[ad_1]

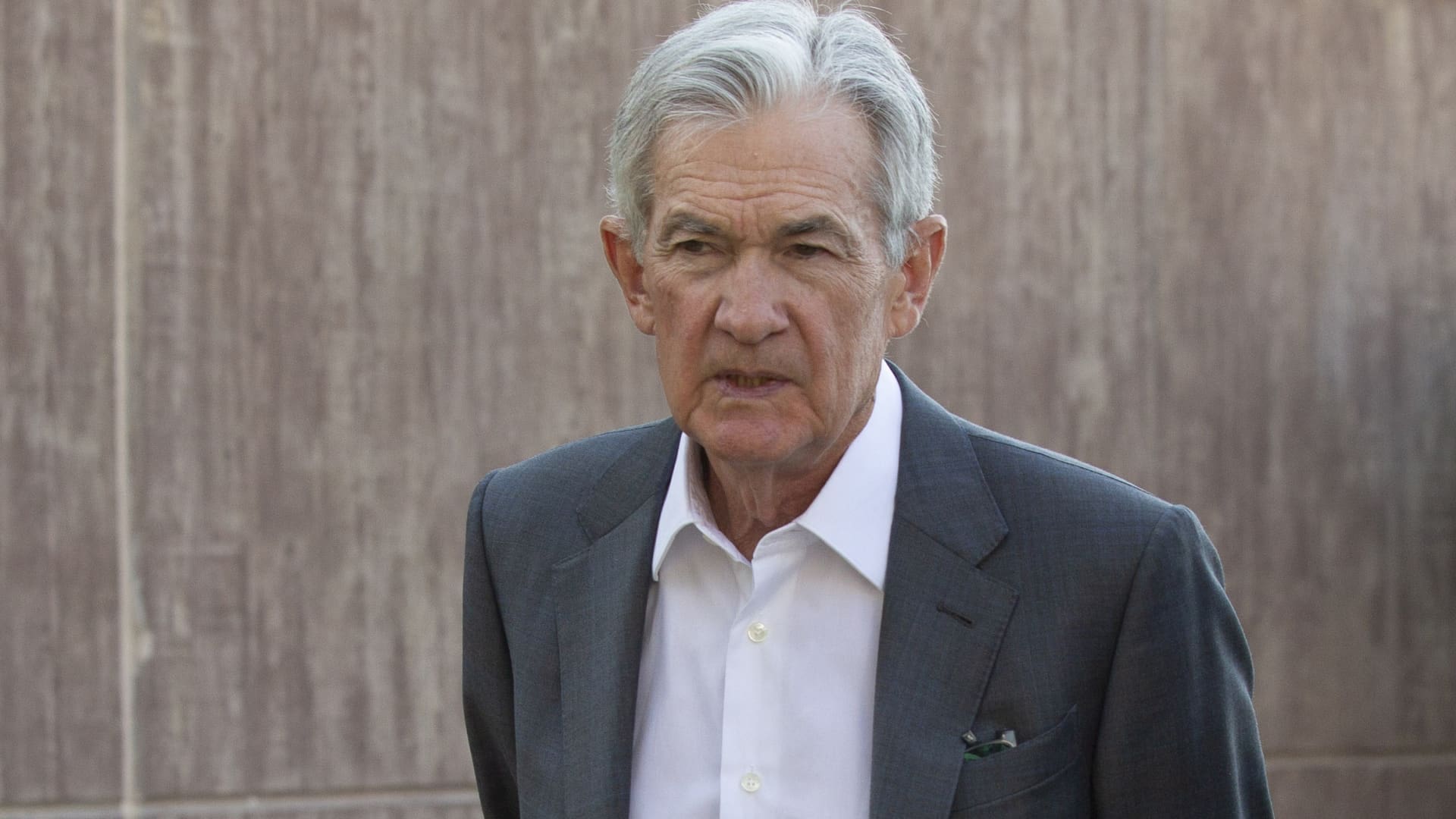

Federal Get Chair Jerome Powell ready Friday for charge of curiosity cuts upfront, although he decreased to provide exact indicators on timing or degree.

” The second has really come for plan to alter,” the reserve financial institution chief said in his much-awaited keynote deal with on the Fed’s yearly resort in Jackson Opening, Wyoming. “The directions of touring is obvious, and the timing and charge of worth cuts will definitely depend on inbound data, the progressing expectation, and the equilibrium of threats.”

Watch reside: Fed Chair Jerome Powell talks from Jackson Opening convention

With markets ready for directions on the place monetary plan is headed, Powell concentrated as a lot on a recall at what created the rising price of dwelling that led to a hostile assortment of 11 worth walkings from March 2022 with July 2023.

Nonetheless, he did take into account the event on rising price of dwelling and said the Fed can at the moment remodel its emphasis equally to the alternative facet of its double required, particularly to make sure the financial state of affairs stays round full work.

” Rising price of dwelling has really decreased considerably. The labor market is not any extra overheated, and issues are at the moment a lot much less restricted than those who dominated previous to the pandemic,” Powell said. “Provide restrictions have really stabilized. And the equilibrium of the threats to our 2 requireds has really reworked.”

He pledged that “we will definitely do each little factor we are able to” to make sure the labor market claims strong and improvement on rising price of dwelling proceeds.

Provides contributed to positive aspects as Powell began to speak whereas Treasury returns went down dramatically. Buyers saved a 100% alternative of on the very least 1 / 4 portion issue worth diminished in September and elevated the probabilities of a potential half-point lower to concerning 1-in-3, in response to the CME Staff’s FedWatch.

” This was a valedictory of mainly Chair Powell remodeling the net web page, stating the target, which has really been focused on rising price of dwelling for the final 2 years, has really succeeded,” financial professional Paul McCulley, a earlier Pimco dealing with supervisor, said on CNBC’s “Squawk on the Highway.”

Sees proceed in direction of objectives

The speech contains the rising price of dwelling worth regularly wandering again to the Fed’s 2% goal although nonetheless not there but. A scale the Fed chooses to find out rising price of dwelling most currently showed the rate at 2.5%, down from 3.2% a year ago and well off its peak above 7% in June 2022.

At the same time, the unemployment rate has slowly but consistently climbed higher, most recently at 4.3% and in an area that otherwise would trigger a time-tested indicator of a recession. However, Powell attributed the rise in unemployment to more individuals entering the workforce and a slower pace of hiring, rather than a rise in layoffs or a general deterioration in the labor market.

“Our objective has been to restore price stability while maintaining a strong labor market, avoiding the sharp increases in unemployment that characterized earlier disinflationary episodes when inflation expectations were less well anchored,” he said. “While the task is not complete, we have made a good deal of progress toward that outcome.”

Markets are expecting the Fed to start cutting in September, though Powell made no mention of when he thinks policy easing will begin. Minutes from the July open market committee meeting, released Wednesday, noted that a “vast majority” of officials believe a September cut will be appropriate so long as there are no data surprises.

“He’s pretty dovish. He bought the option to do whatever he needs to do next month, which is clearly an ease,” said Joseph LaVorgna, chief economist at SMBC Nikko Securities. “I don’t think the bar for 50 [basis points] is particularly high.”

In addition to assessing the current state of play, Powell took considerable time in the speech to evaluate what led to the surge in inflation â hitting its highest level in more than 40 years â as well as the Fed’s policy response and why price pressures have eased without a recession.

‘Good ship Transitory’

When inflation first began to rise in early 2021, he and his colleagues â as well as many Wall Street economists â dismissed it as “transitory” and caused by Covid-related factors that would abate.

“The good ship Transitory was a crowded one,” Powell quipped to laughter form attendees, “with most mainstream analysts and advanced-economy central bankers on board. I think I see some former shipmates out there today.”

When it became clear that inflation was spreading from goods to services, the Fed pivoted and began hiking, ultimately adding 5.25 percentage points to its benchmark overnight rate that had been around zero following emergency cuts in the early pandemic days.

The rise in inflation, Powell said, was “a global phenomenon,” the result of “rapid increases in the demand for goods, strained supply chains, tight labor markets, and sharp hikes in commodity prices.”

He attributed confidence in the Fed and well-anchored expectations that inflation ultimately would ease to the economy avoiding a sharp downturn during the hiking cycle.

“The FOMC did not flinch from carrying out our responsibilities, and our actions forcefully demonstrated our commitment to restoring price stability,” he said. “An important takeaway from recent experience is that anchored inflation expectations, reinforced by vigorous central bank actions, can facilitate disinflation without the need for slack.”

Powell added that there is still “much to be learned” from the experience.

“That is my assessment of events. Your mileage may differ,” he said.

Correction: The Fed hiked rates 11 times from March 2022 through July 2023. An earlier version misstated the number.

[ad_2]

Source link