[ad_1]

Founder and Chief Executive Officer of Masimo, Joe Kiani resolves an interview in Bangalore on January 2, 2017. Â

Manjunath Kiran|Afp|Getty Images

Billionaire Masimo owner Joe Kiani, best understood for his effective lawful battle versus Apple and his relationship with Head of state Joe Biden, has actually obtained versus fifty percent of his $660 million risk in the health-technology firm as opposed to offer his supply, according to corporate filings from previously today.

Loaning versus that much of a risk is uncommon for execs, however might be handy as the firm plans for a battle with an activist intending to take control of the board. The action permits Kiani, the firm’s chief executive officer and chairman, to keep his risk and ballot power while likewise obtaining cash he states he requires for family members factors.

Several medical-tech peers bar such steps, and it might leave Kiani at risk to margin calls if Masimo’s supply drops listed below a particular limit. Kiani has simply under 4 million Masimo shares, or about 7.5% of the firm, according to FactSet information.

Masimo, that makes wearables and health and wellness surveillance items, is preparing to ward off a 2nd proxy battle incomed by Quentin Koffey’s Politan Funding Monitoring. Kiani explained Koffey as “damaging” in a March CNBC meeting.

Masimo shares are up 15% this year, raising the firm’s market cap past $7 billion. The supply had an unpredictable run in the back fifty percent of 2023, dropping 47% in the 3rd quarter prior to getting 34% in the 4th.

Politan controls 8.9% of Masimo shares. While that’s larger than Kiani’s risk, also prior to vowed shares are considered, regulatory filings program that the chief executive officer has alternatives that might increase his holdings to 9.2% if worked out.

Politan currently won 2 seats on Masimo’s six-person board in a controversial 2023 proxy battle, however introduced last month that it would certainly look for 2 even more seats, consisting of Kiani’s, to seal control.

Kiani, 59, vowed 2.97 million Masimo shares since April, valued at $397 million, as security versus “individual finances.” The firm claimed in its yearly declaring Kiani had family members “monetary preparation purposes” that would certainly need him to offer his supply, however that he “did not intend to lessen his shareholdings.” His purposes weren’t defined in the filings.

” The promise of shares was pre-approved by the Board and shows Mr. Kiani’s sentence in the worth of Masimo supply in spite of the temporary decrease in the supply cost throughout the 2nd fifty percent of 2023,” a Masimo representative claimed in an emailed declaration. “Instead of offer his vowed shares, Mr. Kiani boosted his promise to keep his supply possession.”

The representative included that Kiani bought concerning $7 million well worth of Masimo supply in the 2nd fifty percent of 2022 and the very first fifty percent of 2023.

The Masimo logo design is presented at Masimo head office on December 27, 2023 in Irvine, California.Â

Mario Tama|Getty Images

Kiani is a significant Autonomous benefactor that is apparently close with Head of state Biden. He likewise has an 8,000-acre vineyard in Santa Ynez, The Golden State, near Santa Barbara. The borrowing is a rise from the year prior to, when Kiani just vowed 400,000 shares as security.

Masimo’s board likewise consists of Bob Chapek, who joined in January, nearly precisely a year after was he ousted as Disney’s CHIEF EXECUTIVE OFFICER.

Numerous of Masimo’s peers, like Agilent, Stryker and Medtronic, do not enable execs to promise their shares. Firms normally discredit supply promising, though some, consisting of Masimo, allow it with board authorization. Stock-backed borrowing, or “Lombard finances,” normally calls for a debtor to offer their shares if they drop listed below a particular worth, which when it comes to big investors can drive a supply cost down also additional.

Masimo’s earlier proxy battle was noted by lawsuits in between both sides that caused Politan winning $18 million in lawful charges after requiring the firm to desert an initiative to ward off the investment company. There were likewise individual assaults. In regulatory filings, the firm explained Koffey as somebody with “hubris” that was “no various than his even more famous peer Costs Ackman.”

Major investors, including Vanguard, agreed the lobbyist, which claimed that Masimo had actually been spoiled by bad administration methods and the procurement of Noise United, a customer sound firm. Masimo shares dropped 37% the day the bargain was announced in February 2022.

Last month, Masimo claimed it would certainly dilate its customer service, a news that increased the supply. When Politan introduced its 2nd project days later on, shares climbed also greater. Politan has actually claimed information of the offshoot, made after the bell on a Friday and soon prior to the lobbyist introduced its 2nd project, was “hurried” when the firm discovered of the lobbyist’s strategies.

Masimo has actually rejected that case. The firm has yet to submit a proxy declaration or routine a yearly conference.

Masimo has actually had some success in current months. The firm went after prominent license lawsuits versus Apple, affirming that the firm infringed on its pulse oximeter modern technology for the Apple Watch. After some preliminary problems, Masimo won a judgment that limited the sale of some watches. Both firms continue to be in settlements on the issue.

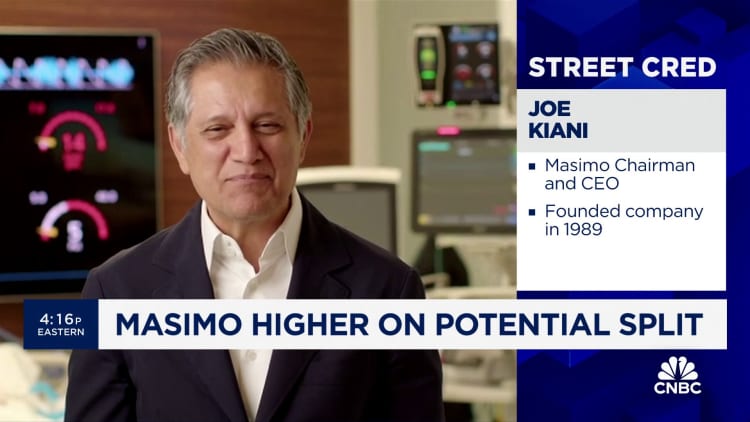

ENJOY: Masimo Chief Executive Officer Joe Kiani on customer offshoot and proxy fight

[ad_2]

Source link