[ad_1]

Match Team, the business that possesses numerous dating applications, consisting of Tinder and Joint, released its first-quarter profits record on Tuesday, which reveals that Tinder’s paying customer base has actually reduced for the 6th quarter straight. On the various other hand, Joint has actually seen a rise in participants that want to spend for the application. Tinder had 10 million paying customers in Q1 2024, which is a 9% decline from the previous year. On the other hand, Joint currently has 1.4 million paying customers, a 31% boost year over year.

The decrease of Tinder was near as a result of the change in dating application society that has actually occurred in the last few years. More youthful customers are a lot more thinking about seeking major, long-lasting connections rather than laid-back connections, which is what Tinder is recognized for. Because its creation, Joint has actually gotten appeal amongst customers trying to find even more significant links.

While Tinder has a hard time to keep paying customers, Joint gets on track to end up being a “$ 1 billion profits service,” promotes chief executive officer Bernard Kim throughout a teleconference with capitalists on Wednesday early morning. Joint has actually seen a considerable profits spike in the previous 6 years, with straight profits expanding to $124 million in Q1, a 50% dive from the year prior. In 2023 alone, Joint generated $396 million.

One concern Tinder presently deals with is encouraging participants to see worth in its “à la carte” (ALC) functions or in-app acquisitions, that include Super Suches as, Improves, “See That Likes You,” and a lot more. ALC profits represent around 20% of Tinder’s straight profits. Nonetheless, in Q1 2024, ALC profits reduced by 13%. This remains in comparison to the record-high à la carte acquisitions in 2018.

Suit Team CFO Gary Swidler confessed throughout the phone call that the weak development in à la carte profits has actually been a descending fad for rather a long time. Nonetheless, it has actually been ending up being “a lot more extreme of late” and is “preventing us to execute extremely well.”

” Our team believe the decrease in ALC profits originates from customer decreases and reduced typical acquisition quantities, partly as a result of weak customer optional investing amongst its more youthful customer base, to name a few factors,” Swidler claimed, including that Tinder payers are anticipated to decrease at comparable prices in the 2nd quarter. The business anticipates there to be indications of enhancement in Q3.

The major factor for taking on an à la carte offering was to attend to the demands of price-conscious Gen Zers, aiding them obtain observed by prospective suits at a reduced cost. Suit claims it will certainly remain to present brand-new à la carte functions on Tinder “at budget-friendly cost factors” in future quarters, Swidler included.

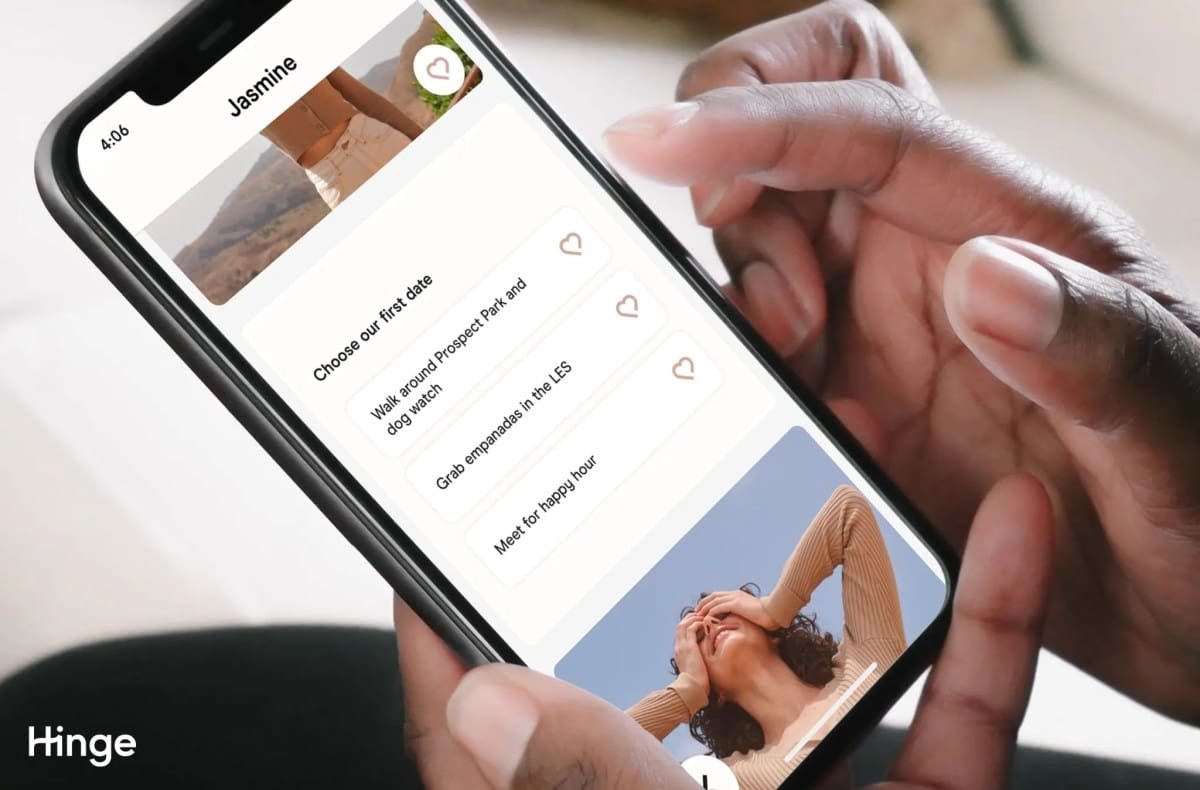

Nonetheless, rather than including a lot more choices, Tinder might intend to consider its sibling dating application, Joint, which just uses 2 à la carte functions: Increases and Roses.

Tinder has actually made numerous efforts to boost the general item experience, consisting of including brand-new security functions like “Share My Date,” where customers can share their day prepares with buddies. Later on this summertime, the application will certainly call for face images in everybody’s account. It’ll likewise release an AI Picture Selector attribute that picks 10 of the very best images from a customer’s video camera roll to boost account top quality.

In current months, Tinder has actually functioned to still expand its profits by pressing even more cash from a decreasing paying customer base, similar to the launch of a $499 per month plan for elite customers. Yet its projection for Tinder profits in the coming quarter indicates development will certainly be level or up by 1%, at $475 million to $480 million, specifically.

Post upgraded after magazine with profits information; 5:15 pm et 5/8/24

[ad_2]

Source link