[ad_1]

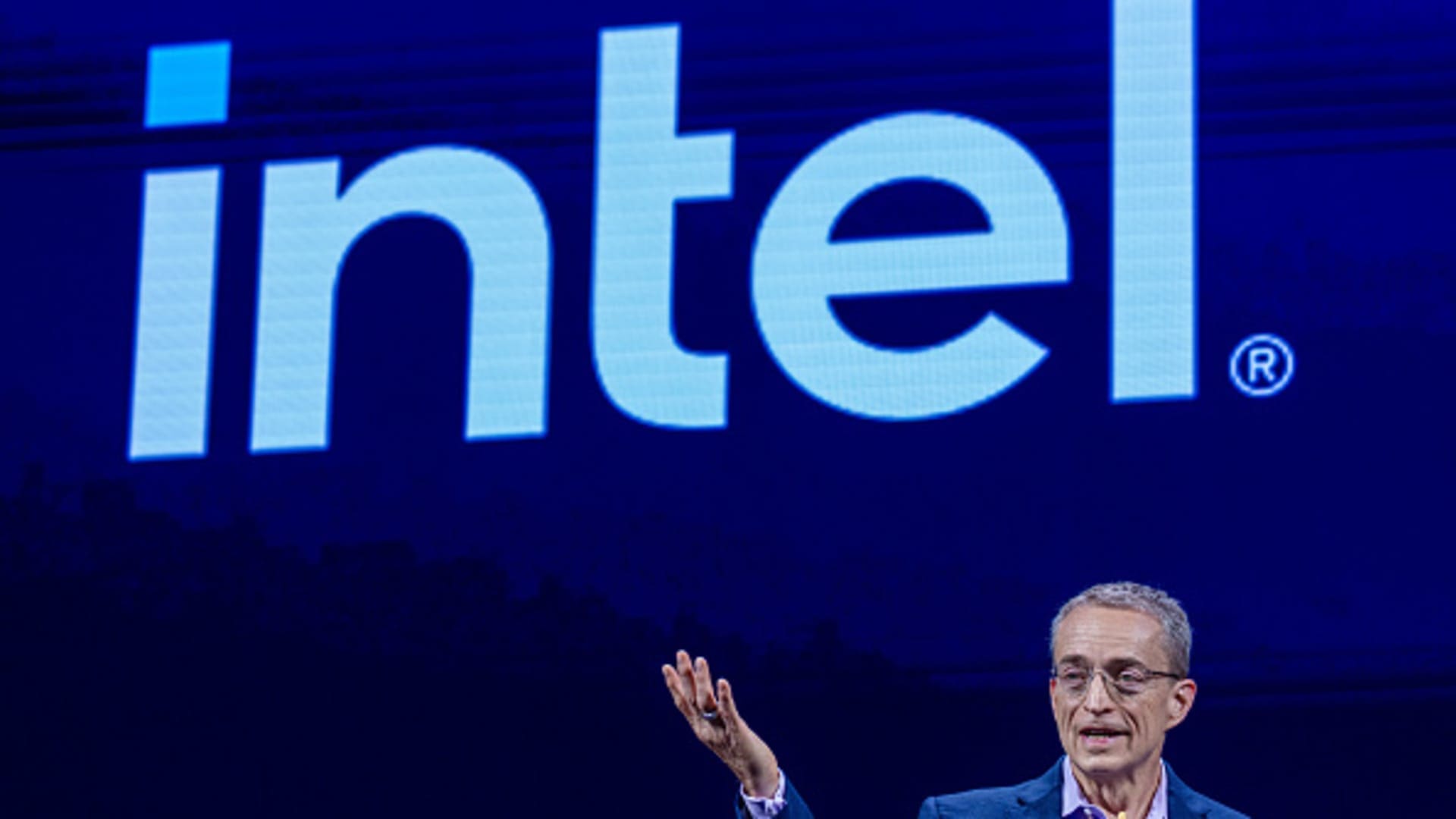

Pat Gelsinger, ceo of Intel Corp., talks throughout the Computex seminar in Taipei, Taiwan, on Monday, June 4, 2024. Gelsinger took the phase at the Computex program in Taiwan to speak about brand-new items he anticipates will certainly assist reverse the trend of share losses to peers, consisting of AI leader Nvidia Corp. Professional Photographer: Annabelle Chih/Bloomberg through Getty Images

Bloomberg|Bloomberg|Getty Images

Global semiconductor supplies dropped on Friday after a dull collection of arise from united state chip company Intel sent its shares cratering, and an international market sell-off considered on technology names.

Intel shares dropped 21.51% at 04:37 a.m. ET in premarket sell the united state on Friday, after the firm reported a huge miss on profits in the June quarter and claimed that it would certainly give up over 15% of its workers as component of a $10 billion cost-reduction strategy.

In Asia, Taiwan Semiconductor Production Co. â $” referred to as TSMC â $” shut 4.6% reduced in Taiwan, and Samsung was likewise greater than 4% reduced at the end of the session in South Korea. TSMC is the globe’s greatest producer of chips, while Samsung is the biggest memory semiconductor company worldwide.

Samsung competitor SK Hynix, which provides united state huge Nvidia, likewise dropped dramatically to shut greater than 10% reduced.

The sell-off proceeded in Europe. Shares of ASML, which offers crucial devices called for to make innovative chips, were greater than 6% reduced at around 4:23 a.m. ET, in the Netherlands. ASMI, which likewise sells the Netherlands, was off by 9%. STMicroelectronics and Infineon were both reduced.

Intel’s outcomes contribute to the combined image throughout the semiconductor industry, where business like AMD and Nvidia remain to flourish from the boom in expert system. Various other gamers, like Qualcomm and Arm, are not yet profiting of the innovation in their economic outcomes.

Including in the stress on chip supplies is an international equity sell-off that started in the united state and has actually fed its means with to Asia and Europe. This specifically considered on tech-heavy Nasdaq and on chip supplies.

The VanEck Semiconductor ETF, that includes significant names in the industry, shut approximately 6.5% reduced in the united state on Thursday.

A variety of significant united state chip names likewise dropped on Friday in united state pre-market profession, with Nvidia trading around 3% reduced.

[ad_2]

Source link .