[ad_1]

The worldwide invest administration field is experiencing a tailwind of kinds. The United States and Canada is perhaps the most significant market in this room, yet invest administration business have actually seen need increase throughout the globe, many thanks to boosting web infiltration, technology improvements and companies’ boosting concentrate on seeing to it they invest sensibly.

Indeed, the room is anticipated to expand at a compound yearly development price of 10.3% by 2030, per Grand Sight Research study, and fostering in various other areas like the Middle East and North Africa (MENA) is anticipated to grab as business progressively take on expenditure administration devices to obtain a more clear image of where their cash is going.

Saudi Arabia-based Simplified Financial Solutions Firm (SiFi), one such invest administration system in the MENA area, has actually currently elevated $10 million in a seed financing round to increase down on its development strategies in its home market. The round was led by Sanabil Investments, a participant of Saudi’s Public Mutual fund, and early-stage MENA VC, RAED Ventures.

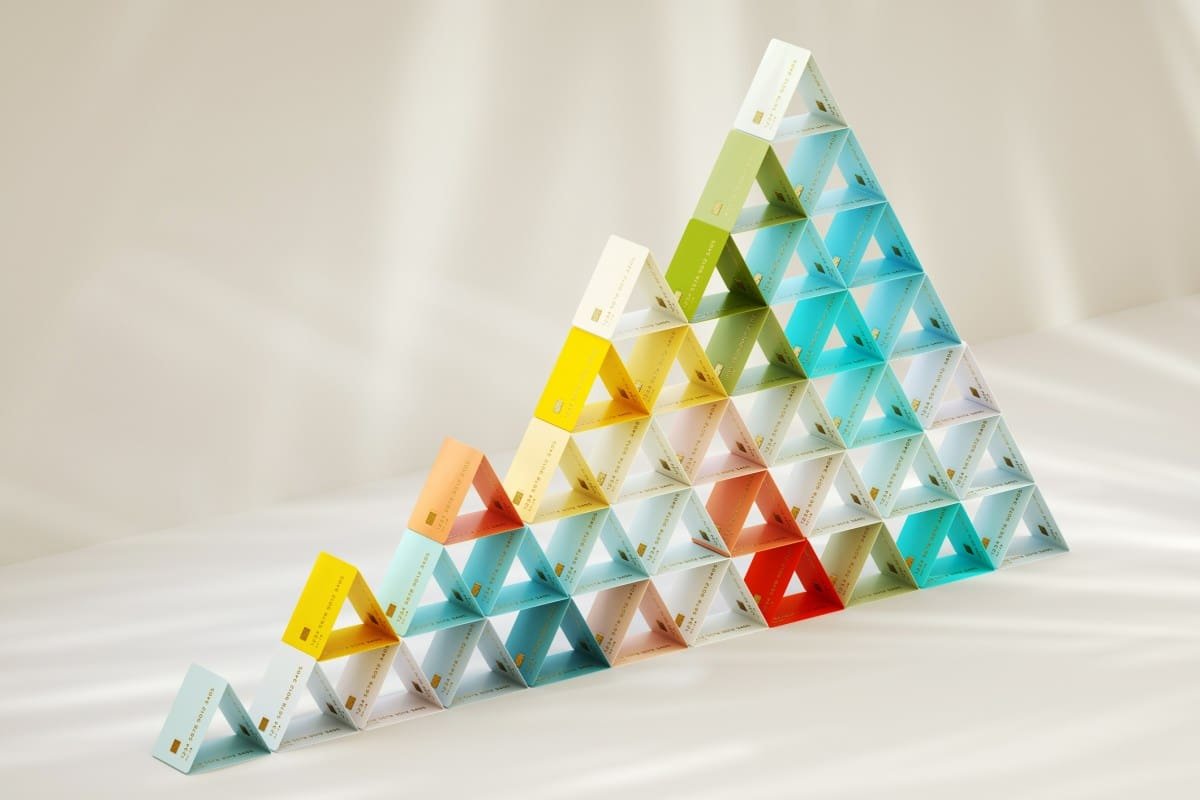

Founded in 2021 by Ahmed Alhakbani, SiFi assists companies take care of all their costs, consisting of supplier and costs settlements, and it is wanting to increase its procedures after it obtained the Digital money Establishment (EMI) certificate from the Saudi Reserve Bank (SAMA) in 2015. The business is intending to touch the certificate to supply a collection of solutions, consisting of e-wallets and clever business cards.

Alhakbani informed TechCrunch that he thought about beginning SiFi when he was functioning as the head of personalizeds in the Kingdom of Saudi Arabia. He saw first-hand just how fragmented expenditure administration went to the head office and throughout the Kingdom’s entrance factors– making it twice as tough to track and regulate expenses, and also leaving area for abuse.

SiFi’s item allows its clients regulate their business cards’ use, and restriction expenses at the seller or geographical degrees. The system additionally makes it possible for staff members, specifically those that do not make use of business cards, to send repayment demands, their costs and billings.

Alhakbani claimed the system assists business stay clear of invest administration troubles like human mistake, fraudulence, absence of appropriate process, authorization hold-ups and absence of invest exposure. “Our team believe SiFi can play a really vital function in making it possible for money divisions to come to be far more efficient in their capability to offer the remainder of the business. We intend to surpass simply costs fully collection of invest options within a business,” he claimed.

He claimed SiFi is constructing an option that will certainly scale past Saudi Arabia as its modern technology pile enables it to incorporate within any kind of market. He did note, nevertheless, that development outside Saudi Arabia will certainly be targeted.

SiFi’s rivals in the MENA area consist of Saudi’s Sanad, UAE-based Pemo, which elevated a considerable seed round in 2022, and Alaan.

Various other financiers that took part in SiFi’s seed round consist of anb seed, Rua Ventures, Byld and KBW endeavors, and existing VCs Khwarizmi Ventures, Seedra Ventures and Technology Invest Com.

SiFi signs up with an expanding listing of Saudi start-ups that have actually elevated excellent cash this year also as VCs reduced task worldwide. The nation proceeds to take the lead in regards to endeavor financial investment in the MENA area, stimulated by the federal government’s press to create a beneficial atmosphere for pioneers and companies as it looks for to expand its profits streams and minimize its dependence on oil.

[ad_2]

Source link .