[ad_1]

The National Settlements Company of India (NPCI), the regulating body looking after the nation’s utilized Unified Settlements User interface (UPI) mobile settlement system, is readied to involve with different fintech start-ups this month to create an approach to resolve the expanding market prominence of PhonePe and Google Pay in the UPI environment.

NPCI execs intend to consult with agents from CRED, Flipkart, Fampay and Amazon to name a few gamers to review their vital campaigns focused on increasing UPI purchases on their particular applications and to comprehend the aid they need, individuals acquainted with the issue informed TechCrunch.

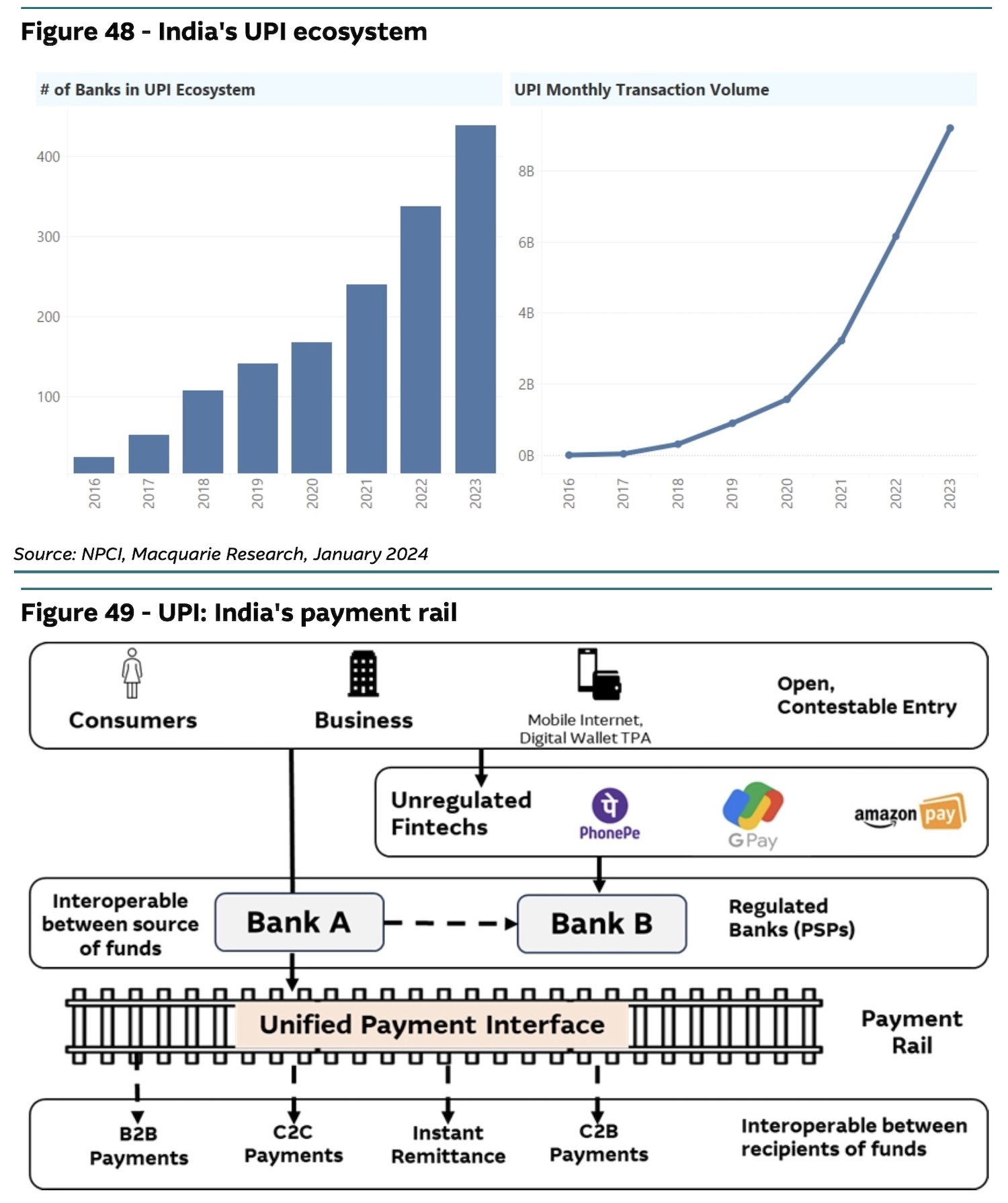

UPI, constructed by a union of Indian financial institutions, has actually come to be one of the most preferred method Indians negotiate online, handling over 10 billion purchases month-to-month.

The brand-new conferences belong to an enhancing initiative to resolve problems increased by legislators and market gamers relating to the marketplace share focus of Google Pay and PhonePe, which with each other represent almost 86% of UPI purchases by quantity, up from 82.5% at the end of December. Walmart owns more than three-fourths of PhonePe.

Paytm, the third-largest UPI gamer, has actually seen its market share decrease to 9.1% by the end of March, below 13% at the end of 2023, complying with a clampdown by the Reserve Bank of India (RBI).

A review of India’s UPI environment. (Picture: Macquarie)

The discussion complies with the reserve bank sharing “annoyance” to the NPCI over the expanding duopoly in the settlements room, an individual acquainted with the issue claimed. An NPCI speaker decreased to comment.

In February, a legislative panel in India advised the federal government to support the growth of domestic fintech players that can use options to the Walmart-backed PhonePe and Google Pay applications.

The NPCI has actually long supported for restricting the marketplace share of private firms joining the UPI environment to 30%. Nevertheless, it has extended the deadline for companies to abide by this instruction throughout of December 2024. The company encounters an one-of-a-kind difficulty in imposing this instruction: It thinks that it currently lacks a technical mechanism to do so, TechCrunch formerly reported.

The RBI is likewise considering a motivation strategy to produce a much more desirable affordable area for arising UPI gamers, one more individual acquainted with the issue claimed. Indian day-to-day Economic Times independently reported Wednesday that the NPCI is motivating fintech firms to use motivations to their customers, advertising using their particular applications for making UPI purchases.

[ad_2]

Source link .