[ad_1]

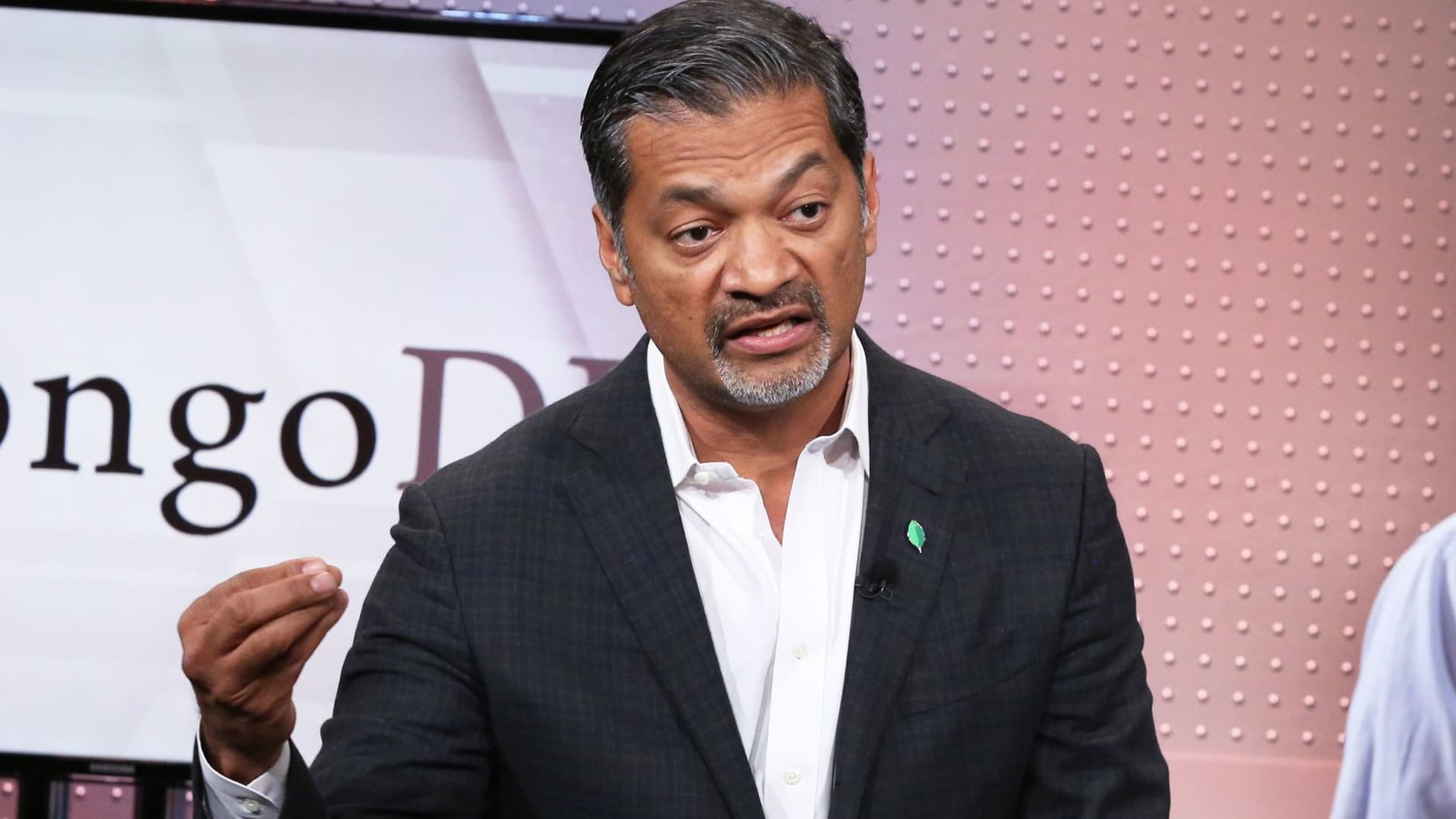

MongoDB chief executive officer Dev Ittycheria.

Scott Mlyn|CNBC

MongoDB supply sank as high as 26% in prolonged trading on Thursday after the data source software application manufacturer released light advice for the quarter and decreased its projection for the complete .

Right here is just how the firm did, contrasted to the LSEG agreement:

- Profits per share: 51 cents readjusted vs. 40 cents expected

- Revenue: $450.6 million vs. $439.7 million expected

MongoDB’s earnings expanded 22% year over year in the financial very first quarter, which upright April 30, according to a statement. Development reduced for the 3rd successive quarter. It was 57% 2 years ago.

The firm had a bottom line of $80.6 million, or $1.10 per share, compared to a bottom line of $54.2 million, or 77 cents per share, in the year-ago quarter.

Worrying advice, the firm asked for modified financial second-quarter profits of 46 cents to 49 cents per share, with $460.0 million to $ 464.0 million in earnings. Experts evaluated by LSEG were seeking 58 cents in modified profits per share and $470.4 million in earnings.

MongoDB cut its 2025 fiscal-year projection, which currently stands at $2.15  to $ 2.30 in modified profits per share and $1.88 billion to $ 1.90 billion in earnings. That suggests 12% development. 3 months back, the projection was readjusted profits per share of $2.27  to $ 2.49 and earnings of $1.90 billion to $ 1.93 billion. Experts had actually anticipated $2.50 in modified profits per share on $1.93 billion in earnings.

” We had a slower than anticipated beginning to the year for both Atlas intake development and brand-new work success, which will certainly have a downstream influence for the rest of financial 2025,” MongoDB’s head of state and chief executive officer Dev Ittycheria was priced estimate as claiming in the declaration. Atlas, MongoDB’s cloud-based data source solution, currently makes up 70% of complete earnings.

On a teleconference with experts, Ittycheria claimed macroeconomic problems factored in to the outcomes, and the firm had not been able to overtake brand-new organization, however the firm isn’t shedding share to rivals. He claimed the overview does not stand for MongoDB’s possibility in the long-term.

The remarks came a day after Salesforce showed that it was seeing offers reduce and take longer to shut.

Prior to the after-hours step, MongoDB shares were down 24% this year, tracking the S&P 500 index, which has actually obtained around 10% throughout the exact same duration.

[ad_2]

Source link