[ad_1]

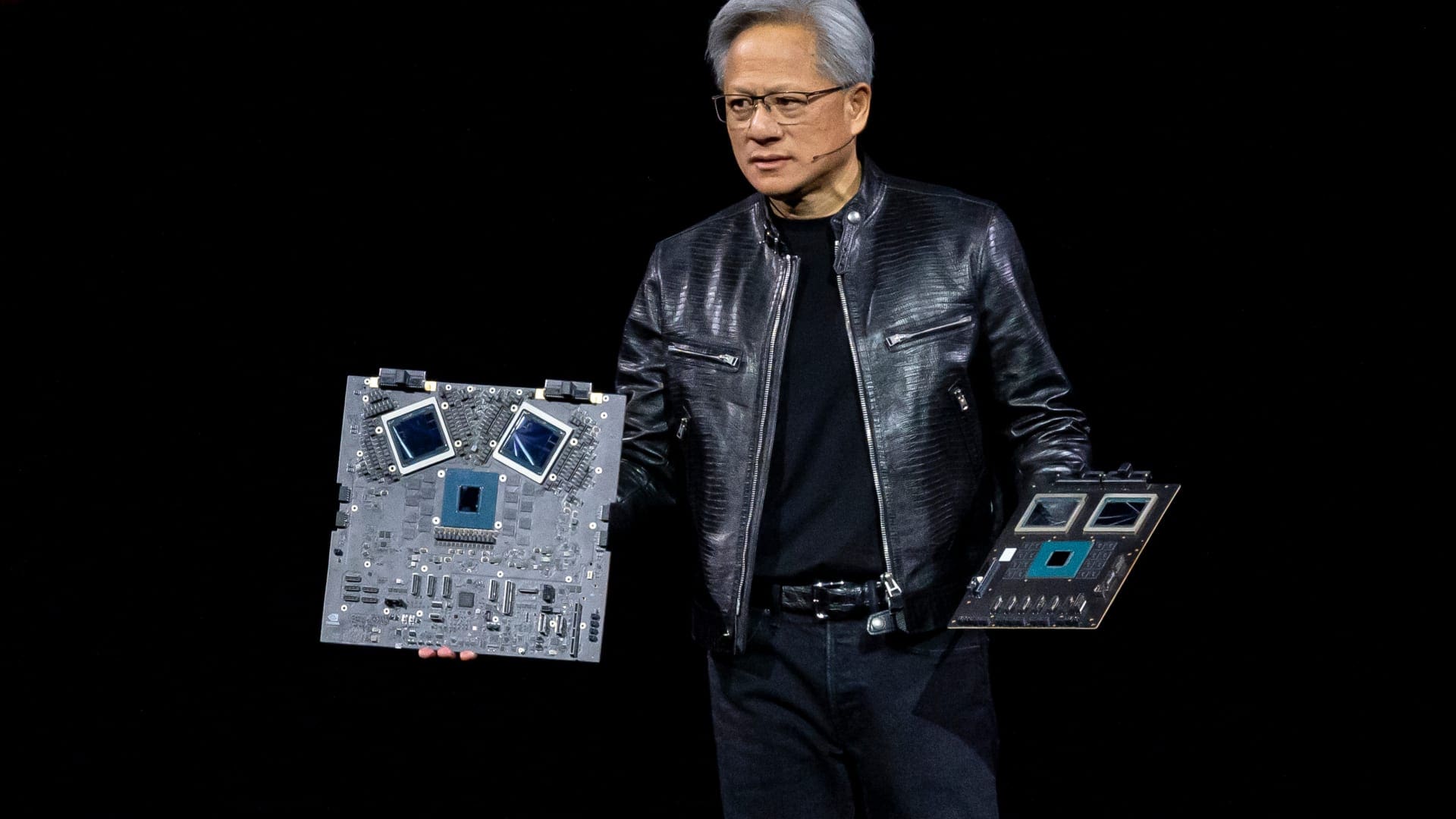

Jensen Huang, founder and ceo of Nvidia Corp., presents the brand-new Blackwell GPU chip throughout the Nvidia GPU Innovation Seminar on March 18, 2024. Â

David Paul Morris/Bloomberg through Getty Images

Not all chip companies are taking advantage of the boom in expert system, incomes program, highlighting the intricacies of the semiconductor supply chain and supremacy of some business over others in various components of the industry.

A multitude of semiconductor business have actually reported monetary outcomes for the June quarter, with some shattering assumptions and others frustrating, supplying a glance right into exactly how exhilaration over AI is impacting their incomes.

Existing rate of interest in expert system focuses on 2 vital terms â $ ” big language versions (LLMs) and generative AI. LLMs call for big quantities of calculating sources and information to educate and they underpin generative AI applications like chatbots from Google and OpenAI.

Technology titans educating the LLMs are not reducing on investing. Meta claimed on Wednesday it anticipates “substantial” development in capital investment in 2025 “to sustain our AI study and our item growth initiatives.” Microsoft claimed today its capital investment increased virtually 80% year-on-year to $19 billion in the June quarter.

This investing by technology titans, as they remain to include computer sources, has actually been a massive increase for Nvidia since the firm’s graphics refining devices (GPUs) are made use of to educate these LLMs.

However Nvidia’s competing AMD has actually brought its very own chip to market, called the MI300X AI chip, for AI functions and is starting to see the benefits. AMD claimed on Tuesday that it anticipates information facility GPU income to go beyond $4.5 billion in 2024, up from the $4 billion the firm projection in April. The chip firm reported incomes and income for the 2nd quarter that defeated market assumptions.

Chip production and device business seem profiting as well from the boom in AI. TSMC, the globe’s biggest manufacturer of semiconductors, claimed last month that its second-quarter web revenue increased greater than 36% year-on-year as its monetary outcomes defeat market assumptions.

On the other hand ASML, which creates professional devices called for to make one of the most sophisticated contribute the globe, claimed last month that web reservations in the second-quarter leapt 24% year-on-year, highlighting need from business like TSMC that make the semiconductors. Samsung claimed second-quarter operating revenue skyrocketed 1,458.2% year-on-year.

However not all semiconductor companies have actually been raised by the development of AI financial investment since their direct exposure to the innovation is presently a lot less substantial at this phase of its growth.

Qualcomm and Arm saw their share cost loss on Wednesday after providing light support for the present quarter.

While both of these business have actually been speaking up their relevance to AI applications, the fact is their direct exposure to the innovation is still extremely restricted.

Arm develops the plans that numerous business base their chips on, and Arm’s semiconductors remain in a lot of the globe’s smart devices. While numerous digital manufacturers are speaking about AI phones, this has actually not caused basically greater development for the chip developer.

The British company still obtains a big piece of its income from customer electronic devices instead of information facilities where AMD and Nvidia have actually located success. Experts have actually formerly informed CNBC Arm might gain from AI when extra tools start to integrate the innovation.

Qualcomm’s chips include in smart devices such as those generated by Samsung, and the firm still makes a great deal of its income from mobile phones. Comparable to Arm, Qualcomm’s silicon is not made use of in the kind of information facilities where the training of LLMs is occurring.

The firm’s chips will certainly remain in Microsoft’s upcoming AI Computers, yet once again, this is a longer-term bet Qualcomm.

[ad_2]

Source link .