[ad_1]

RevenueCat, a leading membership monitoring system for applications that generate income from through in-app acquisitions, is currently flush with brand-new resources as it increases to the internet. The firm has actually shut on a $12 million Collection C led by Adjacent, complying with the launch of a brand-new item, RevenueCat Payment, that permits internet application programmers to incorporate membership acquisitions right into any kind of internet site. Later on, it will certainly likewise sustain Roku.

The timing of the item’s launch is remarkable, as it shows up in the middle of the application of the E.U.’s Digital Markets Act (DMA) guideline, which is compeling Apple to open the apple iphone and the Application Shop to brand-new conclusion. Because of this, Apple initially blocked iPhone web apps (Dynamic Internet Applications, or PWAs) in the E.U., most likely being afraid programmers would certainly desert its Application Shop, prior to reversing that decision under regulative stress.

For RevenueCat, nevertheless, the modifications in advance for iphone– and also Apple’s rejection to reduce its default 15% -30% compensation price– indicate there are currently much more programmers that are seeking to the internet to monetize their applications.

” Maybe for dynamic internet applications or any kind of type of client that intends to take settlements beyond the Application Shop,” clarifies RevenueCat chief executive officer Jacob Eiting, of the brand-new internet payment item. “It’s mosting likely to play within all the brand-new [DMA] guidelines … it’s mosting likely to be a rather substantial item growth for us,” he claimed.

The firm claims it relocated this instructions due to the incoming passion from programmers. Also if they really did not have an internet application, several programmers intended to move their consumers to the internet to pay.

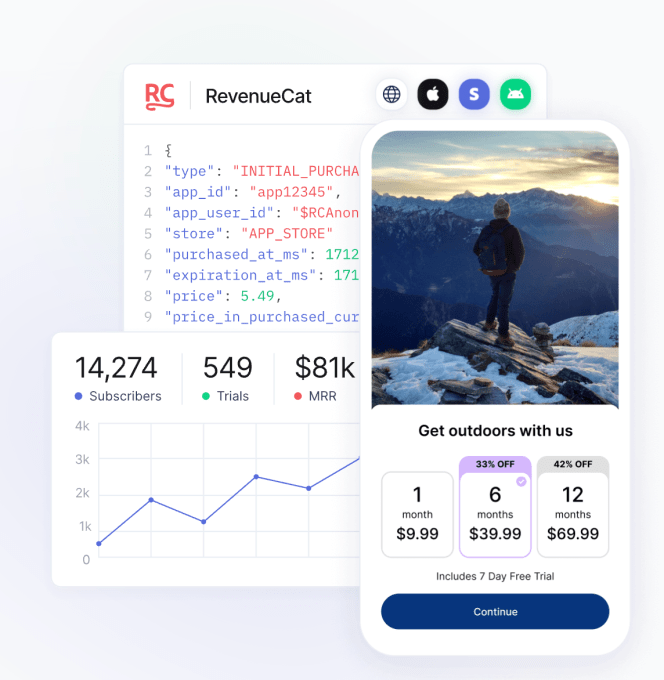

Though Red stripe currently allows this performance, what programmers were doing not have was a system that’s particularly created for customer membership applications. Currently, also if programmers are refining settlements with Red stripe or others, they’re obtaining their information and understandings in the exact same layout and within the exact same control panel where they currently handle their in-app acquisition information. This makes it much easier for them to concentrate on exactly how their membership applications are generating income from, generally, no matter where the settlement originates from– internet or mobile.

Though Apple has actually traditionally not enabled application programmers to guide consumers to the internet from inside their iphone applications, it has actually allowed guiding from various other networks– like the designer’s internet site or e-mails to consumers. The E.U.’s DMA rules should also permit developers to steer customers to the internet from inside their mobile applications, as well.

With RevenueCat Payment, basically an internet SDK, programmers can approve membership settlements from any kind of internet site. It signs up with various other current item launches like Paywall, Targeting, and Experiments, which are all created to aid programmers expand their income. Today, RevenueCat powers memberships in over 30,000 applications and takes care of over $2 billion in memberships yearly, it claims.

The brand-new Collection C from Adjacent (led by Nico Wittenborn— a Collection A capitalist, currently board participant) amounts to $12 million. Various other financiers consist of Y Combinator, Index Ventures, Volo Ventures, and SaaStr Fund. Ahead of this round, RevenueCat had actually increased $56 million, bringing its overall raising to $68+ million.

Along with sustaining its brand-new items, the fundraise will certainly aid RevenueCat increase to brand-new markets, consisting of Japan and South Korea.

” Our primary rival is ‘patching with each other money making modern technology on your own’,” claimed RevenueCat CTO and founder Miguel Carranza, in a declaration regarding the fundraise and growths. “In the united state, we have actually done an excellent task at enlightening programmers, item individuals, marketing experts, and Chief executive officers on the difficulties of structure in-house. In several various other areas, it’s however still the default for organizations to sink useful sources right into something that gives absolutely no distinction or worth for that organization’s end customers. We’re buying those areas by broadening our assistance for languages and neighborhood money later on this year, strengthening our connections with neighborhood modern technology companions and firms, in addition to working with in-market where feasible,” he included.

Photo Credit ratings: RevenueCat

RevenueCat is not yet a rewarding firm, however Eiting claims that earnings is constantly coming up. The firm still has the cash it increased in 2021 and currently has more than $40 million in the financial institution along with around $20 million in ARR. It has actually likewise halved its shed price because last summer season.

” There’s a lot things we can construct by releasing resources and doing it on a rewarding basis would certainly simply reduce us down now. So while there’s accessibility to resources, which isn’t constantly the instance … the most effective point for our consumers and financiers is to take even more resources and release it quicker,” he informed TechCrunch.

” RevenueCat is as well vital to way too many applications to take the chance of the firm driving in the direction of an economic high cliff. This might be counter to the dominating story of exactly how venture-backed firms ought to be constructed, however our financiers are straightened with us and recognize that Miguel and I are leading the firm to make best use of the worth for programmers. Financiers make even more cash when programmers make even more cash,” the chief executive officer included a post. “Therefore, we’re still intending to take the firm public in this years,” he claimed.

[ad_2]

Source link .