[ad_1]

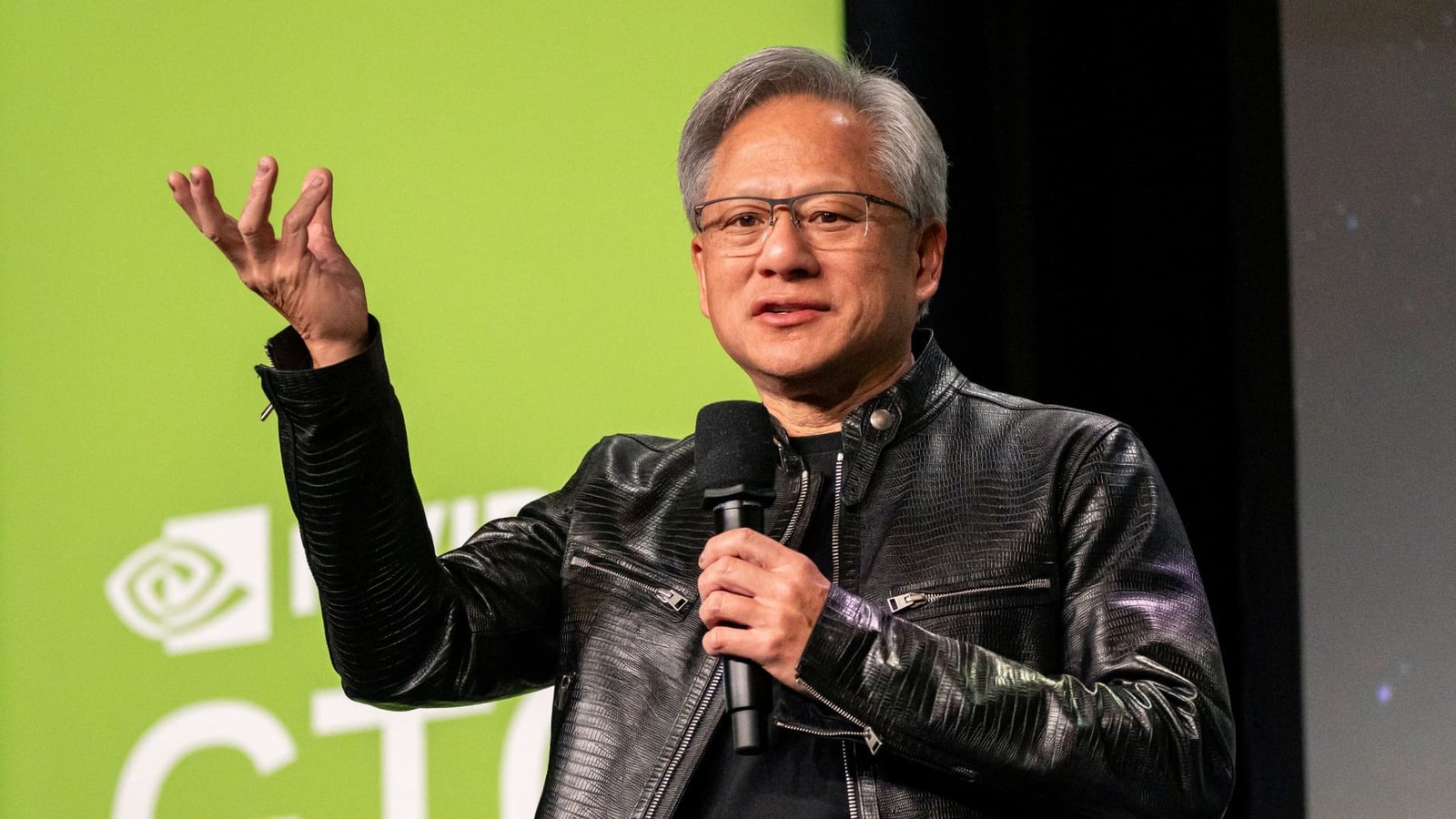

Jensen Huang, founder and president of Nvidia Corp., throughout the Nvidia GPU Modern Technology Seminar (GTC) in San Jose, The Golden State, United States, on Tuesday, March 19, 2024. Â

David Paul Morris|Bloomberg|Getty Images

Nvidia reports financial first-quarter revenues on Wednesday after the bell.

Right here’s what Wall surface Road anticipates, per LSEG agreement approximates:

- Revenues Per Share: $5.59, adjusted

- Revenue: $24.65 billion

The chipmaker, which a years back was a particular niche programmer of 3D pc gaming equipment, has actually discovered itself at the facility of the activity in modern technology.

Nvidia’s record happens a year after the firm initially indicated to capitalists that it will start a stretch of sizzling development powered by need for expert system chips from business such as Google, Microsoft, Meta, Amazon and OpenAI.

Earnings has actually enhanced by greater than 200% in each of the previous 2 quarters, and Wall surface Road is anticipating that pattern to proceed, with price quotes revealing a 243% rise in the initial quarter from a year previously. Earnings is anticipated to be up greater than fivefold from a year ago.

Nvidia shares have greater than tripled considering that the firm reported financial first-quarter revenues in 2015 and supplied remarkably solid support for the 2nd quarter.

The firm’s existing generation of AI graphics refining systems (GPUs), called Receptacle, are needed by the leading AI researchers to establish chatbots, translators, and picture generators. For the previous year, consumers have actually been purchasing them up in droves, with the leading cloud and net business investing billions of bucks on the modern technology to develop out their framework.

Yet concerns are swirling regarding the sustainability of Nvidia’s speedy development as several consumers need to begin revealing a benefit from all their significant expenses. AI software program prices substantially much more to run than typical software program, partly as a result of the investment essential for Nvidia GPUs.

Nvidia is additionally beginning to deliver its next-generation AI GPUs, called Blackwell. Some organizations might be considering the upcoming chips, triggering a feasible time-out in sales of the existing modern technology.

Beginning in the financial 2nd quarter, Nvidia will certainly bump up versus difficult year-over-year contrasts to the preliminary days of AI-driven development. Experts anticipate development to dip listed below 100% in the July quarter and slow down substantially over the complying with 2 durations.

[ad_2]

Source link