[ad_1]

Reddit chief executive officer Steve Huffman hugs mascot Snoo as Reddit starts trading on the New York Supply Exchange (NYSE) in New York City on March 21, 2024. Â

Timothy A. Clary|AFP|Getty Images

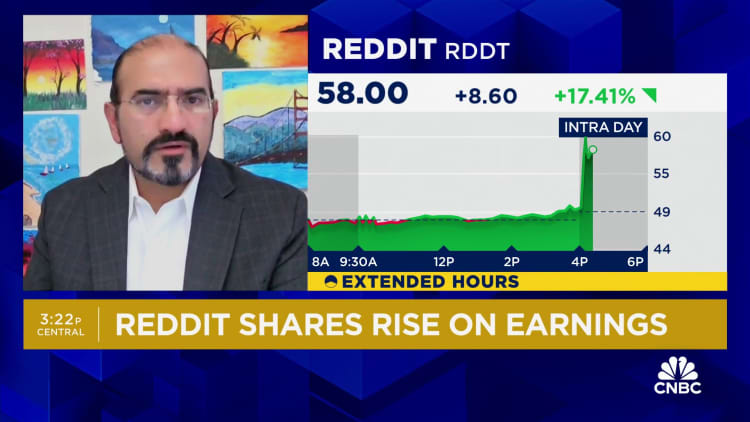

Reddit shares rallied 14% in prolonged trading on Tuesday after the business launched quarterly outcomes for the very first time considering that its IPO in March.

Right here’s exactly how the business did:

- Loss per share: $ 8.19 loss per share. That might not compare to the $8.71 loss anticipated by LSEG

- Revenue: $ 243 million vs. $212.8 million anticipated by LSEG

Revenue climbed up 48% from $163.7 million a year previously. The business reported $222.7 million in advertisement earnings through, up 39% year over year, which is a quicker price of development than at its leading rivals.

Digital advertising and marketing firms have actually begun expanding once again at a healthy and balanced clip after brand names drawn in investing to deal with rising cost of living in 2022. Meta‘s advertisement earnings leapt 27% in the very first quarter, adhered to by 24% development at Amazon and 13% development at Google moms and dad Alphabet.

Reddit reported a bottom line of $575.1 million. Stock-based payment costs and relevant tax obligations were $595.5 million, mostly driven by IPO costs.

For the 2nd quarter, Reddit anticipates earnings of $240 million to $255 million, covering the $224 million anticipated by experts, according to LSEG. The axis of the advice array recommends development of regarding 32% for the 2nd quarter, up from $183 million from a year previously.

Reddit, which organizes countless on the internet discussion forums on its system, was established in 2005 by Alexis Ohanian and Steve Huffman, the business’s CEO.Â

” We see this as the start of a brand-new phase as we function in the direction of constructing the future generation of Reddit,” Huffman stated in a launch Tuesday.

Reddit started trading under the ticker icon “RDDT” on the New York Stock Market in March. The business valued its IPO at $34 per share, which valued the business around $6.5 billion. When technology evaluations were red warm in 2021, Reddit’s personal market appraisal got to $10 billion.

The supply climbed up past $58 in after-hours trading on Tuesday prior to returning a little bit. Must the supply close over $57.75 on Wednesday, it would certainly go to its highest possible considering that March 26, its 4th day of trading. The shares shut that day at $65.11, their highest possible yet.

The business reported 82.7 million everyday energetic individuals for its very first quarter, up from the 76.6 million anticipated by StreetAccount. Typical earnings per customer worldwide climbed 8% to $2.94 from $2.72 a year ago.

Reddit will certainly hold its very first quarterly phone call with capitalists at 5 p.m. ET.

ENJOY: Reddit shares climb after earnings

[ad_2]

Source link