[ad_1]

Fresh off the success of its very first goal, satellite producer Apex has actually shut $95 million in brand-new resources to scale its procedures.

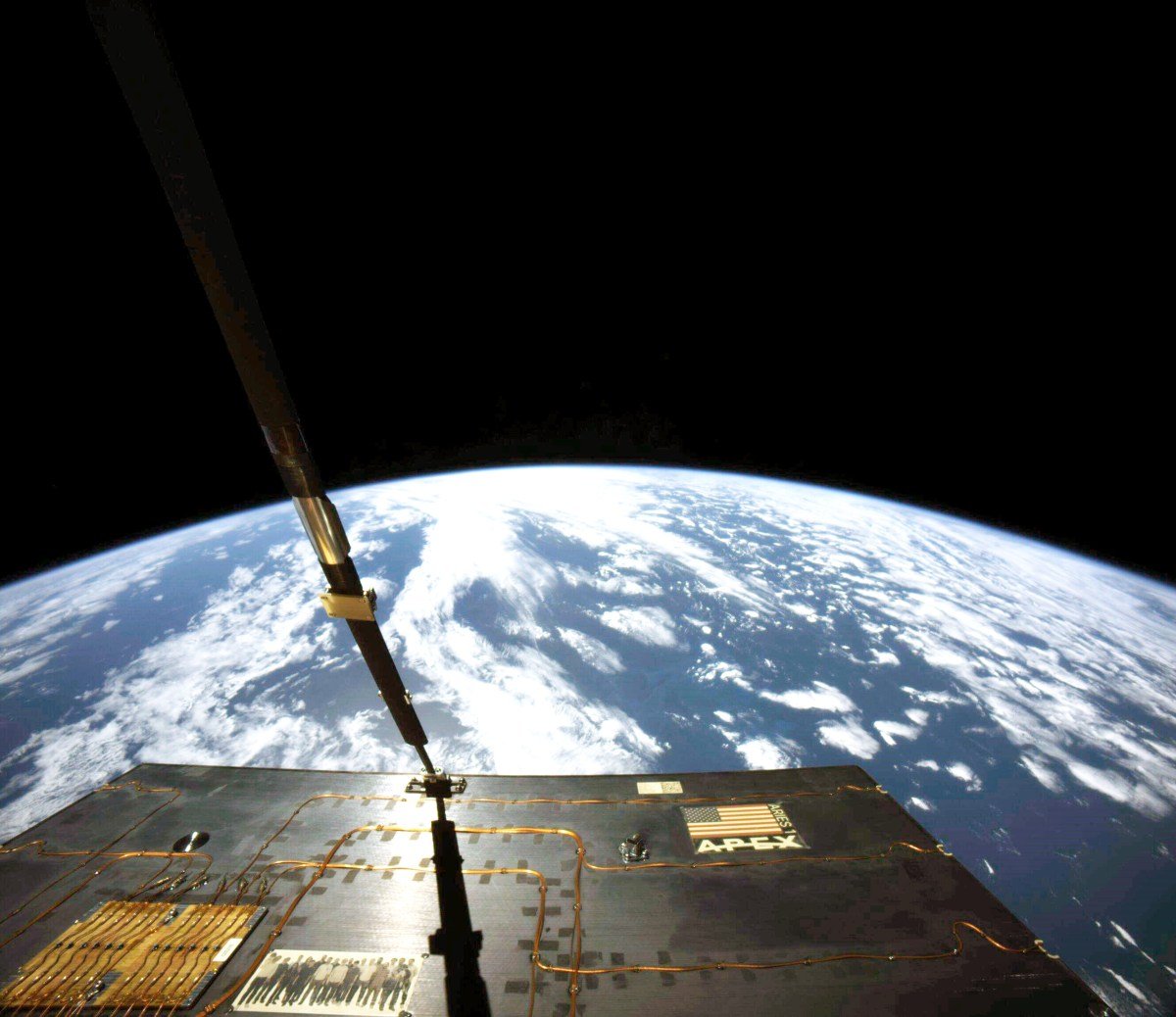

The Los Angeles-based start-up efficiently introduced and commissioned its first spacecraft, a design called Aries, in March. That goal has actually gone off relatively easily– a rarity in the room market– and with trip heritage currently accomplished, the business is directly concentrated on development.

That consists of scaling up manufacturing of the Aries automobile and investing in the growth and manufacturing of Nova, a spacecraft that’s around two times the mass of Aries. The business gets on track to make 5 Aries this year alone, Pinnacle chief executive officer and founder Ian Cinnamon informed TechCrunch.

Apex was started on the thesis that the one of the main bottlenecks encountering the development of the room market was satellite bus production. Cinnamon and his cofounder, Maximilian Benassi, are intending to basically productize (i.e. manufacture and market in typical layouts) satellite buses– which have actually traditionally gone through bespoke design procedures and long preparation– and swiftly range the capacity for business to send their haul to orbit.

The extremely developments that have actually raised need for accessibility to room– specifically the decrease in launch expenses many thanks to SpaceX Falcon 9 ride-share goals– have actually likewise established the problems for a productized spacecraft to win on the marketplace. As much as a specific quantity dimension, clients are paying the very same for an experience to orbit– so Cinnamon and Benassi recognized that spacecraft can be standard, and also a little over-engineered, without extra price using launch to the client.

Focusing on productization has actually created a solid structure for business, Cinnamon stated. “For every single among the satellite buses that we have actually marketed or remain in the procedure of marketing, we have the ability to extremely plainly explain, below’s the asking price, below’s our system business economics, below’s the margin we have,” he stated. “We often tend to be extremely clear with our clients also that we’re not attempting to be the most affordable cost on the marketplace … we’re sometimes able to bill a costs for a really rapid distribution period.”

This clear financial photo no question confirmed engaging to capitalists. While there’s been a great deal of buzz around tough technology just recently, “capitalists still have that solid need to place their cash to deal with organizations where they can truly see the basics,” Cinnamon stated.

One tailwind for the business, according to Cinnamon, is that many clients are not curious about getting a solitary satellite, however in getting numerous, with acquisitions typically crossing time as a constellation is constructed out.

The business is coming close to fifty individuals which number is most likely to increase by the end of this year.

The financing round was led by very early Pinnacle capitalists XYZ Financial backing, and co-led by CRV, in addition to engagement from brand-new capitalists Upfront, 8VC, Toyota Ventures, Point72 Ventures, Mirae Property Resources, Outsiders Fund, GSBackers, and existing capitalists Andreessen Horowitz, Guard Resources, J2 Ventures, Ravelin, Robinhood founder Baiju Bhatt and Avalon Resources Team.

[ad_2]

Source link .