[ad_1]

Sundar Pichai, ceo of Alphabet Inc., throughout Stanford’s 2024 Service, Federal Government, and Culture online forum in Stanford, The Golden State, United States, on Wednesday, April 3, 2024. Â

Loren Elliott|Bloomberg|Getty Images

Google’s organization is expanding at its fastest price in 2 years, and a blowout revenues record in April triggered the most significant rally in Alphabet shares given that 2015, pressing the firm’s market cap past $2 trillion.

However at an all-hands conference recently with chief executive officer Sundar Pichai and CFO Ruth Porat, workers were a lot more concentrated on why that efficiency isn’t equating right into greater pay, and the length of time the firm’s cost-cutting procedures are mosting likely to remain in area.

” We have actually discovered a considerable decrease in spirits, enhanced suspect and a detach in between management and the labor force,” a remark uploaded on an interior online forum in advance of the conference read. “Exactly how does management strategy to attend to these problems and reclaim the count on, spirits and communication that have been fundamental to our firm’s success?”

Google is making use of expert system to sum up staff member remarks and concerns for the online forum.

Alphabet’s leading management has actually gotten on the defensive for the previous couple of years, as singing staffers have actually railroaded regarding post-pandemic return-to-office requireds, the firm’s cloud agreements with the armed forces, less benefits and an extensive stretch of discharges â $ ” amounting to greater than 12,000 in 2014 â $ ” in addition to various other expense cuts that started when the economic situation kipped down 2022.

Workers have actually additionally whined regarding an absence of count on and needs that they deal with tighter target dates with less sources and reduced possibilities for interior development.

The interior rivalry proceeds regardless of Alphabet’s better-than-expected first-quarter revenues record, in which the firm additionally revealed its very first reward in addition to a $70 billion buyback.

” Regardless of the firm’s excellent efficiency and document revenues, numerous Googlers have actually not gotten significant settlement rises” a premier staff member inquiry read. “When will staff member settlement relatively mirror the firm’s success and exists an aware choice to maintain earnings reduced as a result of an air conditioning work market?”

Another highly-rated remark focused around the firm’s top priorities, including its significant financial investments in expert system.

” To many individuals, there’s a clear separate in between costs billions on supply buybacks and returns and re-investing in AI and re-training vital Googlers,” the message stated.

Ruth Porat, Alphabet’s primary monetary police officer, shows up on a panel session at the Globe Economic Discussion Forum in Davos, Switzerland, on Might 24, 2022.

Hollie Adams|Bloomberg|Getty Images

” Our top priority is to purchase development,” Porat stated, as she took the microphone to reply to concerns. “Income ought to be expanding much faster than expenditures.” Â

She additionally took the unusual action of confessing to management’s blunders in its previous handling of financial investments.

” The issue is a number of years ago â $ ” 2 years earlier, to be accurate â $ ” we in fact obtained that inverted and expenditures began expanding much faster than earnings,” stated Porat, that revealed almost a year ago that she would certainly be tipping down from the CFO setting however hasn’t yet abandoned the workplace. “The issue with that said is it’s not lasting.”

Google execs have actually been hammering this style of late.

Browse manager Prabhakar Raghavan, in an interior conference last month, indicated Google’s core organization difficulties, stating “points are not like they were 15 to twenty years earlier,” and advised workers to function much faster. He informed his group, “It’s not such as life is mosting likely to be dandy, for life.”

Google’s cloud organization was amongst systems advising workers to relocate within much shorter timelines although they had less sources after expense cuts.

Google’s use cash

There were a great deal of staff member concerns in advance of recently’s conference guided at the firm’s buyback, Porat stated.

Since last quarter, Alphabet had greater than $100 billion in money on the annual report however, Porat stated, “you can not simply drain it” or the firm would certainly discover itself in the very same setting as in 2022.

By comparison, dispersing money to investors is ruled out a cost on the annual report, she stated, including that the board has a fiduciary obligation to think about such procedures. Buybacks and returns do not change financial investments in AI, Porat stated.

Pichai chipped in when Porat finished up her reaction.

” I assume you practically established the document for the lengthiest TGIF solution,” he stated. Google all-hands conferences were initially called TGIFs since they occurred on Fridays, today they can take place on various other days of the week.

Pichai after that joked that management ought to hold a “Money 101” Ted Talk for workers.

Relative to the decrease in spirits raised by workers, Pichai stated “management has a great deal of obligation below, including that “it’s a repetitive procedure.”

Pichai stated the firm staffed up excessive throughout the Covid pandemic.

” We employed a great deal of workers and from there, we have actually had training course adjustment,” Pichai stated.

Alphabet’s permanent head count reached over 190,000 at the end of 2022, up practically 22% from a year previously and 40% greater than at the close of 2020.

Pichai, that changed Google founder Larry Page as CEO of Alphabet in 2019, has taken his share of criticism of late for his messaging to the workforce as well as his lofty pay package, which swelled to $226 million, including stock awards, in 2022.

The package in 2022 included $218 million in equities through a triennial stock grant. His total pay in 2023 was $8.8 million, up from about $8 million the prior year (excluding the stock grant), according to Alphabet’s proxy filing. Aside from Pichai’s $2 million wage for each and every year, the majority of his added settlement was for individual safety and security.

Workers have whined regarding the degree of Pichai’s settlement at once when the firm is scaling down.

” Provided the current head count and favorable revenues, what is the firm’s head count method?” one inquiry read. One more asked, “Provided the solid outcomes, are we finished with cost-cutting?”

Pichai stated the firm is “resolving an extended period of shift as a firm” that includes cutting expenditures and “driving performances.” Relating to the last factor, he stated, “We intend to do this for life.”

” To be clear, we’re expanding our expenditures as a firm this year, however we’re regulating our rate of development” Pichai stated. “We see possibilities where we can re-allocate individuals and obtain points done.”

A Google representative restated to CNBC that the firm is purchasing its most significant top priorities and will certainly remain to work with in those locations.

The representative additionally stated the majority of workers will certainly obtain a pay increase this year, consisting of a boosted wage, equity gives and a benefit. Execs at the all-hands conference stated that staffers that got elevates in 2014 obtained smaller sized elevates than typical.

Another remark drifted in advance of the conference was linked to “expanding problems regarding work relocating from the united state to lower-cost places.” CNBC reported recently that Google is giving up at the very least 200 workers from its “Core” company, that includes essential groups and design ability.

Execs were inquired about the continuous discharges, regardless of the solid revenues record, and “when can we anticipate an end to the unpredictability and disturbance that discharges develop?”

Pichai stated the firm will certainly have overcome most of discharges in the very first fifty percent of 2024.

” Thinking existing problems, the 2nd fifty percent of the year will certainly be a lot smaller sized in range,” Pichai stated, describing work cuts. He stated it will certainly remain to be “really, really disciplined regarding taking care of head count development throughout the year.”

That suggests the firm is still making difficult selections concerning financial investments in brand-new tasks.

” There’s a great deal of need to do brand-new points and, in the past, we would certainly have simply done it reflexively by expanding head count,” Pichai stated. “We can not do it currently with the shift we remain in.”

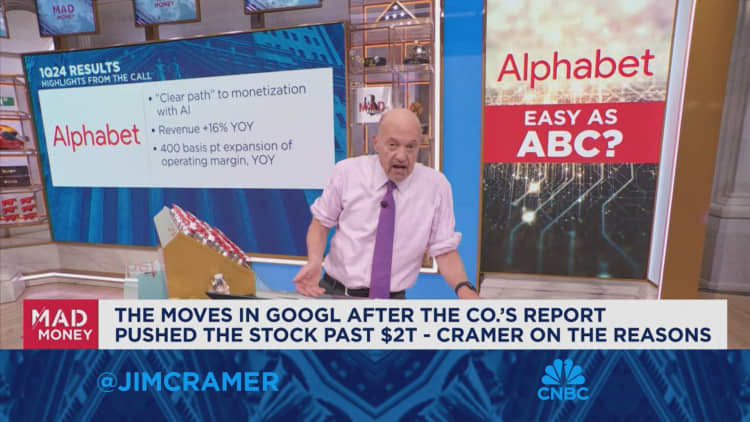

WATCH: Alphabet’s financier telephone call had a ‘exceptional’ degree of openness, claims Jim Cramer

[ad_2]

Source link