[ad_1]

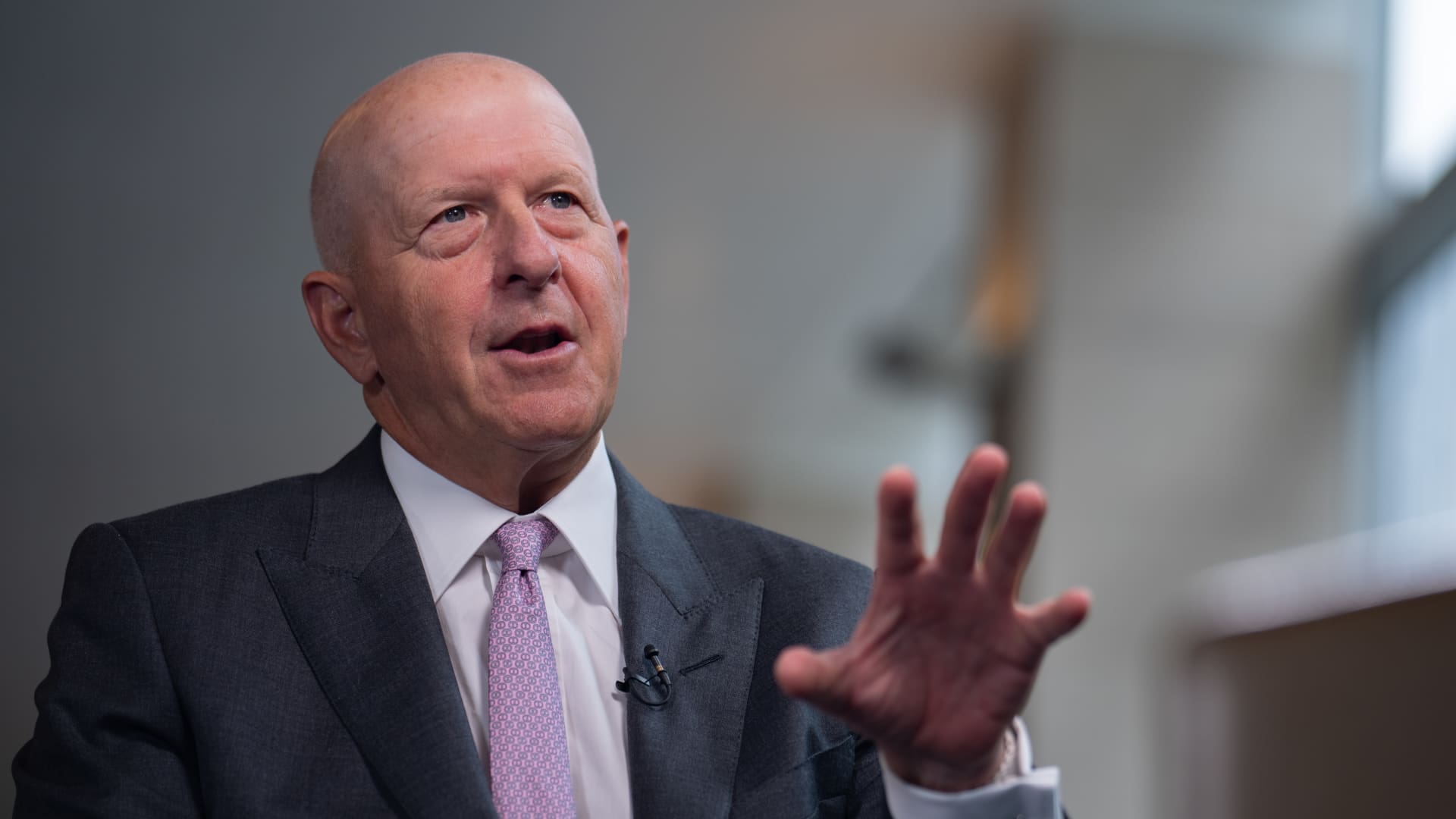

David Solomon, Chief Government Officer of Goldman Sachs, all through a gathering for an episode of “The David Rubenstein Program: Peer-to-Peer Conversations” in New York Metropolis on Aug. 6, 2024.

Jeenah Moon|Bloomberg|Getty Pictures

Goldman Sachs will definitely add an roughly $400 million pretax hit to third-quarter outcomes because the monetary establishment stays to calm down its unlucky buyer firm.

chief government officer David Solomon claimed Monday at a gathering that by discharging Goldman’s GM Card firm, together with a special profile of funds, the monetary establishment will surely add successful to incomes when it studies outcomes subsequent month.

It’s the newest disturbance pertaining to Solomon’s press proper into buyer retail. In late 2022, Goldman began to pivot removed from its incipient buyer procedures, beginning a group of write-downs related to providing parts of enterprise. Goldman’s financial institution card firm, notably its Apple Card, permitted quick growth in retail borrowing, nonetheless likewise resulted in losses and rubbing with regulatory authorities.

Goldman is fairly concentrating on possession and wide selection monitoring to help drive growth. The monetary establishment remained in communicate with market the GM Card system to Barclays, The Wall floor Street Journal reported in April.

Solomon likewise claimed Monday that buying and selling earnings for the quarter was gone to a ten% lower on account of a difficult year-over-year distinction and difficult buying and selling issues in August for fixed-income markets.

[ad_2]

Source link