[ad_1]

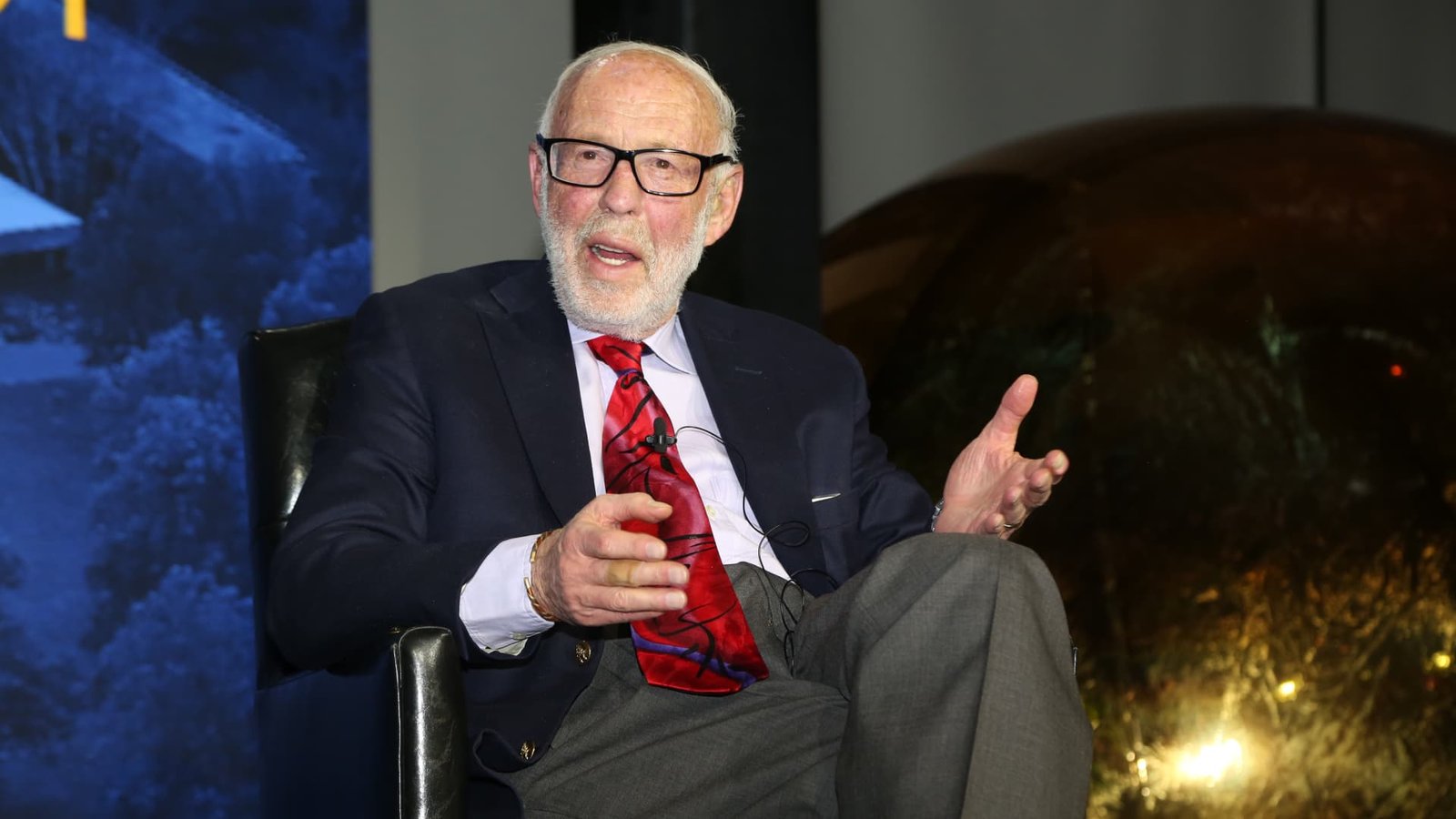

Jim Simons goes to the IAS Einstein Gala at Pier 60 at Chelsea Piers in New York City City.

Sylvain Gaboury|Patrick Mcmullan|Getty Images

Jim Simons, a mathematician that started one of the most effective measurable bush fund of perpetuity, died on Friday in New York City City, his structure revealed on its internet site.

Introducing mathematical models and algorithms to make investment decisions, Simons left a performance history at Renaissance Technologies that measured up to that of tales such as Warren Buffett and George Soros. His front runner Medallion Fund took pleasure in yearly returns of 66% in between 1988 to 2018, according to Gregory Zuckerman’s publication “The Man Who Solved the Market.”

During the Vietnam Battle, he functioned as a codebreaker for united state knowledge, checking the Soviet Union and effectively splitting a Russian code.

Simons obtained a bachelor’s level in maths from the Massachusetts Institute of Modern Technology in 1958 and gained his Ph.D in maths from the College of The Golden State, Berkeley at the age of 23. The quant expert started what ended up being Renaissance in 1978 at the age of 40 after he gave up academic community and made a decision to inject at trading.

Unlike many capitalists that examined basics such as sales and revenues and earnings margins to assess a firm’s well worth, Simons counted completely on a computerized trading system to make use of market inadequacies and trading patterns.

” I have no viewpoint on any type of supplies. … The computer system has its point of views and we slavishly follow them,” Simons claimed in a CNBC meeting in 2016.

His Medallion Fund gained greater than $100 billion in trading revenues in between 1988 and 2018, with an annualized return of 39% after costs. The fund was shut to brand-new cash in 1993, and Simons permitted his staff members to buy it beginning just in 2005.

Measurable approaches that rely on trend-following models have actually obtained appeal on Wall surface Road because Simons changed trading beginning in the 1980s. Quant funds currently represent greater than 20% of all equity properties, according to a quote from JPMorgan.

Simons’ total assets was approximated to complete some $31.4 billion when he passed away, according to Forbes.

The quant expert formerly chaired the mathematics division at Stony Creek College in New York City, and his mathematical advancements contribute to areas such as string concept, geography and compressed issue physics, his structure claimed.

Simons and his spouse developed the Simons Foundation in 1994 and have actually handed out billions of bucks to humanitarian reasons, consisting of those sustaining mathematics and science research study.

He was energetic in the job of the structure till completion of his life. Simons is endured by his spouse, 3 youngsters, 5 grandchildren and a great-grandchild.

[ad_2]

Source link