

Tencent-backed repayments start-up Airwallex is nearing a yearly income run worth of $500 million and will definitely search to arrange for a going public by 2026, chief government officer and founder Jack Zhang knowledgeable CNBC in a particular assembly.

” I imagine the next enormous turning level is the $1 billion. Hopefully we are able to attain that in 2026, or 2027. That’s the goal,” Zhang claimed, in response to an inquiry on what’s following for the Singapore-based firm after nearing the $500 million ARR turning level.

Run worth is a harsh motion of simply how a lot income a agency will definitely make in a solitary yr, based mostly upon common month-to-month effectivity.

Zhang claimed that Airwallex has really seen appreciable improvement in its group within the in 2015, improved by a improvement proper into industrialized markets such because the U.Ok. Europe, and The USA And Canada.

Within the Americas space, Airwallex expanded its income by larger than 300% year-over-year, in line with numbers proven to CNBC.

The U.Ok., Europe, and The USA and Canada at the moment make up larger than 35% of Airwallex’s whole buy portions, Zhang claimed.

When requested by CNBC regarding precisely how he actually feels regarding the potential for an IPO for his group, Zhang claimed: “For us, it is practically acquiring IPO-ready within the following 2 years to be sure that we now have the choice to go or in any other case go.”

” In 2025, we will definitely put together no matter, and we are able to select what to do after 2026,” he included.

Airwallex went throughout $100 billion in yearly reimbursement dealing with portions this yr, Zhang claimed, noting a 73% rise from in 2015. That got here as the corporate noticed portions increasing all through all its gadgets, consisting of repayments, fx, funds, and offering.

” It took us 9 years to go throughout the $100 billion market,” Zhang claimed. “Hopefully it doesn’t take a lot lower than a yr to succeed in $200 billion.

Using ‘AI workers’ to cut back prices

Zhang included that Airwallex is not specializing in making a yearly web earnings offered its current velocity of improvement – but the corporate is searching for means to keep up costs down. Professional system, he claimed, has really assisted Airwallex make its workers members much more efficient whereas likewise producing worth monetary financial savings.

For example, he claimed that Airwallex is discover 11x, a agency that gives varied different companies accessibility to digital “AI workers,” to alter a substantial a part of their gross sales development reps (SDRs) â $ ” workforce that think about caring for gross sales leads.

That experiment has really simply these days gone real-time, he claimed, but Zhang is so sure regarding the fostering of AI representatives to deal with the day by day job of SDRs that he believes they may change as excessive as 70% of those types of workers members inside Airwallex.

He nervous that, whereas some duties will correctly be modified with AI, many will definitely be boosted by the innovation as Airwallex’s gross sales teams will definitely have the flexibility to do much more with a lot much less.

Airwallex, which was most these days valued at $5.5 billion and is backed by Tencent, has really been tipped as one in all a lot of important fintech IPO prospects. Nevertheless Zhang claimed that the way of thinking within the financial innovation sector remains to be principally bitter, for the minute.

” Capitalist understanding remains to be not incredible and remains to be conventional,” Zhang knowledgeable CNBC. “That is been happening for regarding 3 years. Completely nothing has really really remodeled that a lot.”

Nevertheless, he included: “Fintech is a large market. You see enormous companies like Nubank, Revolut, Purple stripe, Adyen continuing to do really well.”

“Investors will still pick the right companies to invest. We just need to make sure that Airwallex is the number one in global payments in the financial space,” said Zhang.

[ad_2]

Source link