[ad_1]

In current years, Africa has actually observed a quick development in electronic financial, improving the continent’s monetary landscape. Somalia is an exceptional instance, where East Africa’s Salaam Financial institution, in cooperation with Paymentology, has actually released a co-branded tokenised tap-to-pay electronic friend card and a physical card for its Waafi mobile cash application customers.

This cutting-edge relocation, an initial for the Horn of Africa, indicates a turning point in Somalia’s monetary field, presenting electronic and contactless settlements with Salaam Financial institution’s digital-first effort. It is likewise a welcome indication that points are relocating the ideal instructions.

Challenges of Typical Financial in Africa

Africa’s financial landscape has actually long been afflicted by difficulties fundamental in standard financial systems. Restricted facilities, high functional expenses, and limited access have actually impeded monetary incorporation and financial development. Nonetheless, technical innovations and cutting-edge services are currently changing this landscape, providing exceptional access, performance, and price.

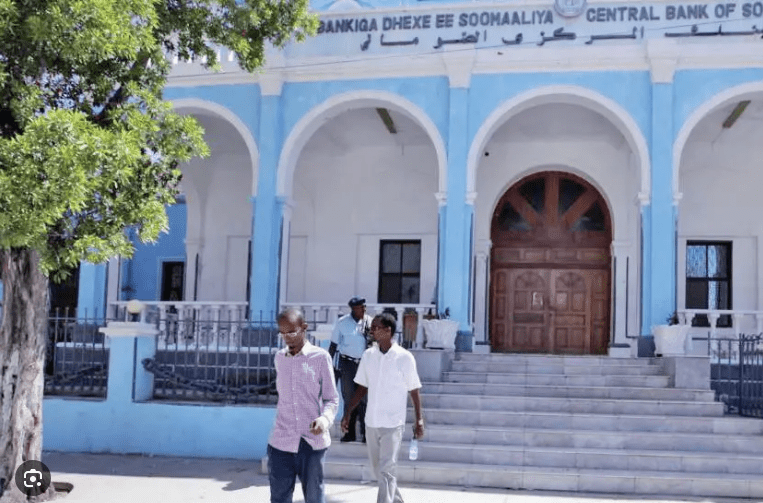

Somalia’s Ambitious Financial Journey

Somalia’s trip in the direction of developing a durable financial field has actually aspired and vibrant yet laden with challenges, specifically complying with extended durations of problem and instability. Unsurprisingly, standard financial has actually dealt with many troubles, consisting of minimal accessibility in backwoods, high expenses, and trust fund problems.

Yet, regardless of these difficulties, Somalia is experiencing a considerable change with the development of electronic services that can supply monetary solutions to even more individuals, consisting of those that have actually been commonly unbanked.

The Increase of Mobile Cash and Fintech

The spreading of mobile cash and fintech signifies significant development, driven by a variety of elements, such as the nation’s expanding populace and quick urbanisation. Somalia, with a median age of 18, is just one of the youngest countries around the world, making it ripe for electronic fostering. Modern technology is boosting ease and access, minimizing the expenses related to standard financial, and promoting a wider reach of monetary solutions. According to a Central Bank of Somalia (CBS) policy brief, the nation documents about 650 million mobile cash purchases worth $8 billion every year, with over 70 percent of grown-up Somalis making use of mobile cash solutions routinely.

Federal government Campaigns Driving Transformation

Another secret to the country’s electronic change success is the federal government’s concentrate on structure freedom, facilities, and financial security. Aiding to drive these objectives ahead is Somalia’s Vision 2030, an enthusiastic nationwide plan that details a detailed technique for electronic change, with a solid focus on monetary incorporation. Considerable financial investments in telecommunications facilities are increasing protection to backwoods, boosting connection, and promoting electronic purchases. Application of electronic ID systems is likewise enhancing Know Your Client (KYC) procedures, making it simpler for people to accessibility monetary solutions.

Effect on Culture and Economy

The excitement of regional economic climates with enhanced monetary tasks and enhanced monetary proficiency is having an extensive influence on culture by boosting accessibility to monetary solutions for underbanked populaces, equipping females and marginalised teams. This enhanced proficiency brings about even more educated decision-making, cultivating a society of conserving and financial investment that sustains long-lasting financial development.

This financial vibrancy is vital for Somalia’s growth and security. According to the IMF, Somalia’s GDP development is forecasted to get to 3.2% in 2024, partly driven by the electronic economic situation.

Motivation for various other African Countries

Somalia’s design of electronic financial supplies important motivation for various other African countries. The scalability of Somalia’s strategy recommends that comparable contexts throughout the continent can duplicate these successes. Nonetheless, customisation is vital to attend to the distinct difficulties dealt with by various nations.

To promote an encouraging setting for electronic financial, policymakers need to motivate public-private collaborations, improve governing structures, and buy facilities. Partnership in between federal government and economic sector entities can drive advancement and facilities growth. Constant financial investment in telecommunications and electronic facilities is needed to guarantee extensive access.

Additionally, local participation amongst African countries can promote the sharing of finest methods and the growth of interoperable systems. This participation can cause a much more incorporated and reliable monetary ecological community throughout the continent, driving additional financial development and growth.

The Course Forward

Somalia’s electronic financial trip is a testimony to the transformative power of modern technology in getting over historic financial difficulties. By cultivating monetary incorporation and driving financial development, Somalia is establishing an instance for the remainder of Africa. As electronic financial remains to advance, various other African countries can attract motivation from Somalia’s success, adjusting and carrying out approaches to produce a much more comprehensive and thriving monetary future for all.

By Kirsten Wortmann, Regional Supervisor for Africa, Paymentology

Kirsten Wortmann is a Regional Supervisor at Paymentology with comprehensive experience in organization growth and sales of electronic services throughout Africa. Before their existing function, Kirsten held numerous settings at Mastercard, where Kirsten concentrated on electronic collaborations and brand-new organization growth in the Sub-Saharan Africa area. With a history in modern technology consulting and task monitoring, Kirsten has a solid structure in the IT sector, having actually operated in various functions at business such as Accenture and Entelect Solutions. Kirsten holds a MBA from the College of Cape Community and a BSc Eng in Electronic Design from the College of KwaZulu-Natal.

[ad_2]

Source link .