[ad_1]

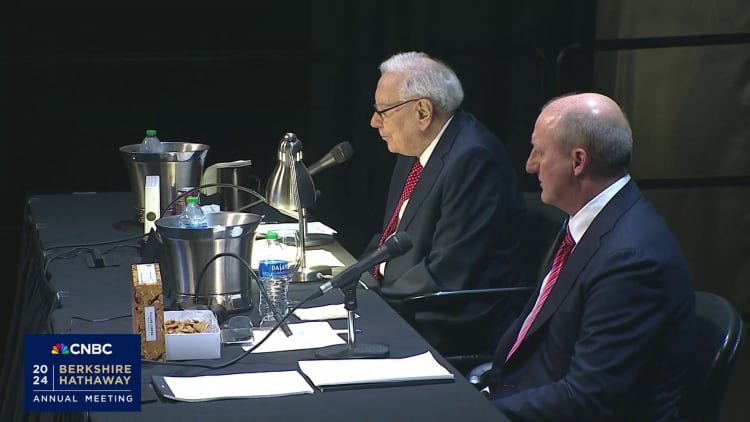

OMAHA, Nebraska â $ ” Warren Buffett claimed Saturday his marked follower Greg Abel will certainly have the last word on Berkshire Hathaway’s investing choices when the Oracle of Omaha is no more at the helm.

” I would certainly leave the resources appropriation to Greg and he comprehends organizations incredibly well,” Buffett informed a sector loaded with investors at Berkshire’s yearly conference. “If you recognize organizations, you’ll recognize ordinaries shares.”

Abel, 61, ended up being referred to as Buffett’s beneficiary noticeable in 2021 after Charlie Munger accidentally made the revelation at the investor conference. Abel has actually been managing a significant part of Berkshire’s vast realm, consisting of power, railway and retail.

Buffett supplied the clearest understanding right into his sequence strategy to day after years of conjecture regarding the specific duties of Berkshire’s magnates after the ultimate change. The spending symbol, that’s transforming 94 in August, claimed his choice is affected by just how much Berkshire’s possessions have actually expanded.

” I made use of to assume in different ways regarding just how that would certainly be managed, however I assume that duty ought to be that of the chief executive officer and whatever that chief executive officer determines might be useful,” Buffett claimed. “The amounts have actually expanded so big at Berkshire, and we do not intend to attempt and have 200 individuals around that are handling a billion each. It simply does not function.”

Berkshire’s cash money heap swelled to almost $189 billion at the end of March, while its big equity profile has supplies worth a monstrous $362 billion based upon existing market value.

” I assume what you’re taking care of the amounts that we will certainly have, you have actually reached assume extremely tactically regarding just how to do huge points,” Buffett included. “I assume the duty should be totally with Greg.”

While Buffett has actually explained that Abel would certainly be taking control of the chief executive officer task, there were still inquiries regarding that would certainly manage the Berkshire public supply profile, where Buffett has actually amassed a massive following by acquiring massive returns with financial investments in the similarity Coca-Cola and Apple.

Berkshire spending supervisors, Todd Combs and Ted Weschler, both previous bush fund supervisors, have actually assisted Buffett take care of a tiny part of the stock profile (regarding 10%) for regarding the last years. There was conjecture that they might take control of that part of the Berkshire chief executive officer duty when he is no more able.

Yet it appears, based upon Buffett’s most recent remarks, that Abel will certainly have decisions on all resources appropriation â $ ” consisting of supply choices.

” I assume the president ought to be someone that can consider purchasing organizations, purchasing supplies, doing all examples that could turn up each time when no one else agrees to relocate,” Buffett claimed.

Abel is recognized for his solid competence in the power sector. Berkshire got MidAmerican Power in 1999 and Abel ended up being chief executive officer of the business in 2008, 6 years prior to it was relabelled Berkshire Hathaway Power in 2014.

Modification: Berkshire’s equity profile deserves $362 billion. A previous variation misstated the number.

[ad_2]

Source link .