[ad_1]

Silo, a Bay Area food supply chain startup, has actually struck a harsh spot. TechCrunch has actually found out that the business on Tuesday gave up about 30% of its personnel, or north of 2 lots workers. Silo has actually verified the head count decreases, making clear the cuts were throughout the board and not concentrated on private divisions.

Silo shared the complying with declaration with TechCrunch relating to the discharges:

We just recently made the challenging choice to decrease our head count by nearly 30%. We are devoted to sustaining those staff member influenced and have actually offered severance bundles and hiring assistance. At the exact same time, Silo continues to be committed to offering our consumers and the perishables sector at big, and will certainly remain to concentrate even more nimbly on structure next-generation supply chain administration software program remedies.

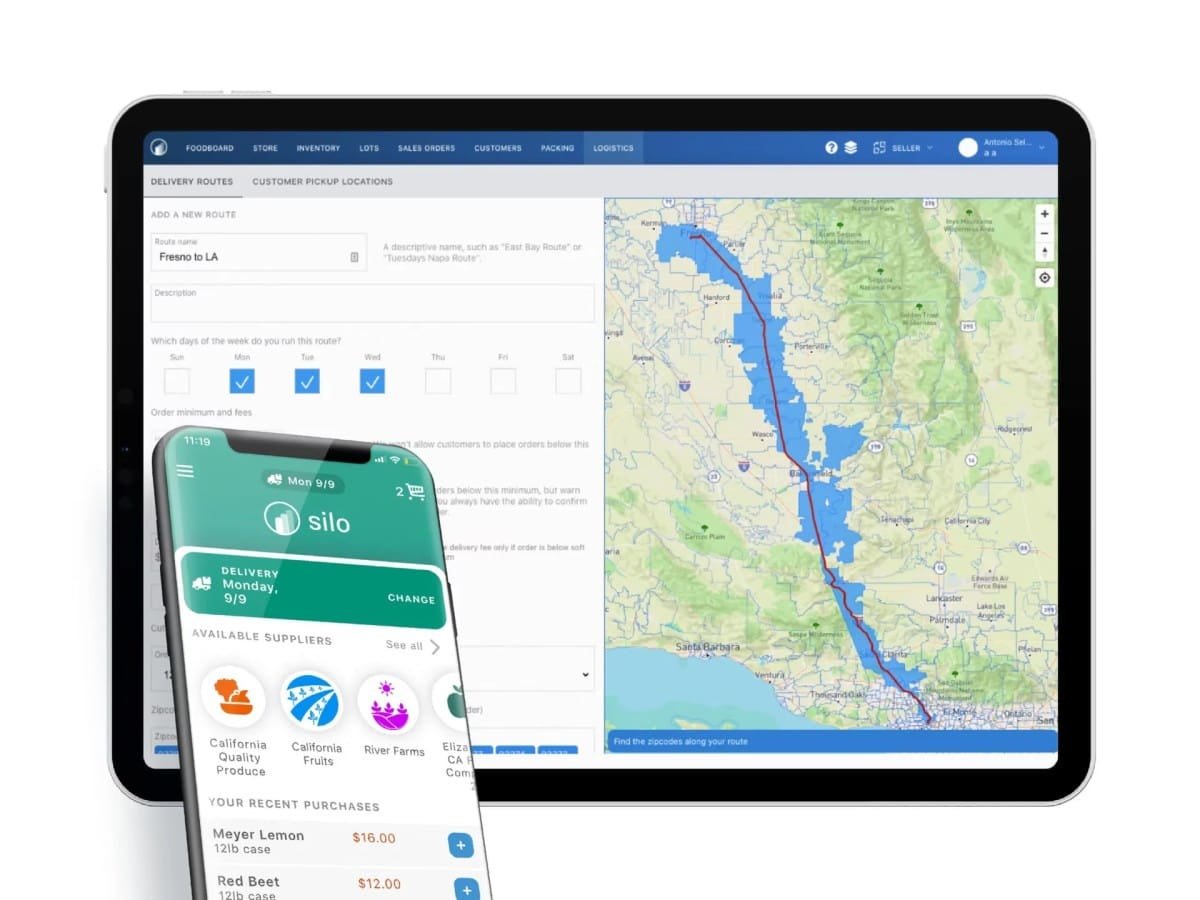

Established in 2018, Silo’s platform helps automate the operations of food and farming companies and later increased right into various other locations, like repayment items for accounts payable and receivable automation, stock administration, journal bookkeeping, funding and even more.

Leading up to the discharges was a concern around a financing item that had actually harmed Silo’s earnings. A business resource verified that a client had actually ended up being overdue on their lending, which triggered Silo’s financial companion to stop the lending item. Silo after that dealt with the financial institution to fix the trouble with the consumer, so the center has the capability to money once again.

While Silo is currently able to offer, the absence of repayment from that consumer and total time out in borrowing suggested a decrease in earnings for that duration, causing the discharges. Because of that, Silo will likely beware regarding increase the borrowing item as it moves on.

This all occurred in current weeks. Nevertheless, it’s feasible that if Silo had actually carried out more powerful threat administration procedures, it would not have actually dealt with the default.

Furthermore, we’re listening to Silo is participated in M&A conversations as an additional feasible resolution to its existing scenario. The business had actually formerly participated in conversations with prospective bargain companions in advance of its Collection C in 2015, yet the fundraise permitted Silo to stop those talks temporarily. In current weeks, those M&A conversations have actually chosen back up once again on the back of brand-new development the business saw in 2015 along with the feasible requirement for a departure.

The start-up raised $32 million in Series C funding last summer season. Financiers consist of Initialized, Haystack, People Resources, KDT, a16z and others.

[ad_2]

Source link .