[ad_1]

As Tesla get ready to report what will likely be unimpressive financial results for the very first quarter on Tuesday, the business is making a lot more relocates to go “spheres to the wall surface for freedom,” as chief executive officer Elon Musk placed it recently in a post on X.

Over the weekend break, Tesla went down the cost of its Complete Self-Driving (FSD) progressed driver-assistance system to $8,000, below $12,000. That cost cut remains in enhancement to recently’s decline of the FSD monthly subscription to $99, below $199. The press to obtain FSD right into a lot more vehicles can be a quote to gather even more information as Tesla functions to improve the semantic networks that perseverance fuller-scale freedom. FSD today can do lots of driving jobs in cities and on freeways, yet still calls for a human to stay sharp with their hands on the wheel in situation the system calls for a requisition.

Tesla deals with tightening revenues as it positions a significant and costly bank on independent driving innovation. Recently, Tesla laid off 10% of its team in a transfer to decrease prices to prepare for the business’s “following development stage,” per an e-mail Musk sent out to all workers.

Previously this month, Musk suddenly introduced on X that Tesla was stopping briefly the advancement of its $25,000 electrical car in favor of a robotaxi that he assured to disclose in August. Resources within Tesla have actually validated to TechCrunch that they really did not have previous caution from Musk on this abrupt change which interior restructurings show a brand-new values that places robotaxi advancement at front and facility.

Every one of this is occurring as Tesla zigzags on its EV rates technique.

Recently, Tesla ditched EV supply cost discount rates, yet over the weekend break reduced rates on the Design 3 and Design Y by as high as $2,000 in the united state, China and Germany. As we saw throughout the first quarter of 2023, those cost cuts are taking their toll on Tesla’s revenue and margins.

Tesla is arranged to report incomes after markets close April 23. Musk has formerly claimed that without freedom, Tesla is “essentially worth no.”

The business will certainly require to persuade financiers tomorrow that its change in top priority to independent cars is a positive side in the cloud of decreasing margins, instead of simply smoke and mirrors.

Considering that Musk let go team and introduced that Tesla would certainly be going hard on freedom, Tesla’s share cost has actually gone down virtually 10%. Shares have actually tipped over 42% because the begin of the year.

What to anticipate at Tesla’s Q1 2024 earnings

Tesla’s reduced first-quarter shipment numbers incorporated with cost cuts are active ingredients for a smaller sized earnings pie. And experts appear to concur.

Experts surveyed by Yahoo Money anticipate a revenue of $0.48 per share on $20.94 billion in earnings. As a tip, Tesla produced $25.17 billion revenue in Q4 and $23.3 billion in the very first quarter of 2023.

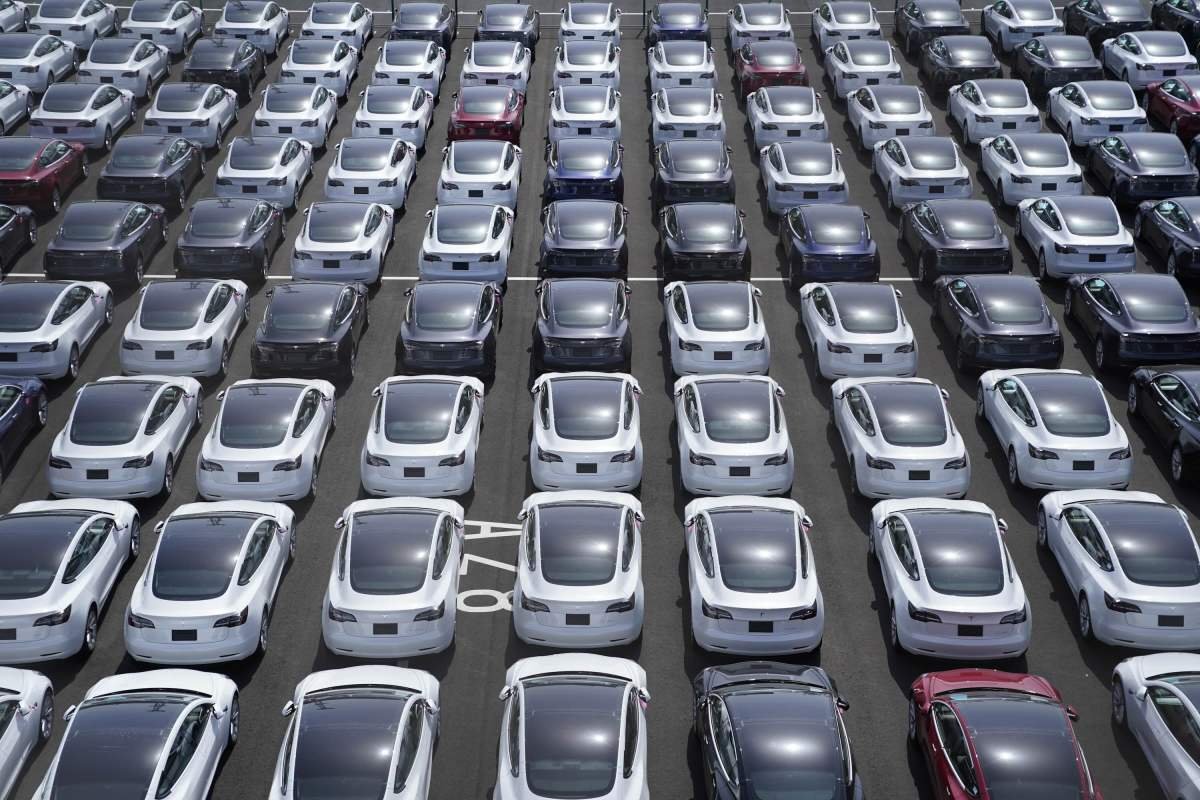

Tesla delivered 386,810 vehicles in the very first quarter of 2024, down 20% from the 484,507 it supplied in the last quarter of 2023. It deserves keeping in mind that this had not been simply a quarter-over-quarter spot. Tesla supplied less vehicles than the very first quarter of 2023– the very first year-over-year decrease in sales in 3 years.

Tesla’s Q4 outcomes reveal a business currently facing reducing earnings margins as a result of its price-cutting technique, climbing prices of its Cybertruck manufacturing launch and various other R&D costs.

The car manufacturer reported take-home pay, on a GAAP basis, of $7.9 billion in the 4th quarter– an outsized number brought on by a single, non-cash tax obligation advantage of $5.9 billion. The business’s operating revenue and its incomes on a modified basis supplied a more clear image of its economic efficiency.

Tesla reported running revenue of $2.06 billion in the 4th quarter, a 47% reduction from the very same year-ago duration. On a modified basis, the business made $3.9 billion, a 27% decline from the very same duration in 2015.

The inquiry is whether Tesla can avoid that earnings pie from reducing to benefit muffin.

Considering that Tesla reported its Q1 2024 manufacturing and shipment numbers, the business has actually remained to draw different economic bars focused on drawing in brand-new purchasers and generating existing consumers to spend for FSD– all while decreasing prices and preserving earnings margins.

Those opposing objectives combined with Musk’s “war time chief executive officer setting” standing are bound to make the Q1 incomes phone call amusing. Past that possible movie theater, there are pushing lasting concerns concerning just how Tesla supplies on freedom and if it will certainly suffice to persuade financiers that it can still lead and introduce.

[ad_2]

Source link .