[ad_1]

Madica, a financial investment program released by US-based capitalist Flourish Ventures to back pre-seed start-ups in Africa, intends to buy as much as 10 endeavors by the end of the year, increase its financing initiatives after shutting 3 first offers.

Madica divulged the strategies to TechCrunch showing sped up purchasing the coming year as it considers as much as 30 start-ups by the end of its three-year program, which began mid in 2015, after launch late 2022.

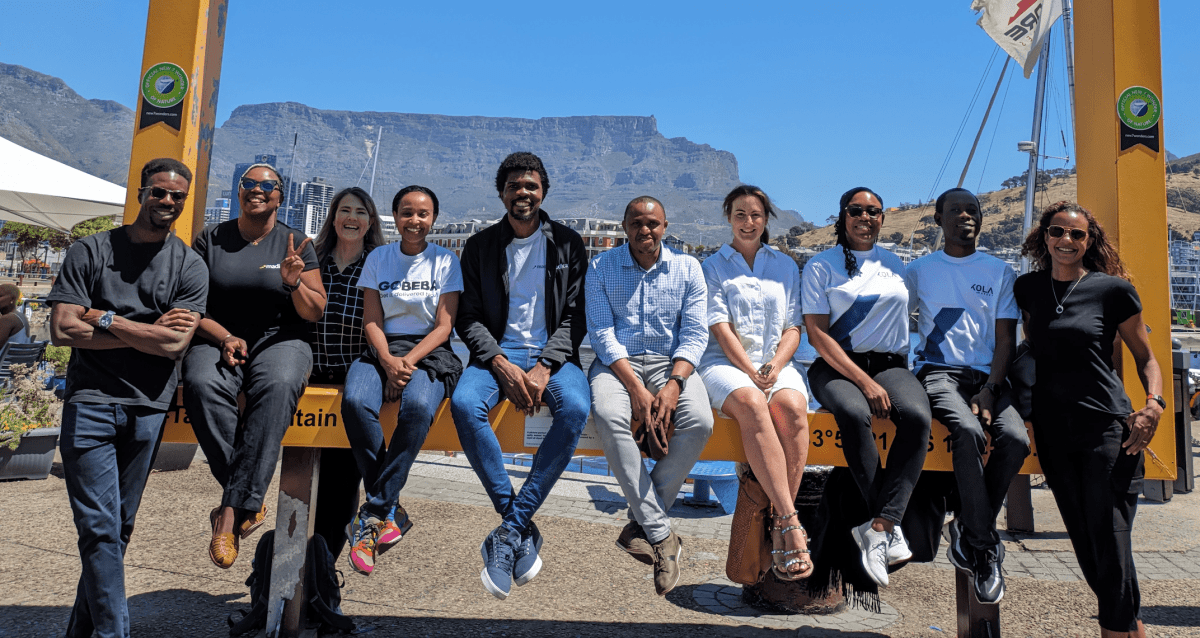

Revealed today, the program’s first investees consist of Kola Market, a B2B system started by Marie-Reine Seshie to assist SMEs expand their sales and streamline their service procedures. Others are GoBEBA, a Kenyan on-demand merchant of family items started by Lesley Mbogo and Peter Ndiang’ui, and Newform Foods (previously Mzansi Meat) a South African grown meat start-up started by Brett Thompson and Tasneem Karodia.

Even more are readied to sign up with the program, as Madica discovers possible sell budding markets such as Tunisia, Morocco, Uganda, DRC, Rwanda and Ethiopia. This remains in line with its strategy to get to start-ups in varied fields and markets, in addition to those run by underrepresented and underfunded owners. Madica is additional looking past fintechs, the most-funded field in Africa, and is additionally crazy about backing start-ups by ladies owners (or where at the very least one creator is a female), a group that remains to obtain meager VC financing.

” I think that with the variety of difficulties that exist throughout the continent, it’s the business owners that remain in those markets that comprehend the context and have actually lived experiences around those concerns that are best placed to fix those difficulties. The factor of the Madica program is to really show and reveal that it’s feasible to locate owners that are developing great organizations however do not fit the common uniform team,” claimed Emmanuel Adegboye, Head of Madica.

Madica spends ahead of time, to a song of $200,000, as soon as an endeavor is approved right into the program, which competes as much as 18 months, and additionally includes customized hands-on assistance and mentorship. It has actually reserved $6 million to buy scalable tech-enabled service and an equivalent total up to run the very first stage of the program, which has moving admission. The program does not have basic terms for financial investment making each offer special.

” Our shows is both really tailored, however additionally structured somehow due to the fact that owners enter the program at various factors. The tailored component of the program is extremely important due to the fact that we intend to comprehend what they require and exactly how we can best sustain them,” claimed Adegboye.

” However we additionally acknowledge that at every time, we’re mosting likely to contend the very least a couple of business we’re collaborating with within the program so we have a couple of components of the program that are really organized which cross every business within the profile,” he claimed.

Adegboye really hopes that as the program militarizes financial investments in the pre-seed phase throughout various environments in Africa, Madica can bring in even more resources right into the continent and ultimately function as a recommendation for international VCs planning to scale procedures in the marketplace.

” Relying on exactly how the program goes, there is an opportunity that we will certainly increase down on it or open it as much as various other companions to join us and increase this objective.”

[ad_2]

Source link .