[ad_1]

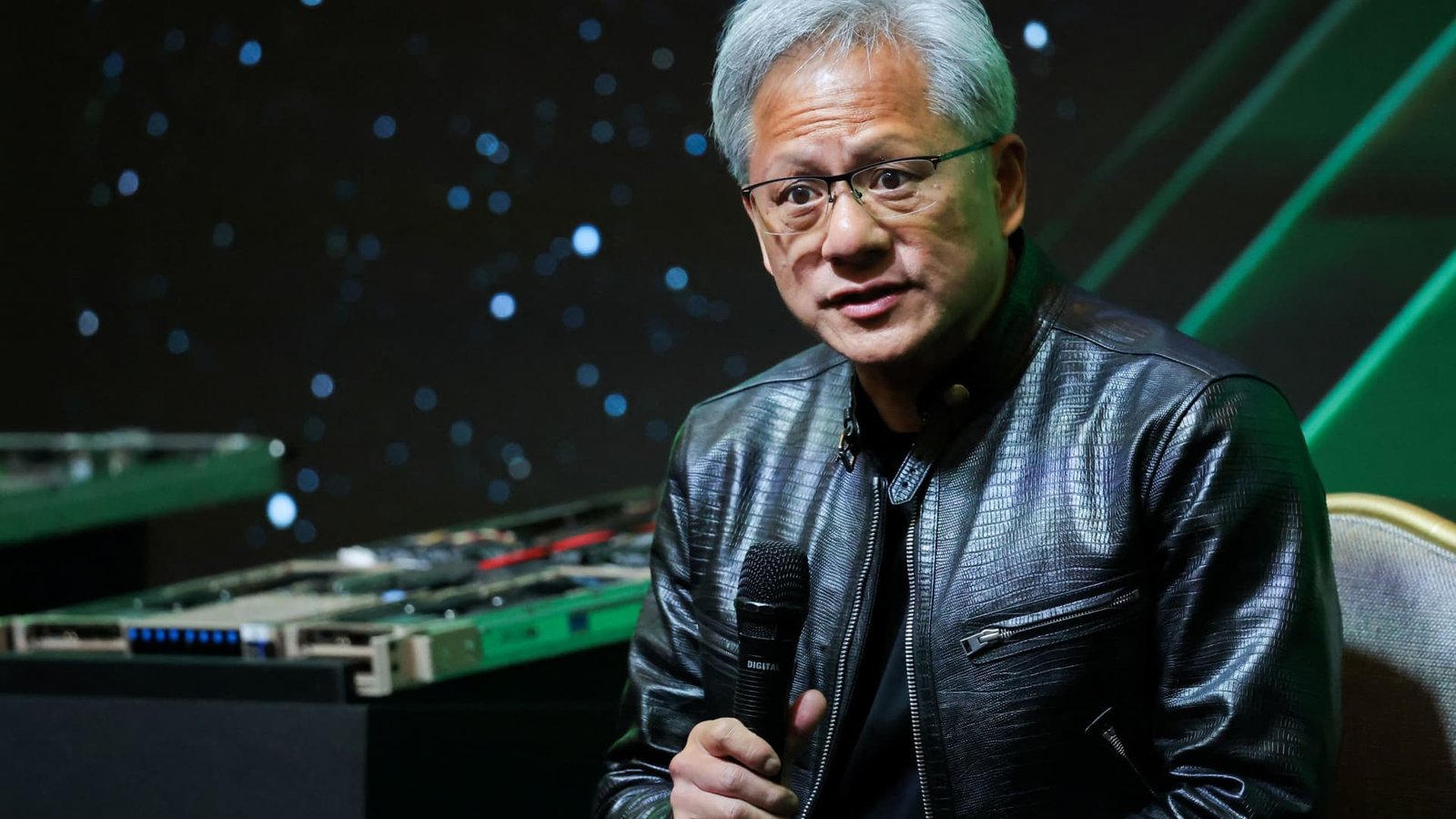

Nvidia chief executive officer Jensen Huang makes a speech at an occasion at COMPUTEX online forum in Taipei, Taiwan June 4, 2024. Â

Ann Wang|Reuters

Since briefly ending up being the globe’s most important firm recently, Nvidia has actually gone down for 3 successive trading days and is currently down 13% from its height.

Monday’s slide was the chipmaker’s second-steepest decrease of the year, as the supply dropped 6.7% to $118.11. Nvidia’s decrease brought with it a slide in chipmakers and various other technology firms that have actually been connected to the expert system boom.

Super Micro Computer, which markets web servers loaded with Nvidia’s AI chips, glided 8.7 percent, and Dell, which contends because market, dropped 5.2%.

Chip developer Arm went down 5.8%, while semiconductor titans Qualcomm and Broadcom went down 5.5% and 3.7%, specifically.

A number of those firms have actually been a few of the greatest gainers in the last pair years as financiers wagered greatly that they’ll be the prime recipients of a wave of AI investing.

Nvidia’s worth has actually virtually tripled in the previous year also after the three-day downturn. Recently, it covered Apple and Microsoft as one of the most important united state firm with a market capitalization over $3 trillion prior to quiting a few of those gains. Nvidia was the fourth-biggest loser in the S&P 500 on Monday. Super Micro is still up practically 200% in 2024.

Financiers might be taking a possibility to secure gains after a couple of warm months.

” I do not believe the celebration mores than, yet it’s had a hell of a run and there are many various other locations in innovation that provide much better appealing risk/reward,” Hightower’s Stephanie Web link informed CNBC on Friday, calling Nvidia shares “overloved.”

Nvidia states need for its valued AI graphics refining devices (GPUs) continues to be high, as firms consisting of Microsoft, Google, Amazon, Oracle, and Meta acquire billions of bucks well worth of the chips to power their information facilities and cloud solutions.

Later on this year, Nvidia will certainly begin delivering its next-generation AI chips, called Blackwell, that some experts state can start an additional cycle with substantial development for the chipmaker and its companions.

Nvidia’s efficiency “is mosting likely to proceed for the following 18-24 months,” Constellation Research study owner Ray Wang claimed on CNBC’s Squawk Box on Monday. “I believe it’s a great time to acquire the dip.”

WATCH: Nvidia will certainly remain to have improvements yet financiers must stick to it

[ad_2]

Source link