[ad_1]

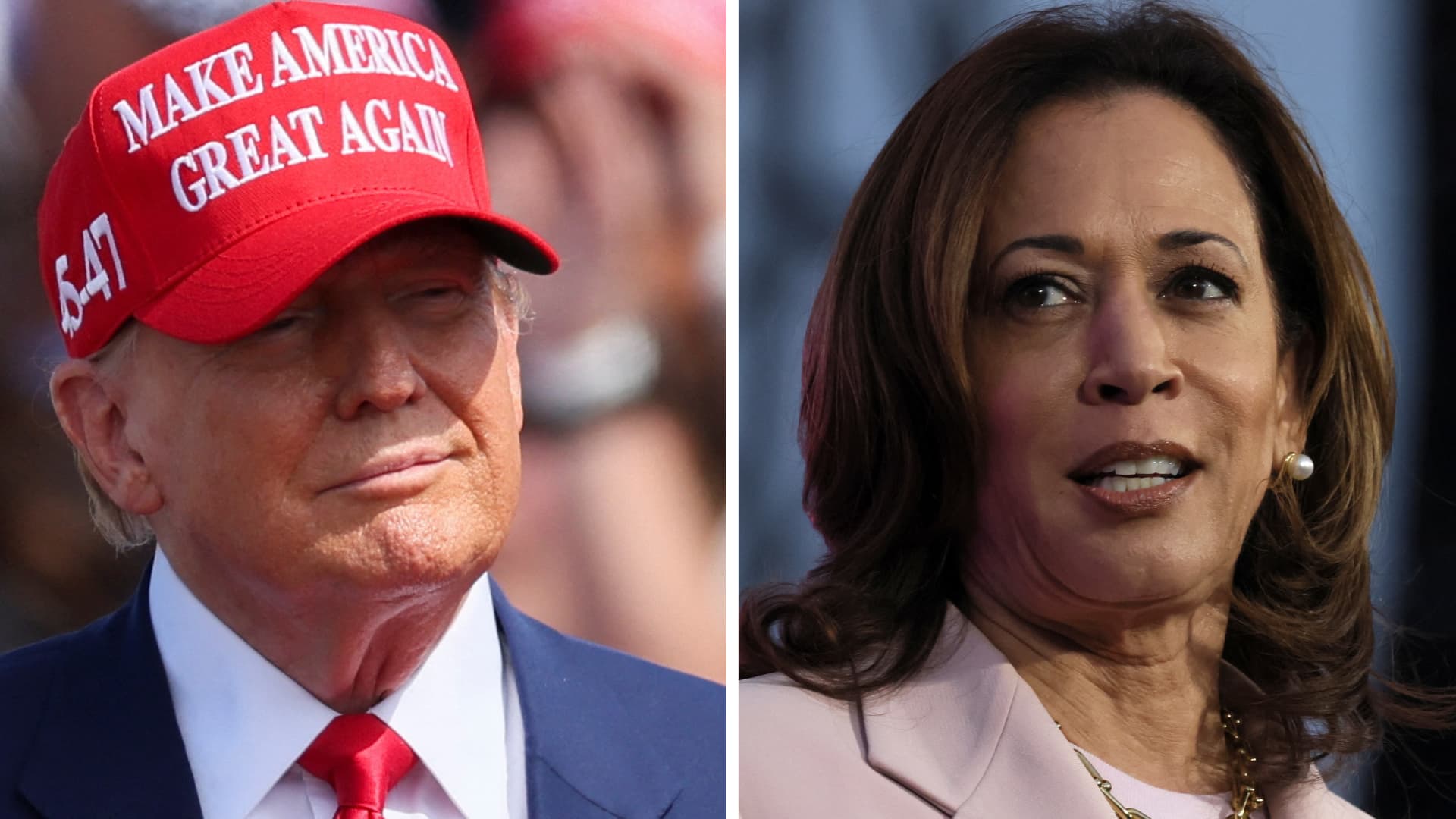

Former Head of state Donald Trump’s monetary propositions will surely improve authorities deficiencies by $5.8 trillion over the next years, practically 5 instances higher than these of Vice Head Of State Kamala Harris, which will surely embody $1.2 trillion, in keeping with a brand-new set of analysis research from the indifferent Penn Wharton Funds plan Model.

The Trump report found that his technique to fully increase the 2017 tax obligation cuts will surely embody over $4 trillion to deficiencies over the next ten years. His proposition to take away tax obligations on Social Safety benefits features a $1.2 trillion value, whereas his promise to higher lower enterprise tax obligations will surely embody nearly $6 billion.

The Harris analysis revealed that her technique to extend the Child Tax obligation Debt, the Earned Income Tax Obligation Debt and numerous different tax obligation credit score histories will surely elevate deficiencies by $2.1 trillion within the coming ten years. And her proposition to supply a $25,000 assist for all certifying beginner property consumers will surely embody $140 billion over a years.

Nevertheless the Harris report found that rising the enterprise tax obligation value to twenty-eight% from its current diploma of 21%, because the vice head of state has truly drifted, can partly counter the costs of her investing by $1.1 trillion.

Along with enterprise tax obligation walks, Harris has truly claimed she sustains the $5 trillion nicely value of earnings raisers included in Head of state Joe Biden’s finances plan proposition for the 2025 .

The lion’s share of Harris’ earnings streams characteristic a big asterisk, nonetheless: They name for legislative authorization.

By comparability, Trump has suggested spending for his schedule with 10% tolls on all imports and 60% tolls on Chinese language imports, neither of which will surely require to be passed by Congress in an effort to be utilized. Trump declares these occupation plans will surely create enough long-lasting residential growth to surpass the non permanent costs of his monetary system.

Nevertheless Moody’s Principal Monetary knowledgeable Mark Zandi approximated to NBC Info that Trump’s tolls would possible create $2.5 trillion in earnings. And further extensively, financial specialists warning that such a hardline toll plan would possible reignite rising value of residing, equally as the worth of buyer charge boosts has truly began to chill down.

The Trump and Harris initiatives are competing to repaint the other facet as a monetary risk, every making an attempt to realize residents which might be drained out by the excessive value of residing.

” Donald Trump’s Job 2025 monetary schedule is a rising value of residing and deficiency bomb that makes the middle course pay much more and the considerable pay a lot much less,” Harris undertaking agent James Vocalist claimed in a declaration to CNBC.

Trump undertaking agent Karoline Leavitt protected the Republican governmental candidate in a declaration to CNBC: “Head Of State Trump is a enterprise proprietor that constructed the perfect financial local weather in American background, and completely doesn’t require enterprise economics classes from the acute San Francisco liberal urgent Communist charge controls.”

Simply over a month on condition that Biden left of the race, the Harris undertaking has truly been working at terminal velocity to current its monetary schedule.

That stress is elevated for the reason that financial local weather has truly been a continuing susceptability for the Autonomous undertaking this political election cycle supplied residents’ glowing fond reminiscences for the pre-pandemic financial local weather underneath the Trump administration.

â $” NBC Info’ Sahil Kapur added to this report.

[ad_2]

Source link .