[ad_1]

Whereas most African digital mortgage suppliers depend on functioning assets to maintain improvement, MoneyFellows has truly silently completed what couple of others have: provide billions of Egyptian further kilos with just about no monetary obligation or annual report direct publicity.

At present, after growing $13 million in a pre-Collection C spherical led by Casablanca-based Al Mada Ventures and DPI’s Nclude Fund, the Cairo-based fintech states it prepares to alter from steady improvement to native development.

The spherical, which moreover attracted engagement from Partech Africa and CommerzVentures, brings the enterprise’s full financing to easily over $60 million.

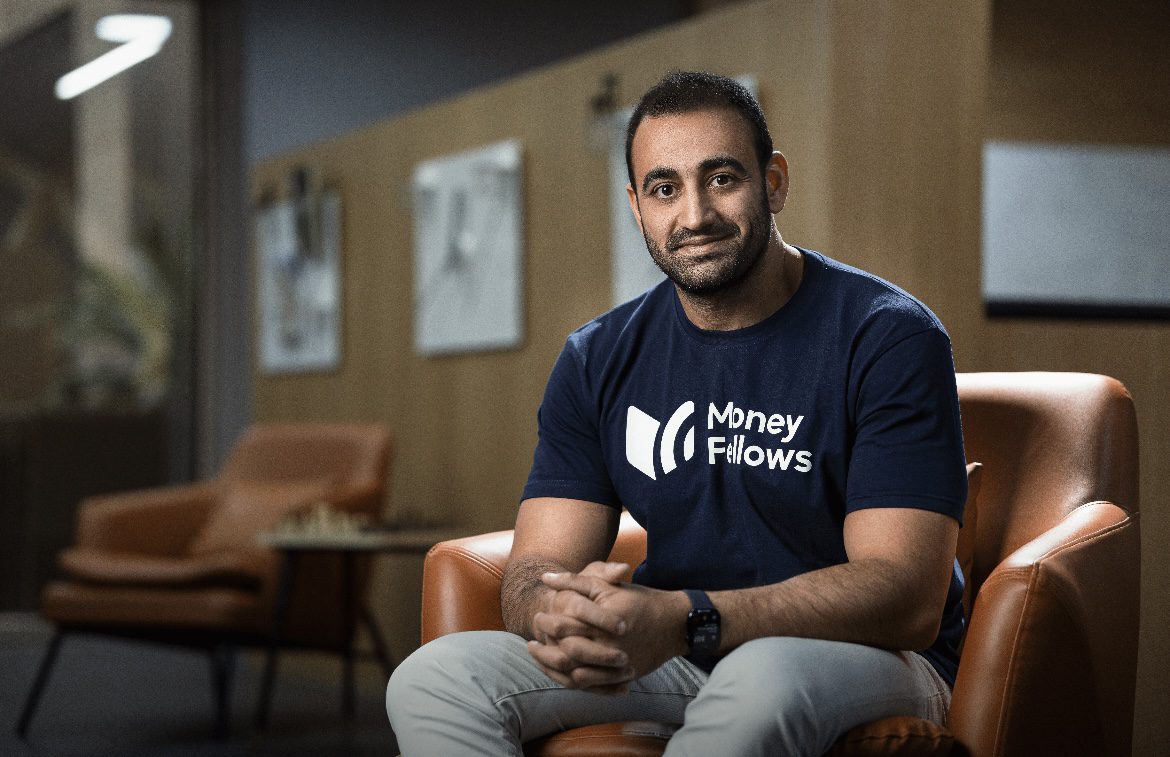

Founder and chief government officer Ahmed Wadi notes that, in contrast to fintechs shedding by way of money cash to vary, the start-up has truly maintained procedures lean whereas digitizing among the many globe’s earliest financial techniques: the turning price financial savings and debt group (ROSCA).

” We’ve truly dealt with to fracture this model and get to productiveness,” claimed Wadi. “Doing this whereas providing out billions with out relying on functioning assets in any approach is relatively turbulent by itself.”

ROSCAs are informal price financial savings groups the place a set number of people add persistently to a typical swimming pool, which pays to at least one participant per cycle. Typical all through arising markets, they move varied names: esusu or ajo in Nigeria, kameti or tab fund in India, and gam’ eya in Egypt.

Proper here is simply the way it works: Declare 10 people every add $1,000 a month. Every month, somebody obtains the entire $10,000. The cycle repeats up till each individual obtains a fee. Whereas these groups operate finest inside relied on circles, their offline nature limitations achieve entry to and scalability.

Techcrunch occasion

Berkeley, CA

|

June 5

MoneyFellows, launched in 2016, digitizes this model by opening up accessibility to a extra complete swimming pool of people all through the nation. By way of its utility, any individual can create or join with ROSCA groups or “circles.” Comparable designs exist around the globe with Pakistan’s Oraan and the U.Ok.’s StepLadder.

Versus operate as a lending establishment, MoneyFellows matches savers (usually final in line) and customers (usually initially in line) making use of behavioral data, credit standing, and earnings charges.

This methodology permits it to vary with out providing from its annual report; the enterprise simply actions in when a ROSCA crew has an unfilled port, based on Wadi.

” If we run circles of 10 people every and simply uncover 9 members for some, we motion in to cash the lacking out on one,” clarifies Wadi, that examined the ROSCA model in Germany and the U.Ok. previous to releasing in Egypt. “Slightly than terminating the crew, we fund one port, which activates and generates revenue from the staying 9.”

In a typical borrowing service, a agency must receive money from monetary establishments or varied different banks to supply it out, loads of the second sustaining ardour costs and default risk.

Nonetheless, in MoneyFellows’ scenario, the risk and financing are unfold out all through its people, sustaining the share of unfilled Rosca ports underneath 10%. In distinction, buy at present, pay afterward (BNPL) suppliers and digital mortgage suppliers continuously have full functioning assets direct publicity on their funding publications.

” At present, simply 7-8% of ports in energetic Roscas want us to motion in with functioning assets,” Wadi retains in thoughts.

Such direct publicity could be decreased in portion phrases, nonetheless as MoneyFellows ranges, it accumulates. Due to this fact why the enterprise, which elevated this financing as a bridge to a a lot larger Assortment C rounded ready for following 12 months, is moreover in modern conversations with neighborhood monetary establishments to safeguard functioning assets in its quote to increase its “circles” a lot faster.

Working beneficially and growing open air Egypt

MoneyFellows states it has truly gotten to productiveness in Egypt, placing it amongst just a little crew of African fintech start-ups working within the black.

Since establishing in 2018, the system has truly expanded to over 8.5 million people, up from 4.5 million at its last funding milestone. The abnormal fee per particular person has truly virtually elevated within the earlier 2 and a fifty p.c years, from 23,000 EGP ($ 453) to 45,000 EGP ($ 906), with strong fostering amongst higher-income sectors.

” This model is often viral,” Wadi claimed of the start-up’s improvement. “Should you digitize the expertise for two members of an offline ROSCA, they continuously convey the assorted different 8 with them. That type of pure improvement is hard to defeat.” Reasonably priced rate of interest, he consists of, have truly moreover aided velocity up fostering.

Beforehand this 12 months, MoneyFellows launched a card merchandise that allows people to get funds, pay again instalments, and make investments all through a vendor community.

The eight-year-old fintech moreover prepares to current monetary funding, pay-roll, insurance coverage coverage and compensation objects down the road, relocates that positioned MoneyFellows in opponents with varied different Egyptian digital monetary establishments like Fortunate, Khazna, and Telda.

Its following examination will definitely be reproducing its success previous Egypt, a ardour Wadi initially articulated in 2022. He confesses that development took longer than anticipated on account of the model’s intricacy, which the enterprise chosen to enhance previous to going native.

Digitizing ROSCAs is not as uncomplicated as releasing a value financial savings or funding merchandise. In keeping with him, the process consists of construction referral engines to match people to the suitable ports, stabilizing numerous circles in real time, and lessening default and failure risk, all whereas preserving particular person rely upon.

” Fracturing the model took longer than we believed,” Wadi stated. “But it deserved the second. Numerous efforts to scale Roscas electronically, additionally by monetary establishments and telcos around the globe, have truly stopped working resulting from the truth that they ignored simply how difficult the underlying actions is.”

After virtually a years refining its model in amongst Africa’s greatest fintech markets, partnering with over 350 neighborhood and native entities and serving to with higher than $50 million in monetary investments, MoneyFellows prepares to launch in Morocco by year-end, having truly protected important collaborations and governing authorizations.

Morocco offers acquainted floor: a giant unbanked populace, a strong informal price financial savings society (acknowledged in your space as daret), and a regulator-friendly ambiance. MoneyFellows is moreover wagering that events just like the 2030 FIFA Globe Mug will definitely velocity up digital fostering within the nation.

The enterprise is moreover contemplating varied different African and South Oriental markets with comparable traits. However, going into much more different markets will definitely consider the model’s flexibility in areas the place informal cash is far much less culturally acceptable or official monetary is rather more established.

” ROSCA’s (Revolving Monetary financial savings and Credit score Historical past Group) are older financial setups, with origins returning a whole bunch, in any other case numerous years,” claimed Omar Laalej, Dealing with Supervisor at Al Mada Ventures. “AMV was excited by the up-to-date variation of this service that Money Others had the power to develop, favorably influencing numerous relations in Egypt.”

.

[ad_2]

Source link